And as he hung up the phone it occurred to me

He’d grown up just like me,

My boy was just like me.

Harry Chapin, 'Cat’s in the Cradle'

One of the largest transfers of wealth in history will occur in the next few years, depending on the health and goodwill of the Baby Boomer generation.

According to US demographic figures, Boomers are the wealthiest generation in history and are currently the custodians of circa USD68 trillion in assets says Cerulli Associates, a US research firm. According to Forbes, Boomers control roughly 70% of all disposable income and have vastly differing attitudes to their parents and their heirs.

What happens when the time comes for this generation to pass down these titanic asset holdings, who will receive them and what impact will this transfer have on the world as a whole?

Who will receive this wealth?

The question now looms, who will receive all of that money?

The first suggestion is Millennials, the heirs of the Baby Boomers, presently aged around 25 to 40 years. The numbers vary, but the most consistent estimate is that Millennials will be five times richer in 2030 than they are today due to this transfer of wealth. And that figure is just for the US. In Australia, Millennials will inherit AUD3.5 trillion over the next 20 years, an average of $320,000 per person.

But there is uncertainty around how much of the Boomers’ wealth will go to their children. The reason is simple: Boomers want to spend their hard-earned cash.

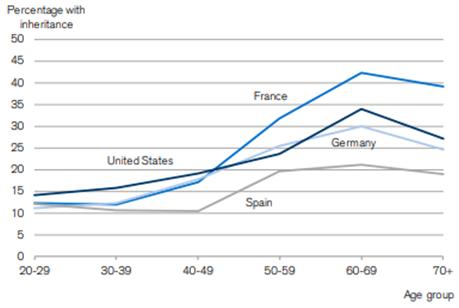

Figure 1: Incidence of inheritance by age, selected OECD countries

Source: Citi Group

Consistent across OECD countries (and most developed nations), more than half of the Baby Boomers do not have an estate allocated to their children. In fact, estimates by CNBC suggest that only 57% of total assets will transfer to Millennials over the next 20 years.

The Boomer generation more than any other has a penchant for spending its own money rather than acting as a walking piggy bank for the next-in-line generation. A Citi Private Bank commentator said that since Baby Boomers are on balance living in a more peaceful and prosperous time than their parents, many don’t consider the same drive to ‘set up’ the next generation. In the absence of war or decades-long financial collapse, the status quo of leaving a nest egg to protect children has been disrupted somewhat.

So where will the money go, if not to their children?

For the most part, back into the economy.

Boomers are living longer, and 65-70 is no longer the twilight years of life. And funding must be put towards retirement living, senior living accommodation, holiday homes and much more.

A lot will remain in the stock market as well, with Baby Boomers having the second lowest average allocation of wealth to ‘cash’ in the last 100 years (according to BlackRock).

Figure 2: Cash allocation

Source: BlackRock

What will be the aftermath of the Great Wealth Transfer?

For any Baby Boomers reading this, you probably know that your children’s outlook on the world and investing is different to your own. The result of this divide in perspective will have consequences for the global economy, and particularly in the realm of financial advice and investing.

Studies reported by CNBC show that over 80% of children who inherit their parents’ wealth will look for a new financial adviser. This represents tens of trillions which will shift between different advisors over the next few decades.

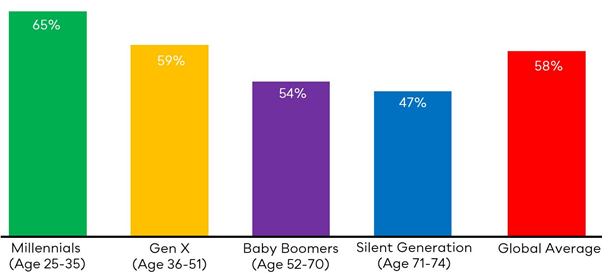

Millennials also prefer to invest into physical assets such as real estate and gold more heavily than their forebears. On average Millennials report investing over 65% of their portfolio into more defensive assets (including cash), and less than 20% report having an allocation of over 25% of their wealth towards stocks. We may see an outflow from equity markets in the next few decades and a global wealth shift to other sources of investment.

We may also see a shift in the balance of wealth classes, as the influence of the generational transfer inflates demographics within the heirs of these trillions.

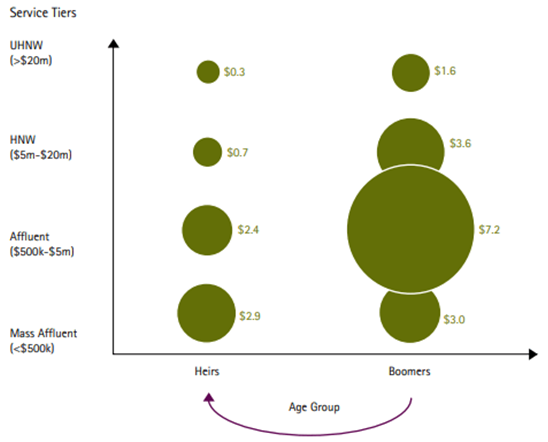

Figure 3: Demographic distribution of wealth

Source: Accenture, Federal Reserve

The chart above shows the discrepancy not just in total wealth, but also in demographic distribution. The two largest groups amongst Boomers are Affluent and High Net Worths, whilst Mass Affluent and Affluent are the two largest groups of their heirs.

When this wealth moves down a generation, we will likely see a greater weighting towards higher tiers of wealth amongst the Millennial benefactors of their parent’s inheritance.

Millennials have a 10% retirement savings rate, more than double that of their parents. They also avoid debt, holding approximately 15% less mortgage debt than Baby Boomers. And as we established earlier, they are not as active in the stock market.

Looking to tomorrow

There will always be question marks around this level of wealth transfer being almost exclusively tied to human behaviour and social preference. Maybe some adult children should be a little kinder to their parents, or maybe those parents will buy another jet ski out of some planned inheritance.

As members of the global investing ecosystem, the Great Wealth Transfer will inevitably affect us all. Investors need to look over the next few decades to consider how the consumption and spending preferences of the two generations differ.

It seems likely that Millennials will not seek to imitate the behaviour or style of their parents, and we will walk blindly into the future not knowing where US$68 trillion will end up.

Max Pacella is a Relationship Executive, Partnerships at Mason Stevens. The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Mason Stevens is only providing general advice in providing this information.