Facebook shares recently hit $150. The milestone reminded me of Barron’s cover article in late 2012 predicting a share price of $15. We all make mistakes (I’ve made plenty), but the article provides a great lesson on investing.

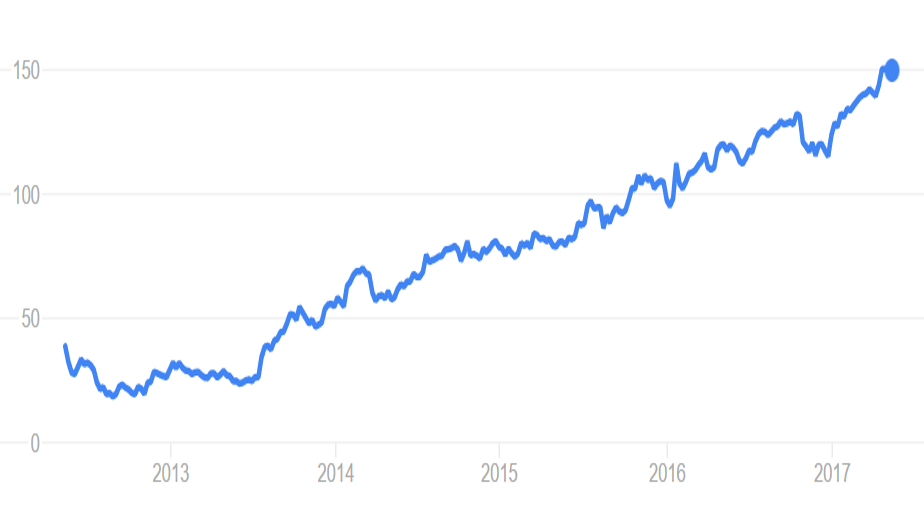

Share price on NASDAQ (in US dollars) of Facebook

NASDAQ:FB Facebook

Source: Yahoo Finance, 17 May 2017.

One of the best ways to identify mispriced stocks is to go through negative stories to see if they make sense. At the time, Facebook’s story was negative with concerns that users’ shifting to mobile was bad for their advertising business. The irony is that mobile phones have become the number one reason for Facebook’s success.

The good news about negative stories is that a story only needs to become slightly more positive to create an opportunity. It’s a bit like investing in an underdog: nobody expects them to win, but if they do win it provides an outsized payoff.

Mobile a plot twist, with a payoff

The story surrounding Facebook was negative on the legitimate concern that small mobile screens would mean less advertising. The story focused on the risks of mobile, but contained no consideration for the potential to increase customer login frequency. Facebook is a major reason why people pick up their mobiles. People check Facebook on the bus or while waiting for coffee. And there’s the payoff: the more you use the app the more Facebook knows about you and the more relevant ads it can serve.

At the time, Facebook was the number one downloaded app on Google Play and number six on Apple iOS, a hint that maybe the shift to mobile could be positive. In fairness to Barron’s, it quotes Mark Zuckerberg: "it's easy to underestimate how fundamentally good mobile is for us. Literally six months ago we didn’t run a single ad on mobile", but his reasons and what potential advertisers thought about their ads weren’t commented on.

Earning results about six months later proved the negative mobile story wrong as daily active users on mobile surpassed desktop and mobile revenue grew to 41% of ad revenue, up from 30% three months earlier. The magazine also reported that ads were shown in 1 in every 20 stories on Facebook and saw no drop in usage. Barron’s did redeem itself, predicting Facebook could rise 20% to $123 August last year.

Fake news?

The Facebook story was an extreme example of a story that was supposed to be a negative but instead became a positive as Facebook became the way to reach people on mobile phones.

It should remind us to dig deeper the next time we see a headline. Are the assumptions behind it true? Is it balanced or is it merely an opinion? What are the facts and what views are left out? In this case, it would have been interesting to get a view from major advertisers.

It’s not easy, but there are usually two sides to every story. Some former news reporters have made good fund managers because of this ability to dig deeper and find out what is really going on. Good investing includes seeing a trend like that and jumping aboard before everyone else.

Jason Sedawie is Executive Director of Decisive Asset Management. Decisive is a holder of Facebook. The material in this article is for information purposes only and does not consider any person's investment objectives or circumstances.