The bad news is that low interest rates, low inflation and low economic growth are likely to be our global economic reality for at least for the next decade. This means challenging business conditions for businesses and investors.

However, the good news is that quality businesses will come into their own. The cyclical improvement in economic growth that has occurred over the past two years is likely to run its course over the next 18 months or so, and average businesses and speculative stocks that have enjoyed temporary macro tailwinds will face a more difficult environment as the cycle turns. Only quality companies with fundamentally solid business propositions will produce long-term growth.

Let’s look at some of the key structural headwinds facing the global economy.

1. The future fall-out from high levels of debt

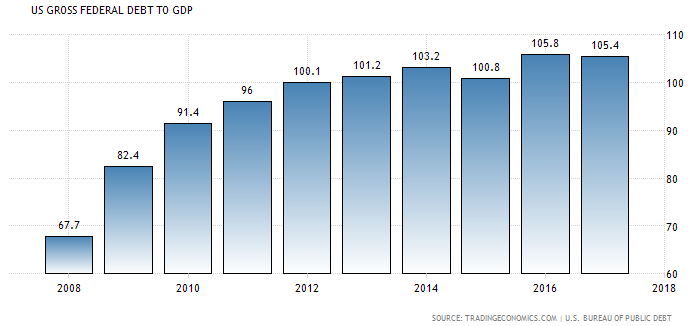

Consumer and government debt have both increased substantially in most major economies over the past decade. Gross Federal Government debt to GDP in the US has risen from around 40% in the 1980s to approximately 105% in 2017.

Over the same period, household debt to GDP in the US has risen from just under 50% to around 80%. And the same story has played out in China, where gross government debt to GDP has risen from under 25% in the 1990s to approximately 48% in 2017, and household debt to GDP in China has increased from under 20% to 48%.

Higher levels of debt have provided a one-off boost to historical economic growth rates by bringing forward consumption and investment, but at the same time, higher financial gearing has increased financial risk levels generally. The global economy’s ability to respond to economic shocks is lowered, while society’s sensitivity to future increases in interest rates has risen.

2. Globalisation drives wealth inequality in developed countries

As the world has become more interconnected, materials and workforces can be more effectively sourced from countries with the lowest cost. Access to foreign capital has improved the lot of workers in less developed countries, but placed downward pressure on the income of workers in developed countries.

Furthermore, migration rates and the declining influence of unions in developed countries have also had the effect of reducing labour costs. The benefits of globalisation have become particularly evident in the increasing numbers of high net worth individuals in countries such as China and India. From 2012 to 2017, the growth in individuals with US$50 million or more in the Asia-Pacific region grew by 37%, and it’s predicted that the number of ultra-wealthy individuals in China will double in the next five years.

The wealth of high net worth individuals is growing relative to individuals in the middle and lower economic brackets. A hollowing out of the middle class is occurring due to downward pressure on wages and increases in automation at the middle-income level. Also, a general trend towards lower corporate tax rates and lower effective marginal tax rates for high-income earners over the past few decades has also accelerated the trend towards inequality. Lower corporate tax rates primarily benefit the wealthy because they are the biggest owners of businesses. According to the World Inequality Database, in 2014, the wealthiest 1% in the US owned 39% of total wealth, up from 22% in 1978.

3. No higher productivity despite technological innovation

Humans have always innovated to improve production output and reduce human labour hours for economic gain. At certain stages, technological advancement has caused huge leaps in both productivity and the average standard of living. However, since the late twentieth century, technological changes in the form of computing, communication, robotics and artificial intelligence have not resulted in higher levels of productivity, and average wage levels have remained depressed in most developed countries.

We have reached a point where some predict that most of the jobs currently undertaken by humans will be replaced by machines and artificial intelligence, and the nature of jobs will change fundamentally. The emergence of some fundamental changes are already impacting the workforce: increasing use of robotics and 3D printing in warehouses, manufacturing and medicine, to name a few. Businesses generally benefit from automation through lower costs, whereas workers only benefit if they can be redeployed into better quality, higher paying jobs.

4. An ageing population will supress real economic growth

An ageing population has implications for labour force growth, both the number of work hours per person and consumer spending. As a population ages, fewer people will be engaged in full-time employment or be able to generate an income from human labour activities. The retirement of the baby boomers is predicted to negatively impact the growth in labour hours per person from 2008 to 2034, with negative implications for real economic growth.

Also, living longer means that individuals will have extended economic requirements that will need to be funded. This may be through government pensions, pension funds or working longer. However, lower incomes mean lower income taxes, at the same time that increasing numbers of retirees are placing strains on pension systems.

5. Climate change and other environment-related constraints

According to the Worldwide Fund for Nature Living Planet Report from 2016, the bio capacity equivalent of 1.6 Earths was needed in 2012 to provide the resources and services humans consumed in that year, and the situation has since worsened. Demand for natural resources is fast outpacing the rate at which resources can be renewed, and the burning of fossil fuels is most to blame.

The link between climate change and investment markets may not be immediately obvious, but every business and household in the world will be negatively affected.

Extreme weather events, including prolonged drought and super storms adversely affect agricultural production, and acidification of the ocean as it absorbs excess CO2 does the same to the marine ecosystem and fishing. It is difficult to predict with certainty what the specific outcomes will be, but the geographic distribution of the supply and demand of goods and services will change, redefining global trade.

Concluding

Global economic activity has experienced a cyclical uptick in the past couple of years, but in our view, the longer-term outlook for economic growth remains subdued due to these structural headwinds.

In a low-growth world, most asset classes will produce relatively low total returns. Our base case is for global equites to produce total real returns that average around 3.5% to 4.5% p.a., and many sectors of the market will find it difficult to maintain current levels of earnings in real terms over the next decade.

For investment managers, tackling low growth is challenging. When the economic tide turns, average businesses frequently fail, and only those businesses with strong fundamentals, in the form of high-quality business models, including low gearing, and large addressable markets will have the ability to offer earnings growth and long-term returns for investors.

Mark Arnold and Jason Orthman are the Chief and Deputy Chief Investment Officers respectively at high-conviction equities manager, Hyperion Asset Management. This article does not consider the individual circumstances of any investor.