Most people tend to follow a pattern in life. They go to school, obtain qualifications, get a job, pay taxes, and eventually settle down with a family. During this time, many make investments and even start a business to increase their wealth and assets.

They can either own those wealth and assets in their own name or set an alternative structure like a family trust to hold them. Such a structure could assist with tax planning, asset protection and obtaining tax benefits.

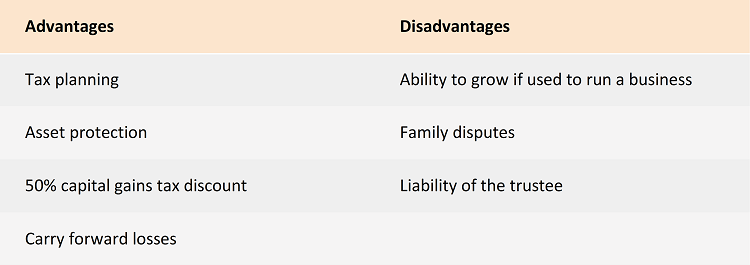

This article discusses the advantages and disadvantages of family trusts.

What are family trusts?

A family trust is a discretionary trust that is used in Australia to hold the wealth and assets of a family. It is also commonly used as the structure for family businesses.

A trust is a legal structure under which a person (the trustee) holds the legal title of a property for the benefit of other people (the beneficiaries). The trustee has a wide range of powers to deal with the property, and any profits generated from that property are distributed to the beneficiaries.

A discretionary trust is a type of trust structure. The most distinguishing feature is that the trustee has the discretion on how much to distribute to each beneficiary if any money is distributed. The beneficiaries are not guaranteed to be paid, they just have an expectation of being paid.

In family trusts, the beneficiaries are usually members of the same family, and a person from the family or a company controlled by the family will be the trustee. This trustee has broad discretion including on the distribution of the income from the trust.

Let us look at some of the advantages and disadvantages of a family trust.

Advantages of family trusts

1. Tax planning

A family trust is taxed at the highest income tax rate, which is 45%. However, any trust income distributed to the beneficiaries is taxed at the income tax rate of the beneficiary who receives the distribution.

A family trust is commonly used to minimise the total income tax paid by the whole family. Generally, the trustee in a family trust distributes the trust income among the trust’s beneficiaries and allocates more distribution for a family member with a lower income tax rate than the other parties. This reduces the total amount of tax paid on the trust income by the beneficiaries.

2. Asset protection

A family trust structure can protect your family’s wealth from creditors. Usually, when a person owes money and cannot meet the repayment requirements, the creditor can access the person’s personal asset to recoup the debt payable. Personal assets include your home, car, and other property a person owns in their name. If the family trust is holding the personal assets, then the trust’s beneficiary has no legal rights over those personal properties and creditors of the beneficiaries cannot access them. This includes even if a beneficiary becomes bankrupt.

3. 50% capital gains tax discount

A capital gains tax is payable on any profits from the sale of an asset. A family trust receives a 50% discount on capital gains tax for profits made from selling any assets the trust has held for more than 12 months.

4. Carry forward losses

A trust does not distribute losses to beneficiaries. This means the beneficiaries will not be called upon to contribute money to the trust to meet any loss. Instead, losses from each year can be carried forward to the following year.

Disadvantages of family trusts

1. Grow as a business

A family trust is also used as the business structure for family businesses. While this structure offers benefits like those outlined above, it restrains a business’s ability to grow. Due to the high tax applied to trust income that is not distributed, trustees almost always distribute the income. Therefore, the business cannot retain the profits to reinvest in the business for the following years. Lenders such as banks are reluctant to lend to trust structures when compared to other business structures like a company.

2. Family disputes

It is usual for families to have disputes. Disputes about the control of the trust can occur where the trust holds a significant amount of family wealth. If the trust deed does not clearly set out the procedure to appoint or replace a trustee and how trust income should be distributed, then family disputes are more likely to occur. To avoid such disputes, the trust deed must set out clear procedures.

3. Liability of the trustee

A family trust provides excellent protection for beneficiaries both from an asset protection and tax planning perspective. However, a trustee is legally liable for the obligations of the trust, including any debts it owes. This can cause significant personal risk to the trustee if the trustee is an individual, which is why a company is often used as the trustee.

Should you set a family trust?

The merit of a family trust depends on your personal circumstances. You will need to get independent legal and financial advice to determine if a family trust structure could benefit you and your family. Note that transferring existing assets to a family trust will come with tax implications.

Stebin Sam is a practising commercial solicitor at LegalVision and a freelance content writer. LegalVision can be contacted on 1300 544 755 or their membership page. If you need help with setting up a family trust, LegalVision’s experienced corporate lawyers can assist as part of its membership offering.

Disclaimer: The above article is for information purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.