It was a deal that created an industry.

In 1988, KKR launched an audacious takeover of tobacco-and-biscuit maker RJR Nabisco. KKR paid the then ungodly sum of US$25 billion ($64 billion in today’s money), making it the largest leveraged buyout in history.

The infamous takeover battle and buyout was the subject of the legendary book, ‘Barbarians at the Gate’, which became an HBO movie. KKR went on to become one of the most storied private equity firms in the world.

The infamous takeover battle and buyout was the subject of the legendary book, ‘Barbarians at the Gate’, which became an HBO movie. KKR went on to become one of the most storied private equity firms in the world.

More than 30 years later, many investors are locked in this narrow, old-world view of KKR as swashbuckling corporate raiders. But KKR’s underlying business has significantly changed from those early days of take-private transactions.

The barbarians of buyouts have become the angels of alternatives. KKR is now one of the most dominant alternate asset managers in the world.

The old-world view, however, means many investors are underestimating the vast opportunities in KKR’s addressable markets. That addressable market is now measured in the hundreds of trillions. Importantly, its shares remain significantly undervalued.

Below, we look at 5 ways KKR is incredibly well positioned for the future and why it represents an incredible investment opportunity for investors seeking superior long-term returns.

1. KKR is well placed in two enormous, underpenetrated markets

KKR has successfully established itself in an enormous $65 trillion channel that provides private equity investments to big institutional investors, including pensions, endowments, sovereign wealth funds.

But KKR has also been developing reach and product capability that go well beyond institutions.

It can now solve the most complex needs for two huge, emerging capital providers that it has methodically targeted for several years: insurance ($40 trillion) and retail-friendly private wealth ($190 trillion).

Channels have trillions of dollars of addressable opportunity

Source: PwC, Montaka. Note: Chart not drawn to scale.

As you can see in the chart above, despite KKR’s seemingly mammoth size (~$500 billion AUM), it has barely scratched the surface of these markets.

And KKR is now equipped better-than-ever to serve them.

In insurance, for example, KKR is delivering fresh investment strategies to solve difficult client needs – leveraging expertise across real estate, infrastructure, credit, public and private equity – to help insurers meet their long-term liabilities.

KKR has also created private wealth solutions that have found product-market-fit with nearly $70 billion under management already. The strategy has been centred on creating dedicated sales channels, product platforms and reducing regulatory overheads so its products can be delivered to advisors and their clients in a frictionless manner.

2. KKR’s private wealth channel is particularly attractive

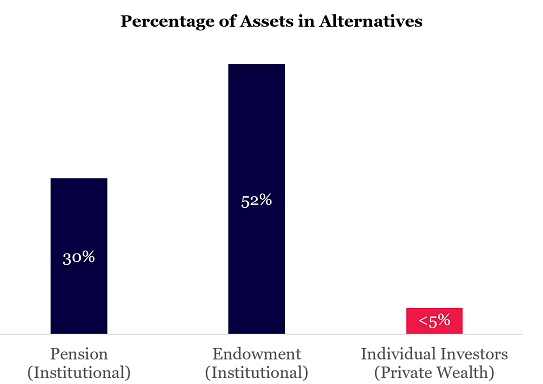

In the sophisticated institutional market (pensions/endowments) investors have allocated 30-50% of their portfolios to alternate asset management strategies. Private wealth (individual investors), however, has allocated just 5% to alternatives. There is enormous scope for that to rise.

With lower regulatory hurdles and rapid product development, some $10 trillion of assets are expected to migrate from private wealth into the alternate asset space in the medium term (through 2025). That is a staggering 20x the total assets KKR manages today.

Significant opportunity to expand penetration across major capital pools

Source: KKR, Montaka.

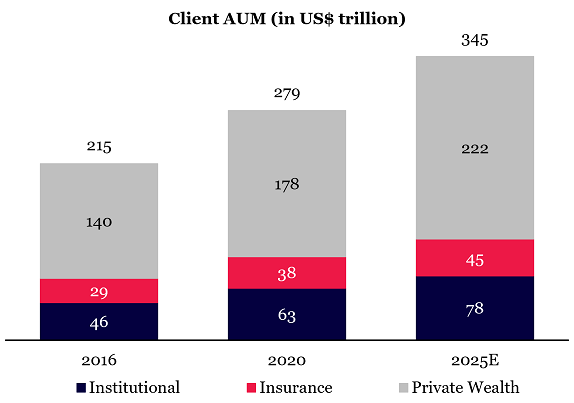

While these numbers are huge, they barely scrape the surface of the ultimate long-term potential in private wealth. The private wealth market is almost three times the size of the institutional market and measured in the hundreds of trillions (with a “T”).

Client assets are increasingly expected to flow towards alternate asset managers

Source: PwC, Blue Owl, Montaka.

The tidal wave of growing private wealth allocations to alternatives will be disproportionately captured by a handful of the world’s leading ‘brands’ in the alternate asset space.

KKR sits at the top of that list (along with Blackstone and a couple of others). Private wealth only accounts for around 15% of KKR’s new asset flows. But KKR has indicated that will increase towards 50% over time.

3. Asian business is an underappreciated competitive advantage

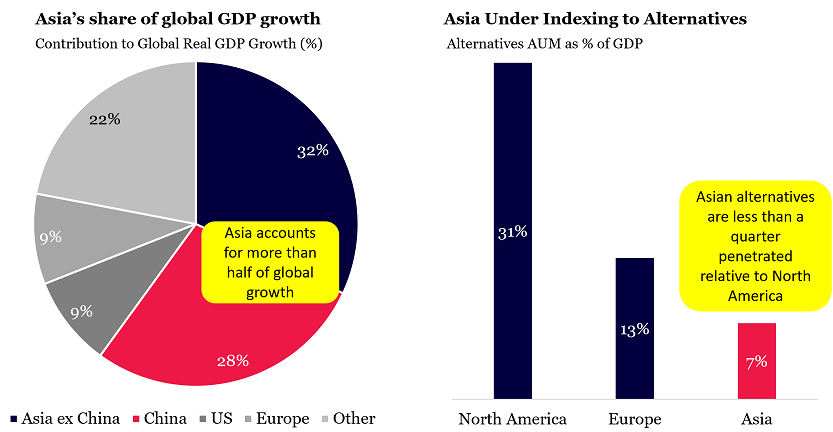

KKR is the clear leader in alternatives across Asia, with assets under management tripling in the region since 2019 (well ahead of peers). In fact, KKR believes its Asian business will reach size of its core North American franchise. Given North America represents 60% of AUM today versus APAC at 20%, that means KKR is anticipating another tripling for Asia. This extraordinary growth is not broadly appreciated.

Asia is particularly attractive because it represents an outsized share of global growth and is benefiting from structurally increasing levels of wealth in the region. Asia also has alternate asset penetration of just one-quarter of North America. By leading the market in Asia, KKR has another opportunity to fill a massive market need.

Asia is a major global growth driver with a significant unmet need for alternatives

Source: KKR, Montaka.

4. KKR has built smoother and more consistent earnings streams

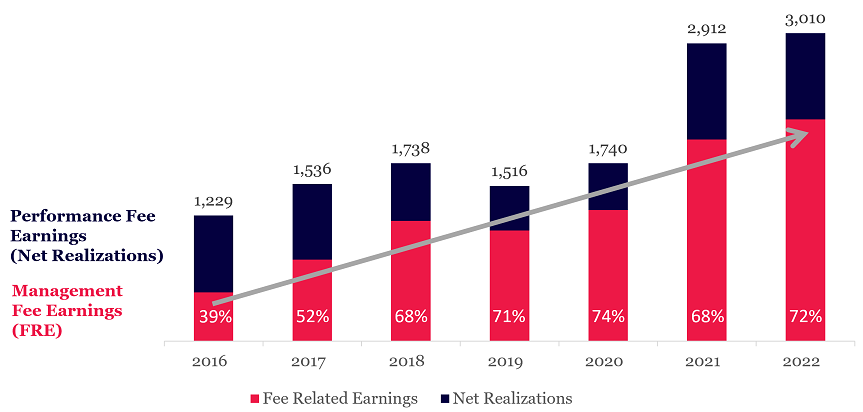

One of KKR’s most significant structural shifts has been lessening reliance on episodic ‘take-private’ transactions – where it buys and delists a public company with the intention of relisting it at a profit in the future and taking a performance fee for the service. KKR’s earnings mix and revenue is now much more tilted towards predictable and consistent asset management fee streams, rather than lumpy private equity entry-and-exit fees.

A good example is KKR’s ‘perpetual’ (aka ‘permanent’) capital vehicles, which deliver customers durable, attractive and consistent yields. KKR builds these strategies on a foundation of long-duration, cash-generative, privileged underlying assets (real estate, infrastructure, credit, etc).

Investors pay KKR management and performance fees on a recurring, contracted schedule. Unlike traditional private equity deals, KKR doesn’t have to sell assets with perpetual capital strategies. They high-grade the quality of KKR earnings and smooth them out. Over time, the market will assign a premium valuation to these enduring, subscription-style earnings.

Major shift toward more stable and predictable earnings streams

Source: KKR, Montaka.

As you can see in the chart above, KKR has significantly increased the proportion of fees that do not require the sale of assets … from around two-fifths to nearly three-quarters of the mix.

5. Its stock is undervalued

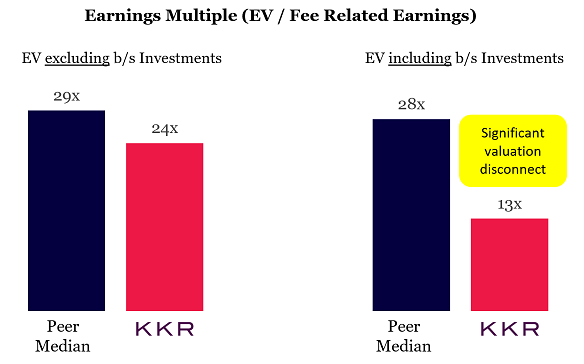

There is a significant disconnect between the market’s price and KKR’s value. Despite being in the top 5% of alternate asset managers on earth, it trades as though it is well below average (at a discount to its peer group).

Most of KKR’s peers do not significantly invest in their own funds alongside their investors. KKR is unique in this regard. It has over $25 billion worth of equity investments on its balance sheet, which is 10-20 times as much as its peers. These balance sheet investments can be thought of as an illiquid form of compounding cash. However, the market prices them at zero.

If KKR’s balance sheet investments were valued like cash, its earnings multiple would be less than half that of its peer group. If it were to trade in line with its peers on this basis, the stock would increase by ~50-100% overnight!

KKR is significantly undervalued by the market

Source: KKR, company filings, Montaka. Peers include Blackstone, Brookfield, TPG and Ares. Fee Related Earnings are net of SBC and based on consensus / Montaka estimates.

A window of opportunity

KKR may be thought of as a bullet train that has just begun picking up speed. It started out moving slowly then steadily, but momentum is about to flip and rapidly propel the business forward.

From the enormous opportunity to further penetrate massive new markets like insurance and private wealth, leverage its scale advantage in highly attractive Asia, or the potential for a valuation re-rating with smoother earnings streams or multiple expansion, the future is full of extraordinary opportunities for KKR.

With the stock undervalued, investors have a window of opportunity. They should embrace this multi-decade, secular growth story and get their tickets aboard the train before the market fully grasps – and prices in – what is going on beneath the surface of this incredible business.

Source: Bloomberg, Montaka.

Amit Nath is a Senior Research Analyst at Montaka Global Investments, a sponsor of Firstlinks. This article is general information and is based on an understanding of current legislation. Montaka owns shares in Alibaba and Meta Platforms.

For more articles and papers from Montaka, click here.