While yields have increased in Australia, including on investment-grade bonds which are rated in the BBB space, it’s also good for investors to know their money is relatively safe.

Standard & Poor's (S&P Global Ratings) releases a report every year looking at default rates for each categoty of credit ratings over time. The 2022 report will be released in 2023 but the most recent report provides some good illustrations and commentary.

Global and Australian defaults statistics

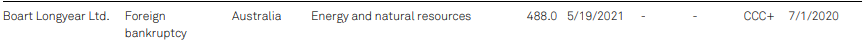

In 2021, 72 global corporate issuers defaulted but most of these were in the non-investment grade CCC/C/B categories. The only default in 2021 from an Australian corporate was from Australian drilling services provider, Boart Longyear, and this was well flagged.

The majority of defaults were in the US, reflecting the breadth of the bond market over there.

Source: S&P 2022

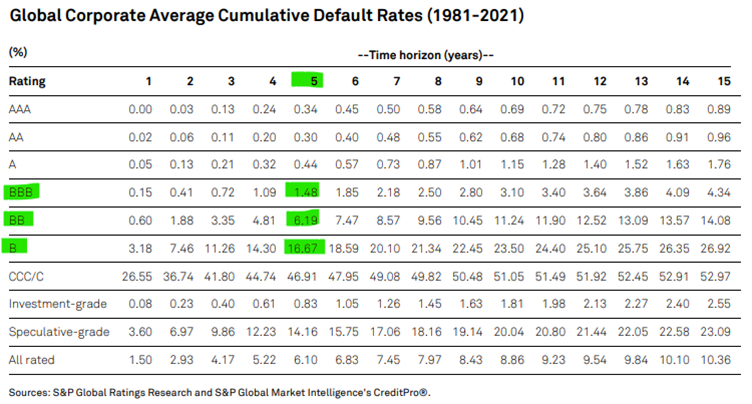

The statistics show that global default rates in investment-grade have been extremely low over time.

Historically, the Australian default statistics are lower than the Global default statistics, in part due to it being a largely investment-grade market locally but also a concentration towards the major banks, which are all rated AA-.

Over the 30-year study period, investors should take confidence in investment-grade bonds. The table shows the probability of default for AAA rated to CCC/C rated, including average default rates of investment grade, speculative grade and all rated.

Source: S&P 2022

For example, a BBB-rated bond has a probability of default over five years of 1.48%. This increases to 6.19% and 16.67% for a BB and B rated bond. Digging deeper, a US BBB-rated bond has a probability of default of 1.83% implying that an Australian BBB-rated bond would have a probability of default over five years of significantly less than 1.48%.

Again, this shows the safety net of the Australian corporate bond market.

Matthew Macreadie is a Credit Strategist at Income Asset Management, a sponsor of Firstlinks. To discuss this topic further and access corporate bonds please reach out IAM. This article is general information and does not consider the circumstances of any investor. Please consider financial advice for your personal circumstances, including eligibility for these investments.

For more articles and papers from Income Asset Management, please click here.