There are good aspects and bad aspects to the Albanese Government changing the superannuation rules to claw back some concessions. To start with the bad, the Government like almost everyone else, fails to recognise that superannuation is not a magic pudding. Sure, it involves setting aside savings to fund retirement, but these funds come from somewhere. Contributions to superannuation (like all forms of investment) involve sacrificing current consumption with the expectation of being able to consume more in the future.

Over 30 years ago, the Government of the day decided when making superannuation contributions mandatory, to place limitations on people making their own choice when deciding between current and future consumption.

The current Government’s proposed objective for superannuation is:

“to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way”

It fails to recognise that the benefits in retirement come at the cost of consumption in prior years, and that this trade-off should be the focus in making policy and implementation decisions with respect to the superannuation system.

Why the super trade-off should be central to policy

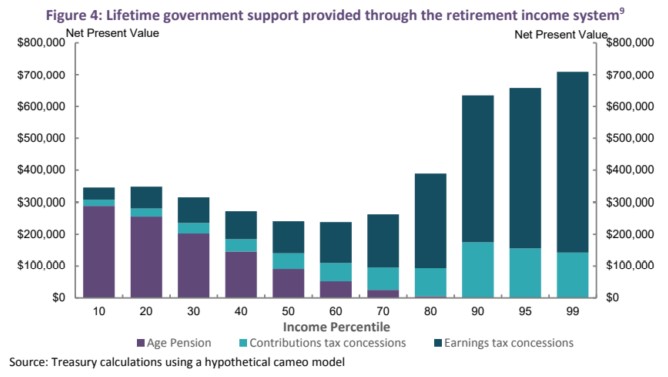

A number of studies examined this trade off as part of analysis conducted in the period leading up to the progression to the 10% contribution rate. Their findings are best summarised by saying that the 9.5% contribution rate existing at the time was found to be already too high for the poorer among us, it was in the ballpark for middle-income earners, and it was largely irrelevant for the wealthy who have the resources to make their own choice without jeopardising their ability to enjoy a dignified retirement. Treasury research used in the Retirement Income Review shows lifetime government support though superannuation concessions accrue to the highest income earners.

Superannuation should be judged based on its contribution to facilitating individuals and households to achieve the best possible pattern of consumption through time, rather than just concentrating on the post-retirement period. The recognition of this trade-off when setting an objective for superannuation will result in much better decision-making at both the policy and implementation levels. Hence, bad policy will almost certainly be the outcome if the objective for superannuation does not explicitly recognise the trade-offs involved between consumption now and in the future.

An objective purely voiced in terms of retirement, will always favour ever higher contribution rates and/or be used to oppose any thoughts of eating into superannuation balances to fund other activities. For example, the ALP is using the objective to beat up on the Coalition because they allowed people to access their superannuation balances in the early period of the pandemic and thus reduced the balance they will accumulate at retirement. Judged on the objective proposed by the government, it is a no brainer that any early access to superannuation funds will never be able to be justified.

However, when the decision to provide this access is judged on the basis of the trade-off between current and future consumption, the policy is not obviously bad as there will be cases where the particular circumstances of individuals or groups of individuals are better off if they are able to consume more now, even if it means lesser consumption in the future.

It may be that the Coalition can be criticised because it did not police access to the withdrawal process sufficiently, but the actual concept of letting people access at a time of need should not be impacted by a bad objective that concentrates solely on the post-retirement period.

How using super for a home deposit should be assessed

Another area in which better policy may emerge if the trade-off that superannuation involves is recognised is the use of superannuation balances to accumulate a deposit for a first home. The recognition of the trade-off is even more important here as people are trading off the opportunity to accumulate assets (a house) outside of superannuation, rather than accumulate their superannuation balance.

The bottom line is that based on the return on equity invested, housing has delivered a higher return over the last 30 years as compared to superannuation, and household welfare from allowing the lower-income earners access to their superannuation balance to purchase a house would have increased by their welfare by around 30%.

Indeed, what we have seen is a continual fall in home ownership dating back to the introduction of mandatory superannuation and a recognition that this is a trend that will only continue. The longer-term negative effect that will have on individuals and households in retirement must be factored into any consideration with a high probability that it will more than negate any benefits flowing from the higher superannuation balances for those who face retirement without owning a home.

Tax subsidies on mandatory contributions were always an error

When the Keating Government introduced mandatory superannuation over 30 years ago, they made the curious decision of offering tax subsidies on contributions even though individuals had no option other than to make the contributions. Even stranger, they applied the same tax rate on contributions and fund earnings across contributors, irrespective of the marginal tax rate of the contributor. Consequently, they opened up the opportunity for mammoth tax benefits for the high-income earners while, if anything, punishing the poorer amongst us. Of course, the subsequent Howard/Costello Government saw this as a good opportunity to use a favourable revenue situation to continually expand access by the wealthy to the superannuation tax incentives.

Despite subsequent governments playing around at the edges and containing the growth of the tax subsidies, we see that they have grown to more than $50 billion a year. We now have a Government acknowledging the inequity of these subsidies and the unnecessary demands that they are placing on an already stretched budget. The bottom line is that we never should have offered tax subsidies to encourage people to so something that was mandatory.

You might point out that these subsidies have encouraged people to contribute above the mandatory amount. This is true but then this is the problem – the vast majority of these discretionary contributions are from wealthy people who are channelling money they would have saved anyway through superannuation in order to exploit the tax benefits.

Undoubtedly, the subsidy should be removed completely, there was no reason to have them in the first place and they have only served as a mechanism to increase the inequities in our society by taking from the poor and giving to the rich.

It is a vain hope that this or any government would go this far, with even the possibility of reduction in the tax subsidies immediately leading to a groundswell of opposition from the coalition and from an industry that is highly reliant on the revenue earned from servicing those who obtain the greatest tax advantage from placing their savings in superannuation.

Immediately, the Government went weak-kneed and announced a reduction in the tax subsidy on the earnings of funds with assets more than $3 million. By so doing they are reducing the tax subsidies by around 1% and affecting 0.5% of superannuation funds. In other words, a proverbial drop in the ocean which the suggests that this (and future) governments will allow the inequities to continue.

The current super system fails the poor

The Government should be applauded for its willingness to address meaningful deficiencies in our superannuation system. It is amazing that the current system can exist for 30+ year without its objective ever being defined. The Murray Inquiry pointed out this deficiency about a decade ago, Treasury then produced three objectives, but these died without ever being legislated. Undoubtedly, superannuation needs an objective, but it does not need an objective that distorts policy and implementation decisions to the extent that it makes individuals worse off.

An objective needs to be crafted that gives recognition of the role that superannuation plays in influencing an individual’s/households’ welfare over their whole life and not only in their retirement years. The Government should also be applauded for opening the debate for cutting the overly-generous tax subsidies offered on superannuation.

These subsidies are unjustifiable and are a major contributor to the inequities within our society, but we have just seen another instance of a government not having the fortitude to do anything of significance about it. Indeed, we currently have a superannuation system that is overly generous to the wealthy who do not need it, but totally fails the poorer amongst us who should be our main concern.

Ron Bird is a finance and economics academic and former fund manager.