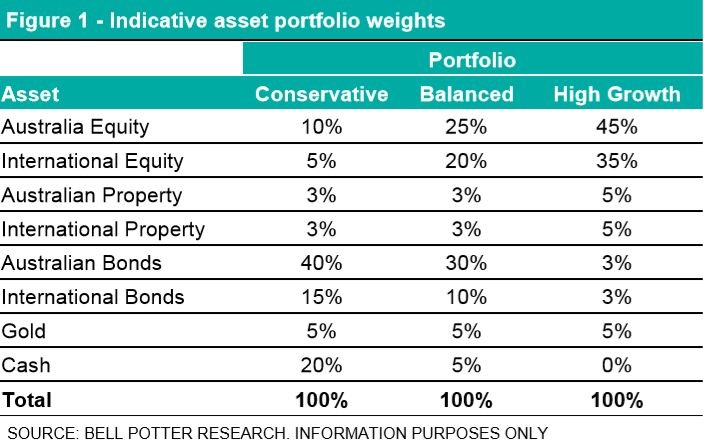

Employing a strategic asset allocation (SAA) can minimise the overall level of portfolio risk for a given level of return. The investment strategy sets target weights to the asset classes in a portfolio. Weightings are primarily allocated based on the investment objective, time horizon and, most importantly, the risk tolerance of the investor.

Combining uncorrelated assets

Support for SAA is provided by the fundamental benefit of portfolio diversification. Combining a group of assets that are less than perfectly correlated can reduce the overall risk of a portfolio for a required rate of return. The main theory, known as Modern Portfolio Theory, was pioneered by Harry Markowitz for which he was later awarded a Nobel Prize (for Graham Hand's interviews with Mr Markowitz, see here and here).

It is centered on the notion that the return of an asset should not be viewed in isolation but assessed on its contribution to the overall portfolio risk and return. The portfolios that provide the highest return for a defined level of risk fall on what is called the efficient frontier. This combination of assets is deemed to have greater diversification and be less susceptible to nonsystematic risk.

To illustrate the risk and return benefits of a SAA in a portfolio, 10 year back-tested data has been provided for three portfolios with different risk profiles: Conservative, Balanced and High Growth.

The portfolio asset weightings have been based on the corresponding BetaShares ETF Model Portfolios of the same risk profiles. This example is provided for information purposes only and is not intended to reflect the actual performance of the model portfolios they have been based on. Risk profiles of each model portfolio are produced in accordance with the Australian Prudential Regulation Authority’s (APRA) standard risk measure.

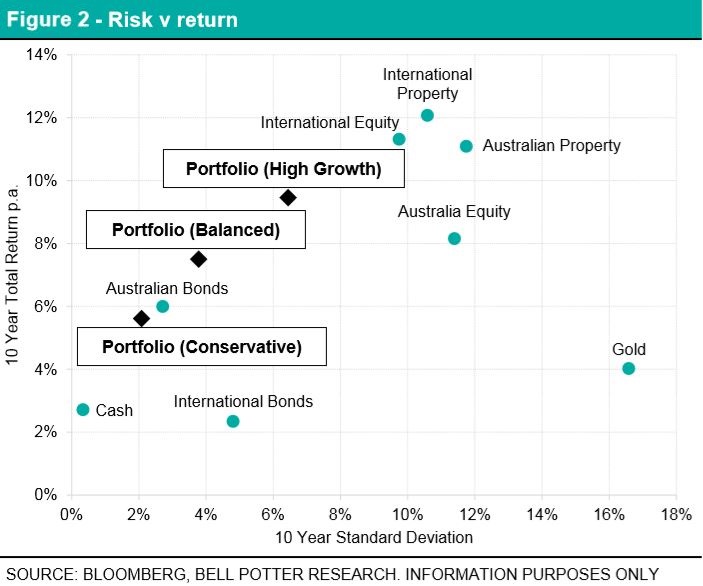

In Figure 2, we have calculated the performance over a period of 10 years ending 30 September 2019, with monthly rebalancing back to the target SAA weights. Broad market cap weighted total return indices are used to generate asset class returns, focusing on indices that are commonly tracked by ETFs.

Figure 2 illustrates that each of the portfolios can be seen as ‘optimal portfolios’ that broadly fall on the efficient frontier. Compared to a portfolio of solely Australian Equity, the ‘High Growth’ portfolio provided a higher 10-year return and lower risk whilst having a monthly return correlation of 92.4%.

A 100% weighting towards Australian Equity would have been a sub-optimal portfolio and an inefficient investment strategy over the 10 years. This highlights the importance of asset diversification in a portfolio and the long-term risk versus return benefits it can provide.

Correlations in returns between different asset classes are also relevant in building a portfolio. Figure 3 shows a 10-year correlation matrix, including the blended portfolios described above. It's notable that even a 'balanced' portfolio has a high correlation to equities.

The results also show the higher returns come with greater 'risk', measured by the standard deviation. These are the classic trade offs expected under Modern Portfolio Theory.

Will Gormly is an ETF/LIC Specialist at Bell Potter Securities. This article is for general information only and does not consider the circumstances of any investor.

Firstlinks provides regular reports on LICs trading at discounts and premiums in the Education Centre.