The drums of class warfare seem to be beating loud and clear after Bill Shorten’s announcement that a Labor Government would stop refunding excess franking credits received from Australian company dividends. This announcement comes on the heels of Labor’s proposal to reform negative gearing, reduce the CGT discount and tax family trusts at a minimum of 30%.

Dividend imputation prevents investors being double taxed, once at the company level and again at the individual level. The franking credits allow individuals to reduce their taxable income by the amount they paid in corporate tax as a shareholder. The Keating Government introduced this policy, however the Howard Government extended the policy by refunding any franking credits not used to reduce taxable income. Labor is not ending dividend imputation, but is rather returning to the imputation system envisaged by Paul Keating.

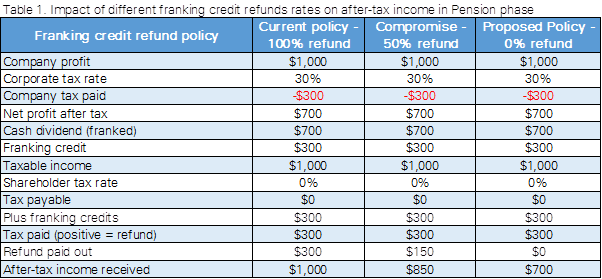

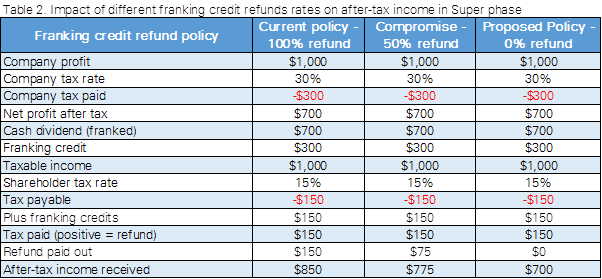

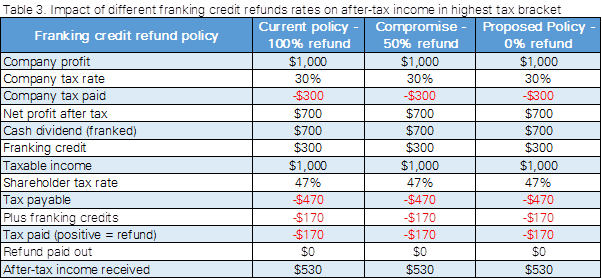

The new (or is it old?) policy will have no impact on investors paying a higher tax rate than the company tax rate, since they don’t receive franking credit refunds (see Table 3 below). However, for investors who pay a lower tax rate, the removal of the refund policy renders some or all of their franking credits worthless, lowering their after-tax income (Tables 1 and 2).

Political posturing begins

Unsurprisingly, the Liberal Party is crying murder, with Treasurer Scott Morrison describing the policy as “a brutal and cruel blow for retirees, for pensioners”. This is the Treasurer who introduced balance limits on superannuation accounts and capped non-concessional contributions leading to higher taxes for wealthier investors. Each side of the aisle is employing a healthy amount of spin after the announcement. Labor is claiming their policy is not a tax increase, but it’s not a stretch to say that removing a measure to prevent double taxation is effectively a tax increase. The Liberals are calling it a $59 billion tax grab, which is the expected value of the foregone refunds over 10 years. Why stop at a decade? It’s a half trillion dollar tax grab if we extrapolate over a century.

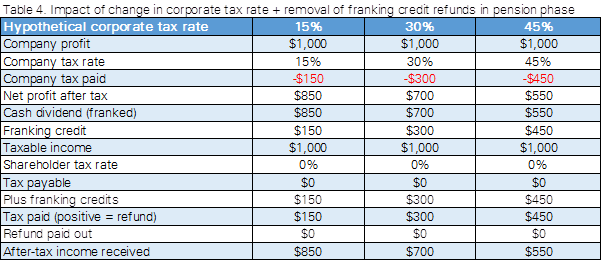

An interesting development will be that if Labor removes refundable franking credits, changes in the corporate tax rate will affect the after-tax returns of investors with a lower tax rate than the corporate tax. As detailed in Graham Horrocks’ article in last week’s edition of Cuffelinks, the corporate tax rate currently has no impact on the after-tax income because higher rates render higher franking credits and vice-versa. However, if investors paying little tax aren’t able to realise their franking credits via a refund, they will benefit from lower tax rates that increase dividends and thus reduce franking credits (i.e lower corporate tax rates = higher returns for low tax investors) (Table 4).

SMSFs may change asset allocations

The Labor announcement has caused some to warn that the policy will drive SMSF investors from listed shares to income-paying assets such as REITs and direct property, driving property prices further up. In an interview on The Today Show on 14 March 2018, Bill Shorten acknowledged this possibility, adding that Labor would make “improvements in property investment to make it more attractive to invest in new housing”. This statement may come as a surprise to many, since Labor is promising negative gearing reform to promote housing affordability. All things being equal, an asset reallocation may occur, but all things are rarely equal, and a Labor budget is almost certain to target property investors despite Shorten’s recent comments.

A key consideration for all investors is how the policy will affect dividend payout ratios in corporate Australia. Classical financial theory suggests that lower payout ratios would result in higher share valuations, since companies keep more capital to re-invest into growth opportunities. However, this relies on the assumption that Australian management can invest additional capital wisely. This week’s hearings from the Royal Commission suggest this may be a somewhat heroic assumption.

Tables showing impact of removing refunds at different shareholder tax rates

Source: Stanford Brown calculations

The tables assume Australian shares paying fully franked dividends are the only investments held by the relevant shareholder, so for example, there is no other taxable income to reduce by using the franking credit. It's worth repeating that Labor is not proposing to abolish dividend imputation, but rather the refunding of excess franking credits.

The examples show the material impact of the proposed policy on after-tax income of a pension or super fund holding only shares paying fully-franked dividends.

Nicholas Stotz is Investment Research Analyst at advisory firm, Stanford Brown. This article is general information and does not consider the circumstances of any individual investor.