Business quality is a key factor in our investment process, and we typically define a high-quality business as one that can earn a decent return on its capital. The Real Estate Investment Trust (REIT) sector is not typically thought of as a high total return sector due to the low-yielding nature of real estate and high capital intensity to just ‘stay in business’. That said, it may come as a surprise that Charter Hall Group (ASX:CHC) has delivered a total return of ~11.5% p.a. since its IPO in 2006. This performance has been driven largely by CHC’s transition from a traditional REIT to a fund manager, which generates fees on client capital with minimal amounts of incremental investment required.

Now, I know you are probably thinking, “Why would I want to invest in an office fund manager, particularly in the current interest rate environment?” We believe these risks are more than captured in CHC’s current price and have provided the opportunity to invest in a high-quality business at an attractive valuation.

But isn't office property dead?

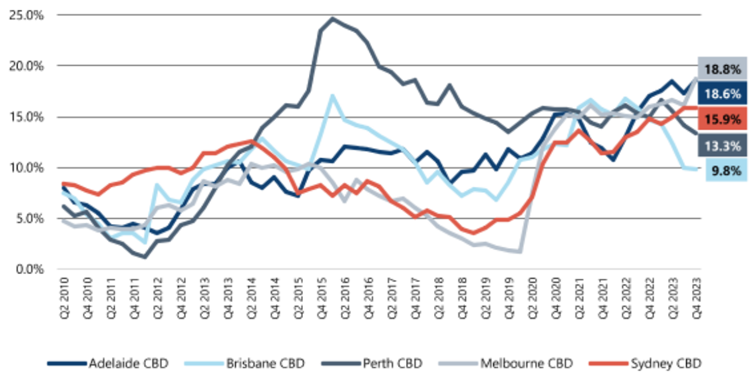

We don’t disagree that the ‘Work From Home’ trend has created meaningful challenges for the office sector. Corporates have quite reasonably concluded they can achieve substantial rent savings while providing their workforce with increased flexibility. This has resulted in an increase in market vacancy and placed pressure on rents.

Prime CBD office vacancy rates

Source: Jefferies, JLL

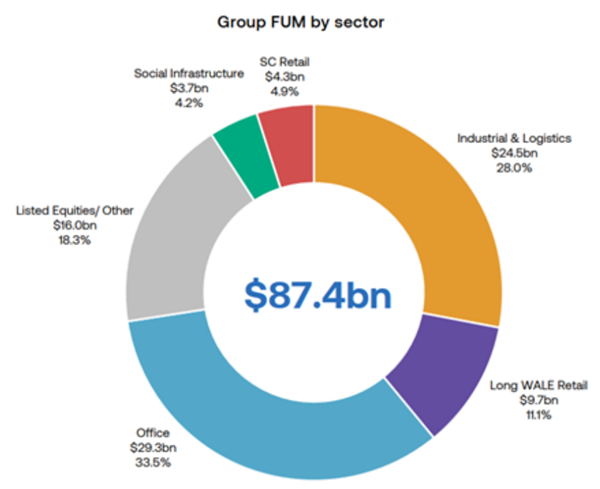

This has understandably weighed on Charter Hall, with the share price down 48% since its peak of $21.83 in 2021. While Charter Hall will undoubtedly be affected by weakness in Office, we believe the criticism is not entirely fair given roughly two-thirds of its Funds Under Management (FUM) is in ‘non-office’ sectors, including Industrial and Logistics (28%), Equities (18%), Retail (16%) and Social Infrastructure (4%).

Source: Charter Hall

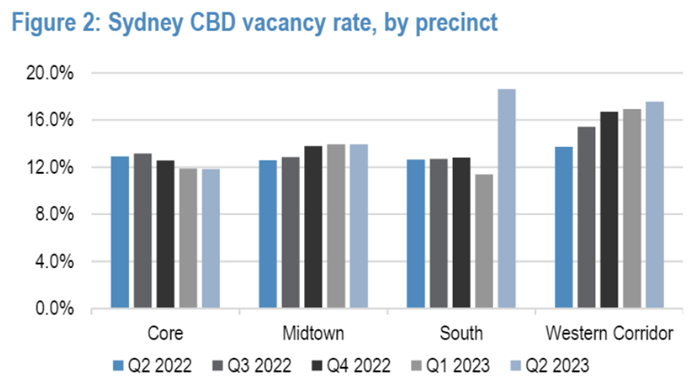

Further, the real estate cliché 'location, location, location' remains as relevant as ever. The fundamentals for well-located, new and environmentally friendly buildings are markedly different from those that do not have these characteristics. The figure below highlights the divergent vacancy trends seen between core and non-core regions of Sydney CBD. Equally, the vacancy rate for buildings in Sydney that are less than 10 years old is ~6% versus ~13% for those over 10 years old.

Source: JLL and Charter Hall Research

CHC’s Office Portfolio skews to newer, better-located buildings, which has led to superior outcomes including 96% occupancy (vs 85% national average), 89% leasing retention rate and a high-quality tenant base like the Australian Government, multinationals and listed companies (which account for 56% of the Group’s property platform income).

What about high interest rates?

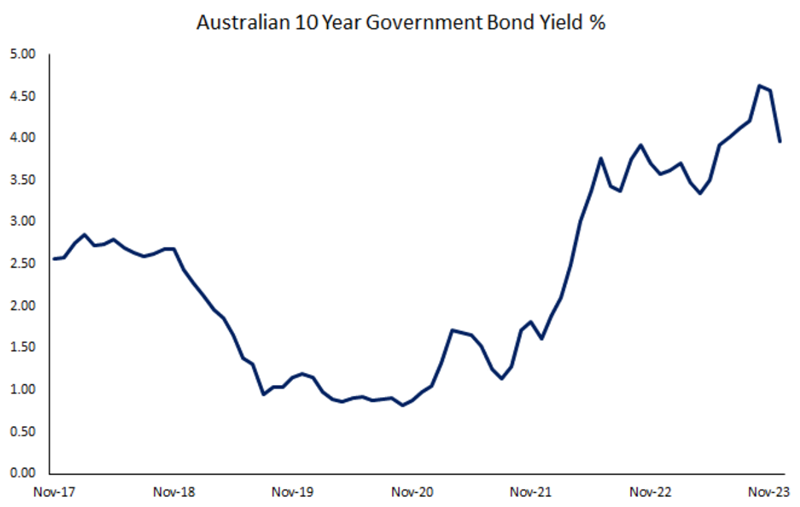

It wouldn’t be an investor communication without a quote from Warren Buffett, who said, “Interest rates are to the prices of assets like gravity is to the function of earth”. As such, it’s no surprise that the 10 Year Australian Government Bond Yield rising from <1% during the pandemic to almost 5% weighed on an asset manager like CHC. Most obviously, it has reduced the value of the assets that it manages and charges fees on.

Source: Federal Reserve Bank of St Louis

Second, the rapid increase in interest rates has frozen transaction activity in the sector with investors unwilling to make long-term, illiquid investments for fear the price of the asset could fall in the near term. This is not ideal for Charter Hall where transaction activity allows it to acquire new assets, increase its FUM and thereby grow earnings.

While we don’t claim to be economic forecasters, we’d argue that with interest rates at 10-year highs and inflation measures falling, it seems more likely than not that interest rates have peaked. We believe this peaking of interest rates is likely to see transaction activity begin to return and allow CHC to mitigate devaluations in its FUM. From FY19 – FY23 CHC added $5.7 billion per year to FUM from acquisitions and $2.0 billion p.a. from developments. Therefore, a return to average transaction and development activity would sufficiently offset a 10% decline in current Property FUM of $71 billion due to devaluations.

Underappreciated business quality

CHC trades at ~15x FY24 EPS guidance, which is a large discount to the ASX 200 of ~22x (excluding financials and resources) despite a track record of growing EPS at 15.1% p.a. over the last 10 years.

Source: Charter Hall

We believe CHC is a higher-quality business than it is given credit for, with several factors often overlooked:

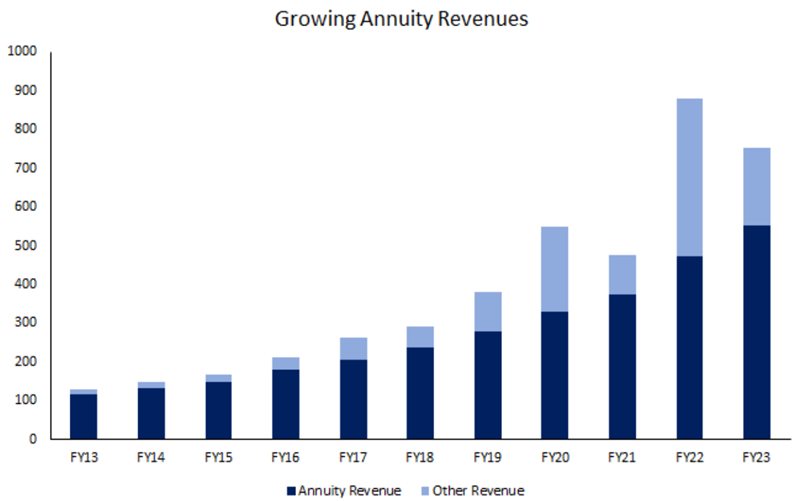

- ~73% of its revenues are highly recurring, creating a stable, lower risk earnings stream for shareholders, which therefore should warrant a higher multiple.

- CHC’s FUM are relatively ‘sticky’, meaning they cannot be easily or quickly redeemed. This is somewhat a by-product of redemption terms being structured to align with the fact that the underlying investments are large and illiquid:

- ~72% of FUM is in ‘Wholesale’ (unlisted) strategies where institutional investors typically have redemption windows every 5 – 7 years, meaning they cannot pull their money out quickly.

- ~15% of FUM is in ‘Listed’ vehicles, which more or less cannot be redeemed.

- ~12% of FUM is in ‘Direct’ (unlisted) strategies for HNW individuals, which can typically be redeemed only every 5 years.

- Many of CHC’s ‘wholesale’ investors have a lower cost of capital (return requirement), which means CHC can pay more for assets, providing it with an advantage in an auction for an asset.

- There are few other Fund Managers in Australia with the ability to purchase large assets worth more than >$1 billion, which further reduces competition in auctions for CHC.

- Funds Management EBITDA Margins have grown over the last ten years to 73%, highlighting the business’s scalability. Even after removing the more volatile transaction and performance fees, the EBITDA margin is 62%, which reduces operating leverage and creates a stable earnings stream.

- As Charter Hall’s funds management business has delivered strong performance, and its relationship with equity partners improved, CHC has not needed to ‘seed’ its investment vehicles with the same proportion of capital. This reduces its overall capital requirements of the business, allowing for both a higher return on capital and greater returns to shareholders.

- While there is implied leverage related to Charter Hall’s investments in its own funds, at the group level, CHC has a very clean balance sheet with virtually no net debt, which provides it with optionality, particularly in a more difficult real estate market.

Attractive valuation

CHC has rising margins, decreasing capital requirements, proven earnings growth and business quality. Further, we view the company’s FY24 guidance of 75 cents per share as ‘trough’ earnings given it implies virtually no performance or transaction fees. If we normalise FY24 performance and transaction fees to a level that is in line with historical averages, CHC would be trading at ~10x FY24 EPS. We believe that if inflation continues to fall, interest rates stabilise and there is discussion of rate cuts – as we have seen in recent months – CHC’s multiple should re-rate to account for the cyclically low earnings and depressed multiple.

Jack McNally is an Investment Analyst at Magellan-owned, Airlie Funds Management. Magellan Asset Management is a sponsor of Firstlinks. This article has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not consider your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.