The taxation of superannuation in Australia is complex, inequitable, and subject to regular change. These features reduce the long-term confidence of Australians in their superannuation system. We can and should do better.

This article proposes:

- Paying Superannuation Guarantee (SG) contributions on all government-paid parental leave funded by reduced super tax concessions

- Extending the Low Income Superannuation Tax Offset (LISTO) so that it fully compensates those earning up to $45,000 for tax on their superannuation contributions

- Reducing the Division 293 tax threshold from $250,000 to $225,000

- Introducing a maximum superannuation benefit at age 70 of $3.4 million

- Requiring all superannuation benefits be subject to minimum drawdown rules from age 70.

The current superannuation tax arrangements

A good starting point to review the current tax arrangements for superannuation is to briefly describe the existing rules that apply to most Australians. It is also helpful to separate those rules that apply during the accumulation (or pre-retirement) years and the pension (or post-retirement) years.

Accumulation years

Contributions paid into super

- From the employer or from an individual where a tax deduction is received

– Taxed at 15% at most income levels

– Capped at $27,500 pa, except for some catch up rules

- From an individual where a tax deduction is not received (i.e. from after tax money)

– No further tax on the contribution

– Capped at $110,000 pa

Investment income (received by the super fund)

- Taxed at 15% with a 10% tax on realised capital gains

- Reduced by tax deductions for expenses and offset by franking credits

Pension years

Investment income (received by the super fund)

- No tax is paid on earnings on pension products with a starting limit of the Transfer Balance Cap (i.e. a current maximum retirement benefit of $1.7 million per person)

- For balances not in pension products: taxed at 15% with a 10% tax on realised capital gains, reduced by tax deductions for expenses and offset by franking credits

Benefits paid from super

- Tax free on all benefits paid after age 60 (lump sums or pensions), except for some death benefits

Proposals to improve the super system

1. Super Guarantee on paid parental leave

Under current legislation Superannuation Guarantee (SG) contributions must be paid on most forms of leave, including annual leave, long service leave and sick leave. Yet, these compulsory super contributions are not required on paid parental leave, whether paid by the government or an employer.

This is unreasonable and disadvantages many more women than men.

Recommendation

- Require that the SG be paid on all government-paid parental leave

The net cost to the Government based on the long-term SG rate of 12% and allowing for the 15% contribution tax is approximately $0.36 billion [estimated using data in the Budget Papers October 2022-23].

2. Low Income Super Tax Offset

Concessional contributions, subject to an annual cap of $27,500 (plus some carry-forward contributions, where eligible), are generally taxed when received by the superannuation fund at a flat rate of 15%. This is the less than the marginal tax rate for all income taxpayers.

The low-income super tax offset (or LISTO) is paid to those with an adjusted taxable income of $37,000 or less. The offset equals 15% of the individual’s concessional contributions, thereby removing the tax on contributions, subject to a maximum of $500.

The value of the tax concession provided to individuals on their concessional contributions is the difference between the individual’s marginal tax rate and the tax paid on their super contributions.

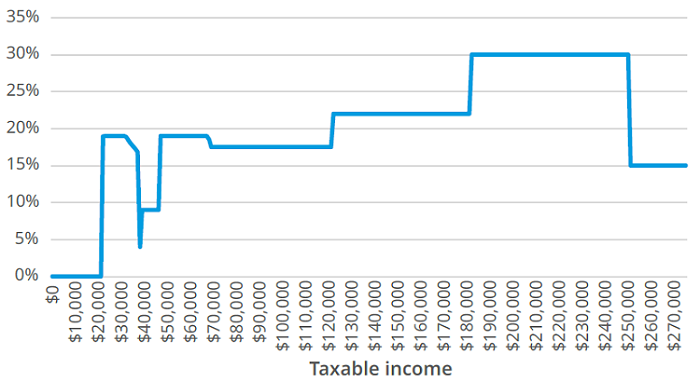

Figure 1 shows the value of this concession, expressed as a percentage of the concessional contribution, for each level of taxable income, assuming the current SG contribution rate of 10.5%. This graph assumes the person is single (with no dependants) and ignores the Medicare levy, as well as any impact relating to private health insurance.

Figure 1: The current value of tax concessions on concessional contributions for 2022-23

This graph is a simplified form of a similar chart in the Retirement Income Review (Chart 3A-1) which used an effective income tax threshold of $21,884 for 2019-20. The above chart uses the same threshold given the abolition of the low-medium income tax offset after 2021-22. This graph is based on taxable income and not the definition of Division 293 income that applies at very high incomes. Hence, the graph overstates the level of the concession for someone whose taxable income is under $250,000 but where their Division 293 income exceeds $250,000. The Retirement Income Review also adopted this approach.

It is apparent that there are several anomalies in the current arrangements, including:

- There is no concession or advantage received by individuals with an income below $21,884 after allowing for the low-income tax offset. These individuals receive no tax concession as they pay no income tax and also pay no tax on their super contributions due to LISTO.

- Due to the inconsistencies between the threshold under LISTO (i.e. $37,000) and the second income tax threshold of $45,000, individuals with incomes between these two figures receive a lower concession.

- The LISTO cap of $500 is less than the tax payable on the 11% SG contribution in 2023-24 for individuals with incomes above $30,303.

Recommendations

- Increase the income threshold for LISTO from $37,000 to $45,000 to match the second income tax threshold.

- Increase the maximum LISTO payment from $500 to $810 to match the tax payable on a 12% SG contribution for an income of $45,000.

The cost of this change is approximately $0.52 billion per year [based on Mercer analysis from data in ATO, 2% sample unit record file of individual tax returns, 2019-20].

3. Division 293 tax

Figure 1 showed those with taxable incomes between $180,000 and $250,000 receive the highest tax concession on their concessional contributions. In fact, it is more complicated than this as the extra 15% tax arising from Division 293 uses adjusted income, which includes concessional contributions and other items. Hence, the graph overstates the level of the concession for an individual whose taxable income is under $250,000 but where their Division 293 income exceeds $250,000.

Notwithstanding this complexity, many individuals whose taxable income is between $180,000 and $250,000 receive the highest level of taxation support for their concessional contributions.

Recommendation

- Reduce the Division 293 threshold from $250,000 to $225,000. This is 25% above the highest income tax threshold, thereby allowing for the maximum level of concessional superannuation contributions and other items used in the definition of adjusted income.

This measure would raise additional revenue of approximately $0.22 billion [using data from the ATO, 2% sample unit record file of individual tax returns, 2019-20].

4. Capping the size of super benefits

There are various limits within the superannuation system relating to the level of contributions. However, there are no limits in respect of benefits. The Retirement Income Review noted that:

“At June 2018, there were over 11,000 people with a balance in excess of $5 million. People with very large superannuation balances receive very large concessions on their earnings.” (their emphasis)

The Review observed that certain tax concessions are not cost-effective. The implication is clear. The introduction of some form of benefits cap would limit the significant concessions received in respect of investment earnings by those with very large balances.

This leads to two questions:

1.What is the maximum retirement benefit that should receive full tax exemption on investment earnings during retirement? This is the Transfer Balance Cap (TBC) on amounts transferred to pension accounts and is currently $1.7 million, going up to $1.9 million on 1 July 2023.

2. Should there be an additional benefit cap above the TBC (i.e. on the total balance in super, not just in pension accounts?) If so, what should the cap be?

The second question relates to the appropriate tax treatment of superannuation balances outside pension products (i.e. beyond the TBC). Currently, investment income from these superannuation balances is taxed at 15% (10% for capital gains) which represents a tax rate below the lowest marginal tax rate.

The financial position of retirees with superannuation balances above the TBC varies significantly. Some have limited income outside superannuation whereas others may have significant income from investment portfolios or ongoing employment. Hence, the appropriate tax rate on investment earnings on these super balances varies significantly. There is no 'correct' answer for all retirees.

The recommendation is for retirees to retain up to $3.4 million within the superannuation system. This total figure should be indexed annually (as currently occurs with the TBC) so that its real value is maintained.

The next question is how to apply such a cap. As with the TBC, it should be a one-off test and not repeated during retirement. In addition, a transition period is needed to avoid forced disposal of assets such as property in the short term, which may be particularly relevant for SMSFs.

Recommendation

- Require all individuals at age 70 to reduce their TSB to $3.4 million.

The introduction of the additional cap would raise revenue of approximately $0.70 billion, after allowing for some behavioural change.

Following the introduction of this cap, individuals currently aged 70 or over would be given three years to reduce their total superannuation balances to the legislated cap.

The application of this cap should also prevent these individuals from subsequently making a downsizer contribution into their superannuation account.

5. Minimum drawdown rules to apply to all super

There are currently no minimum drawdown rules applied to the balances in excess of the TBC, irrespective of the age of the member. Applying the minimum drawdown rules to the total balance would reduce the scope for superannuation to be used for estate planning.

Recommendation

- Require the minimum drawdown rules to apply to all superannuation balances from age 703.

***

1 We have used 31 years for the retirement period as it represents the average life expectancy from the preservation age of 60 (ABS, Life Tables 2019-2021) plus 5 years, which recognises that half the population will live beyond the average life expectancy. In addition, we expect individuals who have these above average benefits will receive little or no Age Pension so that the eligibility age for the Age Pension is not relevant.

2 This value assumes that the pension is paid for 20.0 years based on the latest ABS life expectancy figures at age 67. The use of a wage related deflator simplifies the calculation as the Age Pension is linked to average wages.

3 Age 70 is suggested as it is between the Age Pension eligibility age of 67 and age 75, which is the maximum age permitted to make non-concessional contributions without a work test.

Dr. David Knox is a Senior Partner and Senior Actuary at Mercer Australia. This article is general information and not investment advice, and does not consider the circumstances of any person.