Investors have been treated for the past two decades to a period of extremely strong returns. This has been driven by a massive structural decline in inflation and interest rates, set against the backdrop of reasonable economic growth, a global savings glut and supportive policy settings. There have been setbacks along the way, including the sharp downturns in the early 2000s, in 2008-09 and in 2020, but they have been met with increasingly aggressive monetary policy easing.

Most policy makers now wish to see higher wages, higher inflation, lower unemployment, and eventually more ‘normal’ interest rate levels. This pivot towards both arms of policy working in tandem is designed to not only reflate economies but spread the benefits more widely than experienced over the years of reliance on monetary policy alone.

The 60:40 portfolio has easily met its objectives

The traditional balanced portfolio (60% growth, 40% defensive) has performed strongly in the predominately disinflationary regime of the past two decades, generating returns of 7.9% a year over the past 10 years and 6.9% over the past 20 years.

With inflation averaging just 2% over 10 years and 2.5% over 20 years, the traditional portfolio has easily achieved its return objective with relatively low volatility.

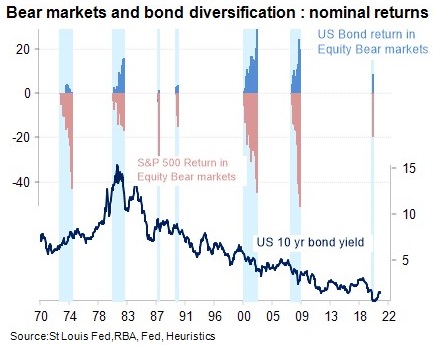

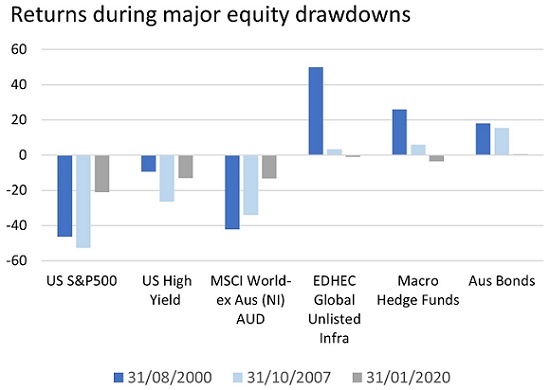

When equity market drawdowns have occurred, bonds have generally provided the diversification expected through a combination of yield and capital growth associated with declining yields on long duration securities. Even in the COVID-19 equity market downturn in 2020, bonds provided some gains to help cover initial equity losses.

Inflationary periods are different

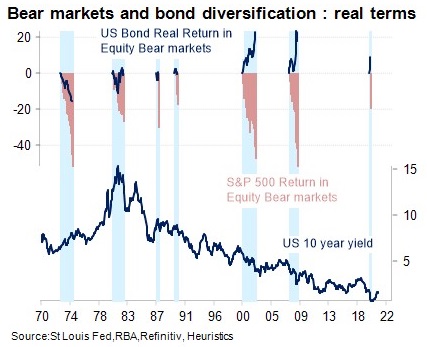

But in earlier, more inflationary periods, this was not always the case. As the following chart shows, in inflationary periods, despite high yields to begin with, bond returns in real terms failed to offset equity market declines, and in some cases, compounded the problem.

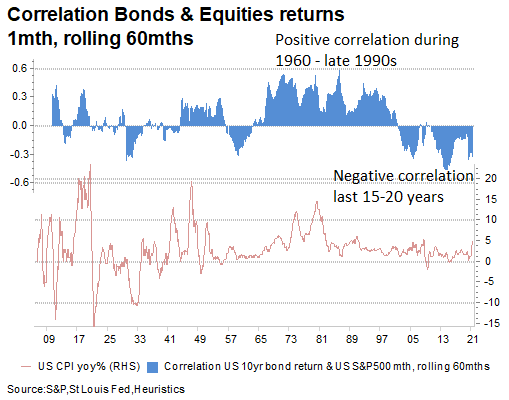

In future, we may not be able to depend on bonds for diversification benefits if the negative correlation between bond and equity returns reverts to a positive correlation in an environment of rising inflation but with low, perhaps even suppressed, nominal yields.

What to expect in the future

It’s obvious that the income attribute of bonds has diminished significantly. While bonds would still likely produce solid capital growth in a deflationary regime, helping to offset equity declines, their ability to provide a dampener on volatility is likely to be found wanting in a rising inflation environment.

Even in an environment of low growth, low inflation and extremely accommodative policy bonds now rely almost totally on further capital gains (declining yields) to produce an offset to equity weakness.

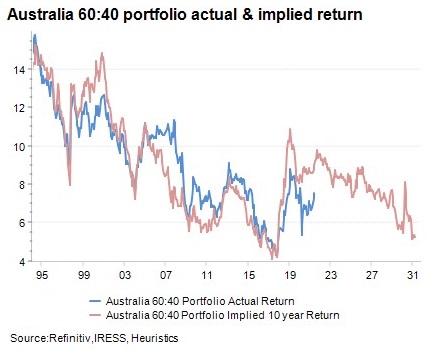

If we assume that the 10-year forward returns for a 60:40 portfolio reflect a return to mean valuations and earnings for equities, and that the current 10-year yield is a good approximation of bond returns for the next 10 years, then a simple 60:40 portfolio in Australia might be projected to return around 4% in nominal terms over the next 10 years.

With inflation back to the target of 2.5%, that would generate real returns of 1.5% a year, significantly below most ‘CPI plus’ objectives and recent history.

Rather than assume the naïve mean reversion scenario, it would be useful to reflect on what might happen in different inflation regimes.

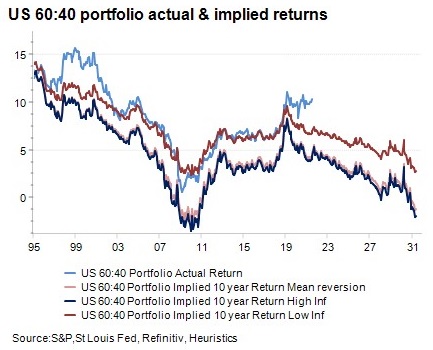

In the chart below we show for the US, that the 10-year return outlook varies considerably depending on the inflation regime.

In a simple mean reversion scenario, returns for a US 60:40 portfolio might be expected to be zero over the next 10 years.

Under a higher inflation scenario, we might expect a significant de-rating of equities. The average Shiller PE in high inflation regimes has been around 16 times, dragging total returns lower to an estimated -2% a year over the 10 years in nominal terms and -5.5% in real terms.

On the other hand, a continued low inflation regime (with more moderate mean reversion) would see returns closer to 3% a year (or 1-2% in real terms).

What are the solutions?

Bonds still have a role to play, particularly in the event of a major equity market drawdown related to a deflationary event or regime. As we saw earlier, a high inflation regime is typically not good for bonds and equities. The equity bear markets since 2000 have all occurred within a deflationary backdrop.

Here are five possible scenarios:

- Seeking yield and defensive attributes in asset classes such as unlisted infrastructure and direct property is one approach but introduces a level of illiquidity and exposure to a rise in real yields from current extreme lows.

- Certain hedge fund strategies have provided solid performance in equity drawdowns since 2000 but limited data from the higher inflation periods and the dispersion of performance across managers in this space creates another set of challenges.

- Higher yield in credit is a feature of the current investment environment but credit has a relatively high correlation to equities and spreads are already hovering near record lows. Some credit markets also have considerable duration risk.

- Buying defensive characteristics in quality equity exposures, high dividend or defensive sectors can also play a role although equity beta is still high, and these sectors also carry an exposure to rising bond yields.

- Offshore currency exposure for an Australian investor has provided portfolio diversification benefits during equity drawdowns with unhedged global equities providing similar performance to that of high yield during equity bear markets over the past two decades.

The chart below shows the performance of a range of these assets during the last three major equity market drawdowns.

Investors want the best of all worlds

Investors desire income, growth, downside protection and inflation protection although often in different doses. Projected income returns are now very low, growth exposures come with a heavy price tag, while downside protection and inflation protection are generally expensive, sometimes illiquid, and difficult to access.

Rather than think in terms of an arbitrary 60% growth and 40% defensive portfolio, investors need to think in terms of the growth/defensive continuum and building a robust portfolio for a range of different environments. Defensive assets are often characterised as such based on having lower volatility but perhaps investors should be more concerned about the ability of an asset to provide downside protection in different scenarios.

Bonds provide downside protection in deflationary environments but not in periods of inflation. Inflation-linked bonds, gold and commodities are more volatile, but may provide a defense against inflation. Protection strategies, gold and bonds may be useful in a deflationary environment. Infrastructure and property assets offer modestly defensive characteristics in disinflationary scenarios but perhaps not so in economic downturns or rising inflation and interest rate phases. Some growth assets have relatively more defensive characteristics than others if they carry a certain factor, sector or regional exposure.

For Australian investors, unhedged global equities can provide some downside protection. By understanding an asset’s attributes in different circumstances rather than merely focusing on volatility and arbitrary definitions of growth and defensive assets, investors will be better placed to build truly balanced portfolios for the more challenging investment environment ahead.

Damien Hennessy is Head of Asset Allocation at Heuristic Investment Systems, a subsidiary of Zenith Investment Partners. This article is general information and does not consider the circumstances of any investor.