Macro investing is hard, and not many investors were well positioned for Brexit or Trump. A more consistent method is investing behind trends with tailwinds. Two of the more unusual trends I follow are the selfie and e-gaming or e-sports.

Everyone’s a paparazzo

We have all witnessed the selfie effect; with a phone and camera in our pocket everyone has effectively become a member of the paparazzi. The rise of the selfie (there are over 280 million posts #selfie on Instagram) has led to the success of fast fashion retailers like H&M and Zara that are famous for quick inventory introduction. With everyone carrying a camera, millennials expect their photo to be taken every day. This trend has made the founder of Zara (Inditex) Amancio Ortega one of the richest men in the world.

It’s also no surprise that Microsoft found our average attention span had decreased from 12 seconds in 2000 to 8 seconds today. We are so distracted by our smartphones that users struggle to concentrate.

Deloitte Global estimates that in 2016, 2.5 trillion photos were shared online, a 15% increase over the previous year. Facebook and Instagram give direct investment exposure to this trend, while beauty stores are a good downstream investment. Stores like Sephora are extremely busy though as a division of LVMH, we can’t make a direct investment. Their competitor Ulta Salon (ULTA) was one of the strongest performers of 2016. Ulta Salon is only in the US but it has 21.7 million members in its loyalty program. We still need to go to salons and can’t get a haircut or colouring on Amazon.

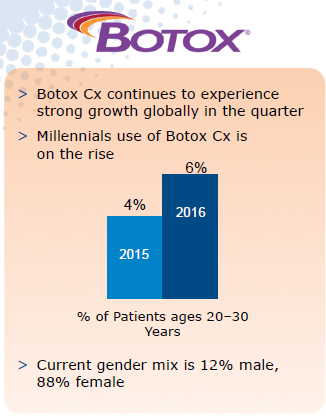

The craziest effect has been the increased use of Botox. Some 6% of customers are aged between 20 and 30, up significantly (see graphic). The pressure is greatest in Silicon Valley where the bias towards young people and startups is extreme. Older engineers are pressured to look younger, and while its illegal, most Silicon Valley engineers presume older workers have outdated skillsets. Thankfully the opposite applies to finance. Experience and grey hair is viewed as a good thing.

Gamers the new sport stars

E-sports is the other strong trend. Video gaming has grown from a niche to a form of mass entertainment for millennials. This year, HIS forecasts 6.1 billion hours of viewing increasing to 9 billion in 2020 after growing 750% over the past four years. Audiences are just as large as sports and similarly franchises are being created like traditional sports with teams based in cities around the world.

Even sports teams are jumping on the bandwagon

The Philadelphia 76ers basketball team was the first to buy not one but two e-sports teams. E-sport fans are passionate, and with the average user spending 90 minutes a day on it, it’s one of the reasons why traditional sports viewing is down. Newzoo reports that 22% of males in the US aged between 21-35 watch e-sports ahead of hockey and just ahead of baseball.

Unfortunately, our geographical isolation means it will be hard for Australia to do well. Our distance between the US and Europe means delays are a critical issue when milliseconds are the difference between victory and defeat.

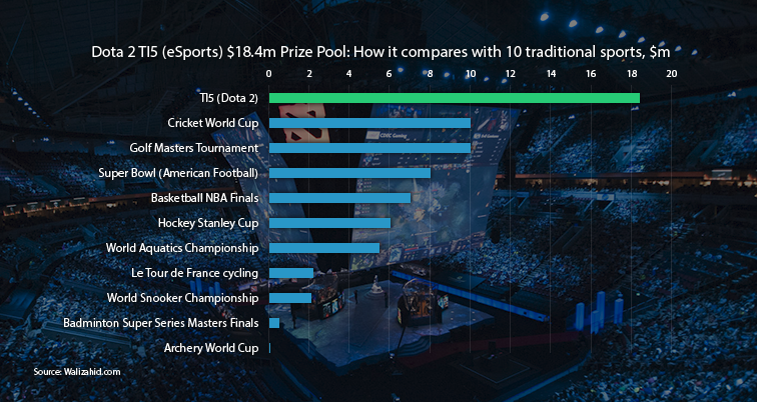

The best exposure to this trend is through the major game publishers Activision Blizzard and Electronic Arts. They own the underlying games and will benefit from future broadcasting, licensing and advertising. One way to measure the growth and potential is through prize pools. Unlike most competitions where organisers solely provide for the pool, thousands of fans contribute by buying game add-ons. A game most of us have never heard of, Defense of the Ancients, ended up with a $20 million prize pool. The organisers base prize pool was $1.6 million and the rest was co-funded by fans. The winning team received $9.1 million and even the sixth placed team made over a million dollars. At this rate, parents may begin to encourage their kids to play e-games instead of sport as its safer and offers potentially more prize money.

Source: www.xygaming.com

Jason Sedawie is a Portfolio Manager at Decisive Asset Management, a global growth-focused fund. The material in this article is for informational purposes only and does not consider any person’s investment objectives.