Each year like clockwork, when the Australian winter sets in, my Facebook newsfeed begins to fill with pictures of Hawaiian or European summer destinations. With the July school holidays upon us, this process is well underway and conversations with friends inevitably turn to holiday check lists: where is everyone going, have they booked accommodation and what fun activities are planned for the kids?

A much less exciting item on the check list for most, but one that deserves more attention, is managing currency before you go on an overseas trip. It is often forgotten, and people miss out on what can be significant amounts of money, or at least enough to encourage a splurge at a particularly good restaurant.

Here are my top four foreign exchange tips to consider before travelling overseas:

1. Plan around currency volatility

Leaving exchanging currency to the last minute means you are at the mercy of notoriously unpredictable currency fluctuations. A Twitter post from the US President can move currency markets several percentage points overnight whilst many overseas trips are planned months in advance. People should watch how the Australian dollar sits in comparison with the country they are visiting and exchange currency when the rate looks strong.

This can be done via the traditional method of visiting a foreign exchange bureau or through the use of a multi-currency account. Citi’s Global Currency Account holds money in 10 currencies and gives the flexibility to transfer between them or externally at any time, to take advantage of favourable rates. It’s linked to a debit card and knows your location, so you can pay in the correct currency via the card when you travel, or withdraw money from the card when you are ready.

Similar accounts exist at other international banks and at fintech companies like OFX and Transferwise. Local banks offer comparable products, but these normally come with higher fees and wider currency spreads. The ‘spread’ is the difference between the price which you can sell the currency at (the ‘bid’) and the price which you can buy the currency for (the ‘ask’).

2. Factor in explicit and implicit fees

Ensure you are factoring explicit and implicit fees when you are choosing where to exchange currency. Explicit fees include account fees, ATM withdrawal fees, card load, telegraphic transfer fees, while an implicit fees is the foreign currency spread. Many banks are guilty of promoting low explicit fees and assume people won’t calculate the implicit fees and work out they are being ripped off. They can do this because foreign exchange is still an area many struggle to understand, and part of this is because of the jargon involved (like the ‘spread’, ‘bid’, and ‘ask’ explained earlier).

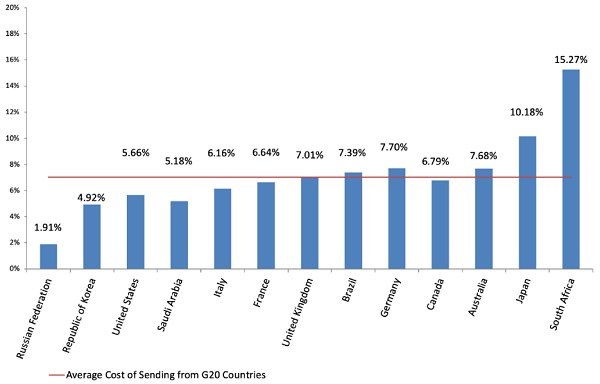

The World Bank has found that the average cost of sending money from Australia (7.68% of the money sent in the world) is significantly higher than the G20 average. On a hotel booking of $3,000, the average cost of $230 far outweighs the cost of an international ATM withdrawal.

Average cost of remitting from G20 countries

Source: World Bank, Remittance Prices Worldwide June 2019

3. Avoid the traps

The worst trap of all is exchanging money at the airport. A study by News Corp and The Currency Shop showed that on A$2000, travellers can lose as much as $350 by exchanging cash at the airport. While it might be convenient, it’s going to cost you.

Another way travellers get confused is when they are asked whether they want to pay in their own currency or the currency of the country they are in. If you pay in your own currency, the merchant or ATM operator will charge a foreign exchange fee at a rate they determine.

Prepaid travel cards can also be a trap. They often come with a range of fees e.g. for loading the card, using at an ATM or closing the account. It’s important to consider how these different fees will impact your budget overall.

4. Use technology to your advantage

My colleague Matthew Hayja wrote a piece for Cuffelinks called: “Retail FX: the last bastion of no competition”. While this remains largely true, there are some technological developments disrupting the FX space. Fintech players like Transferwise, Currency Fair and Worldremit specialise in small payments for individual customers. Using an online business model, they have low overheads and offer competitive rates.

Are we saying this is a reason not to transact with Citi? International banks have stepped into the ring to compete too. The rates on Citi’s Global Currency Account sit better than the domestic big four banks but slightly higher than the fintechs, with at 1.5% spread on USD exchanges. The currencies are linked directly to a Citibank debit card, meaning users can switch between currencies instantly via their mobile app and pay with their card when travelling. There are no ATM fees charged by Citibank when using local currency.

It’s worth doing your homework

Ultimately, the take-out for those about to head off overseas, is to do your homework before you go and be wary of traps that can cost you money. Hopefully, there will be continued disruption in the field of FX and providers will be forced to offer consumers more options that make it easier to go overseas and ‘spend like a local’.

Marcus Christoe, Head of Banking and Wealth Management Product at Citi Australia, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any individual.

For other articles by Citi, see here. You can also view Citi’s guide to FX investing here.