You may have heard that inflation is surging around the globe. Some commentators point to lax policymakers who are still ‘printing money’ and engaging in fiscal largesse even as demand strengthens, labour markets tighten and global supply bottlenecks linger. They warn of a return to the price spirals of the 1970s, a dismal time for most asset classes and especially fixed income.

Despite warnings, inflation signs are weak

The truth is that we cannot be sure whether these tail risks will emerge. Economists have a lousy record of forecasting inflationary regime shifts and there seems just as many (if not more) vocalising the opposite argument – that the ultimate economic impact of COVID will be deflationary.

Yet, some things can be said with greater confidence.

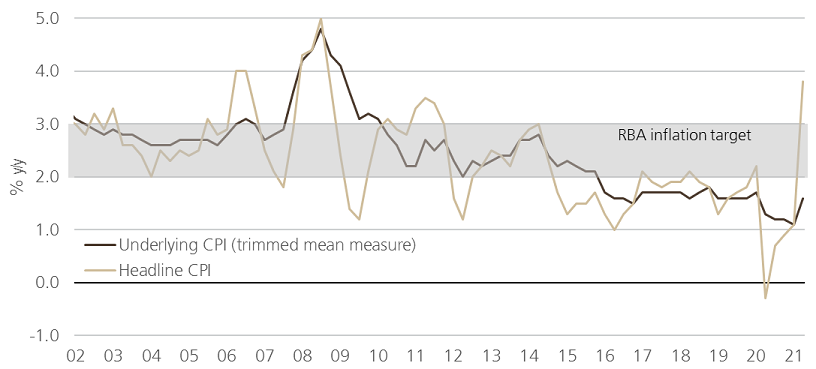

Top of the list is that Australia should be one of the last places where we'd expect to see worrying inflation rates. This much is evident in the latest consumer price index (CPI) data. Whilst the raw headline measure jumped to 3.8% year-on-year in Q2, this is easily explained by the reversal of factors that had caused it to drop negative last year, such as childcare subsidies and the slump in fuel prices.

Looking at the RBA's preferred trimmed mean shows just how tepid underlying inflation is, with the index running at just 1.6%.

Chart 1: Core inflation still below RBA’s target, where it has been for more than 5 years

Source: Bloomberg

The labour market also does not ring any alarm bells. Australia’s unemployment rate has already pushed below the 5% level that had proved sticky prior to COVID and, with the tap of inward migration turned off, some have argued that this might finally result in a strong pick-up in wages. But this is not borne out in the aggregate data.

Wages grew at a disappointing annual rate of 1.7% in Q2, a period largely free of lockdown distortions, which remains far from the 3%-plus that the RBA aspires to. Our explanation is simple. The uncertain demand backdrop means employers are reluctant to lock-in higher wage costs. It is hard to see this changing any time soon.

Still below the RBA target

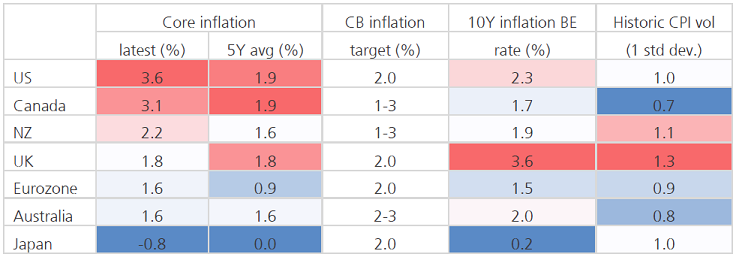

In fact, it could still reasonably be argued that Australia's problem is a shortfall of inflation, at least when it comes to meeting the central bank's 2-3% target. It is this which sets Australia apart from the likes of New Zealand, US and Canada, which are all currently experiencing above-target core inflation. Longer-term market measures of inflation expectations such as the breakeven rates implied by 10-year linkers paint a similar picture, anchoring close to 2%.

Chart 2: Inflation trend appears lower than peers such as US, Canada, UK and NZ

Source: UBS Asset Management, Bloomberg

Note: Core inflation is central bank preferred measure

What are the implications for investors?

This has two implications for Australian Commonwealth Government Bonds (ACGBs), both positive.

First, inflation trends still point to market expectations of low-for-longer interest rates persisting. RBA Governor Lowe has increasingly acknowledged the inflation undershoot and, with his term approaching expiry, has vowed not to raise interest rates until inflation is sustainably within the 2-3% target band, a condition the bank does not expect to be met until 2024, at the earliest. A shallow expected path of the cash rate should exert a gravitational pull on bond yields.

Second is how this relates to the other component of bond yields, the term premium that compensates bondholders for the risk of holding the security to maturity. Greater uncertainty over the inflation outlook argues for larger absolute levels of term premium and wilder swings in bond yields. The table above however shows that Australia is not just experiencing lower inflation than most of its peers but also that volatility is lower.

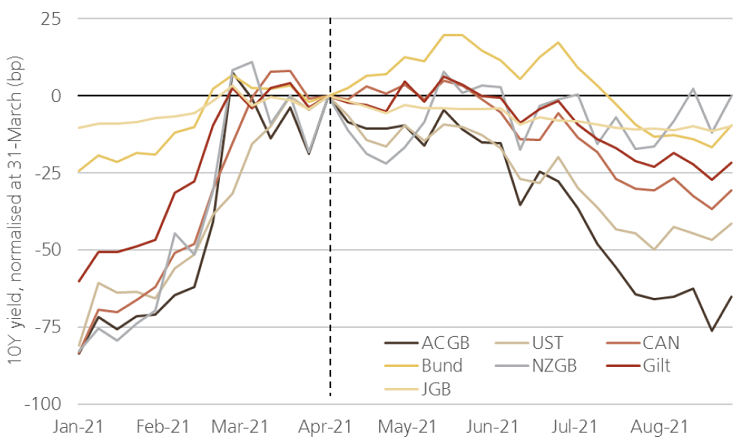

This need not mean local bond markets will be dull - witness the high sensitivity of ACGBs to the rout in global bonds in February. What it does say is that investors can take advantage of these episodes of volatility, adding duration in the knowledge that higher yields are unlikely to be warranted by fundamentals. As it has turned out, investors taking that view in March would’ve been rewarded handsomely with ACGBs staging a world-beating rally since.

Chart 3: ACGB yields have fallen the furthest since March

Source: Bloomberg

Tom Nash is Portfolio Manager, Australian Fixed Income Investment Team at UBS Asset Management Australia. UBS is a sponsor of Firstlinks. This article is intended to provide general information only and should not be construed as an offer or invitation to the public, direct or indirect, to buy or sell securities as it does not take into consideration your investment objectives, legal, financial or tax situation or particular needs.

For more articles and papers from UBS, click here.