Vanguard recently received a superannuation licence, which will give it the ability to go head-to-head with the large superannuation funds. The 'Vanguard Super' offering will launch later in the year with details yet to be confirmed, but you’d expect it to look a lot like the new Vanguard Personal Investor product. The big question: Will it really be able to compete with the likes of AustralianSuper?

Vanguard is a global monolith with over $10 trillion of assets globally, but homegrown AustralianSuper is pretty sizable on the global stage with over $250 billion in assets. So let’s take a look at the AustralianSuper Plan's Balanced Option versus Vanguard’s Personal Investor Growth Index Fund (as a proxy for the super product) to see how they compare.

Objectives

An investment strategy’s stated objectives can often prove a bit confusing, although understanding what each strategy aims to do is crucial when working out if a product is suitable for your needs.

Asset Allocations—Listed and Unlisted Assets

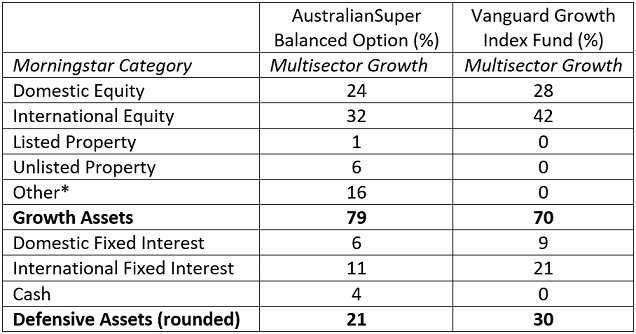

Bottom line? We can see that these two strategies are suited to a similar type of investor. But let’s take a look at the asset allocations to be sure. The table below shows that the asset allocations are broadly comparable and are both categorised by Morningstar as multisector growth. Asset-allocation definitions can often be quite contentious, and AustralianSuper has categorised the growth/defensive split closer to 70% growth assets and 30% defensive assets on its website. But like anything to do with investing, it is better to be roughly right than precisely wrong, and these two strategies are roughly comparable from an asset-allocation perspective, enabling us to confidently compare the performance of each strategy.

Asset Allocation and Morningstar Category Comparison

Figures have been rounded to whole numbers and adjusted to sum to 100. Source: Morningstar Investor; AustralianSuper website – as at 31 July 2022 *Other – unlisted infrastructure exposure.

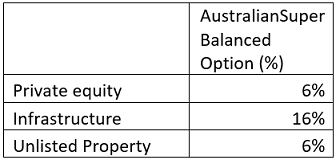

One area where these strategies are very different is their holdings of listed and unlisted assets. AustralianSuper has around 28% of its portfolio in unlisted property, infrastructure, and private equity (see table below). These assets are not listed on the Australian Securities Exchange or other global exchanges, often making it more challenging to know exactly what you are holding and at what price. From an investment merit perspective, there’s nothing wrong with unlisted assets; in fact, returns have been favourable over the years for AustralianSuper. What’s key to understand is that unlisted asset valuations tend to move around a little less than listed asset valuations. This means that the ups and downs of markets will impact the returns less than a fund with only listed assets. Unlisted assets tend to go up less in up markets and down less in down markets—generally because they are not revalued every day.

AustralianSuper Balanced Option’s Allocation to

Private Equity, Infrastructure, and Unlisted Property

Source: AustralianSuper website – as at 31 July 2022.

The flip side is liquidity—that is, how easy it is to convert assets into ready cash. Stock exchanges (think the ASX or the New York Stock Exchange) are designed so that a lot of buyers and sellers can come together and exchange assets quickly and easily. As unlisted assets are not transacted on these exchanges, the sales process can be more protracted. Liquidity is important when a large number of members decide to sell out of the AustralianSuper Balanced Option (like we saw when COVID Early Release occurred), the Option needs to be able to sell assets to provide ready cash to these members. Given the majority of AustralianSuper’s Balanced Option is liquid, liquidity shouldn’t be an issue, and we saw AustralianSuper manage Early Release and other periods of market stress well from a liquidity perspective.

It's also worth pointing out that during periods of market stress, liquidity on global listed exchanges can come at a price. During the coronavirus selloff of March 2020, Vanguard increased the cost of exiting the Balanced Fund to 0.39% from 0.10%. This cost reflected market conditions, and the increase was important to protect the investors who remained invested in the fund. Panicking and selling out of liquid or illiquid investments during periods of stress is seldom advisable.

Can You Beat the Market?

Another important difference between the two strategies is their investment approach. Vanguard’s strategy is not designed to "beat the market"—the fund simply tries to generate a return in line with some large indexes (think the S&P/ASX 300 Index). Vanguard’s track record, when it comes to providing investors the return of an index, is impressive. Over long time periods, markets have delivered solid results, but don’t expect anything more than market returns from this strategy. AustralianSuper, on the other hand, tries to beat the market. Beating the market is tough, but to date, it has been very successful across a number of assets. It is generally harder to beat the market at this sort of scale—AustralianSuper’s size is $250 billion—but if you want to try, this strategy is more suited to your values. The obvious risk is that returns may end up lower than the market and quite often trying to beat the market involves higher fees (as we see below).

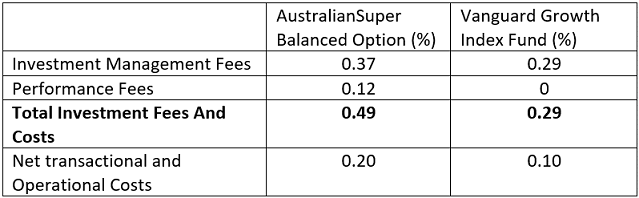

How Much Will It Cost?

Investment fees can’t be ignored—a higher fee burden makes outperformance more challenging. And this next table shows that Vanguard is true-to-label in delivering a low-cost investment option compared with AustralianSuper. As we said, trying to beat the market comes with a price tag.

Investment-Related Fees and Costs

Source: Morningstar, AustralianSuper, Vanguard

Administration fees and costs are the other big focus when it comes to comparing options. The value proposition can vary—members value different services, including access to an investment option; ongoing reporting; insurance; and investor education and support. In the case of AustralianSuper: An investor with $50,000 will pay $102 each year (or 0.20% per year) to be a member of AustralianSuper. Now the details of Vanguard Super are yet to be announced, but let’s look at Vanguard Personal Investor—if you invest in Vanguard’s funds, there is no cost for administration. A side note, though: Vanguard will earn 0.50% each year from any cash parked in the cash account.

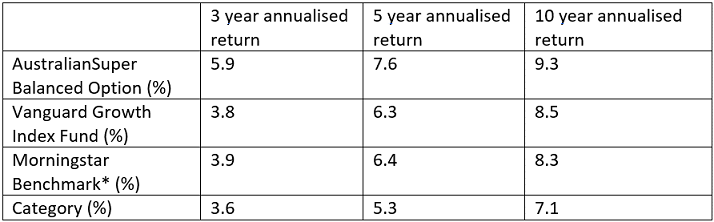

Performance

We all know that past performance is not a guide to future performance, although as far as declaring ‘success’, long-term returns and results are an important yardstick. And ultimately net returns are what are most important to investors. So, how did the options stack up? AustralianSuper has it over Vanguard in terms of net returns over the long term, although AustralianSuper’s higher allocation to growth assets would help. But, in reality, the returns from both strategies are strong—beating the Morningstar benchmark and the category average over 10 years.

Performance Returns as at 31 August 2022

Source: Morningstar Investor; *Morningstar AUS Growth Tgt Alloc NR AUD.

Who Is Winning the War?

AustralianSuper and Vanguard are investment powerhouses, and both offerings are compelling. It is important to understand the nuances between them and select the one most appropriate for your needs. We eagerly await the details of Vanguard Super so that we can make a more fulsome comparison. Safe to say, though, Vanguard is really throwing down the gauntlet to the industry. Vanguard’s Personal Investor interface and setup process is seamless, and the arrival of Vanguard Super feels very much "game-on" in the super wars. Hopefully, the end beneficiaries will be the investors.

Annika Bradley is Morningstar Australasia's Director of Manager Research ratings. Firstlinks is owned by Morningstar. This article is general information and does not consider the circumstances of any investor. This article was originally published by Morningstar.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free, four week trial below:

Try Morningstar Investor for free