Most countries are on a net-zero emissions crusade. Whether the goal is 2050 or later, there is no escaping the global push to reduce carbon emissions and combat climate change.

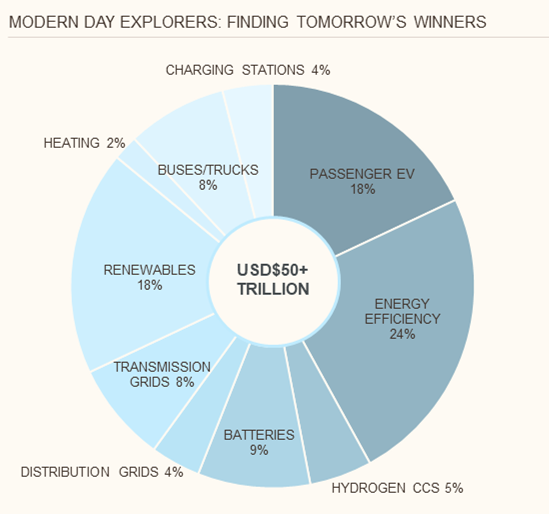

This transition presents a huge opportunity for investors to invest in those companies building or adapting the technology and infrastructure to reach this target. We believe there is $US50 trillion to be spent over the next 30 years in this transition across a diverse range of industries and companies.

The potential

As the chart below highlights, investment will not just be on passenger electric vehicles (EVs), but also on the infrastructure - such as charging stations - needed to support EVs. Likewise, investment also needs to be made in energy efficiency, renewable energy, battery manufacturers and the power grids to support the transition.

Ultimately this will translate to $US50 trillion in revenue to the companies that are going to enable the transition.

Figure 1: This is how much de-carbonisation is going to cost

Source: Goldman Sachs, Munro Partners Estimates (31 December 2020)

At Munro, we've been investing in this space for 15 years, but in the last few years we've seen momentum shift to the point where there is consensus around the need to decarbonize the planet.

Our focus is to find the solution providers for this transition. We seek to invest in these enablers because they are the companies positioned to secure the spending and therefore revenue, which will ultimately lead to earnings and share price growth.

The year ahead - three themes

1. EV penetration

EV penetration is accelerating for a number of reasons. Manufacturers have been cutting prices and Tesla is leading the market with price drops of between 15-29% in the US.

Importantly, the US's Inflation Reduction Act included a potential $7,500 tax credit for Americans cars that qualify, bringing the EVs in reach of many more potential consumers.

At the same time as price reductions, input costs for EVs are also decreasing. Lithium is down close to 70% from its peak, freight costs are also down, as are many other raw materials needed to manufacture these vehicles.

2. Gridlock

'Electrify everything' is an easy catchphrase but there is a potential bottleneck to this process when it comes to grid capacity and capability. Power grids need to be able to cope with the extra power that is being put on them. Whilst the grid is a solution to climate change because it enables electric vehicles and other things to be electrified, the grid itself is actually at risk because of climate change.

If we look at the US, 70% of the grid is now over 25 years old. Electricity demand is going to nearly triple by 2050 and grids need to be able to work in a more bi-directional way than they did historically. To do this, money needs to be spent on their development and advancement, an issue we believe is going to come to a head this year.

3. Globalisation reversing

Recent geopolitical conflict and tensions have put a question mark over the last 30 years of globalisation. This was highlighted with Russia's invasion of the Ukraine, when Europe quickly realised that the question of energy security and decarbonisation were more aligned than they originally thought.

China is also one of the main manufacturers of many of the components in solar panels and has increased its penetration in the production of these components over the past decade. As the geopolitical tensions between the China and the West intensifies, there are opportunities for companies to offer solutions to their governments around that industrial base to enable countries to continue that decarbonisation journey in a more self-sufficient way. This should help US and European companies in the clean energy space compete domestically after decades of losing share to China.

Under the hood - Waste Management

Recently we were asked why, if there is so much potential for growth, is the market not pricing transition companies accordingly. We believe that is because the market continues to price the companies we seek out - i.e., the solution providers - on what they are doing currently instead of what they could do in the future.

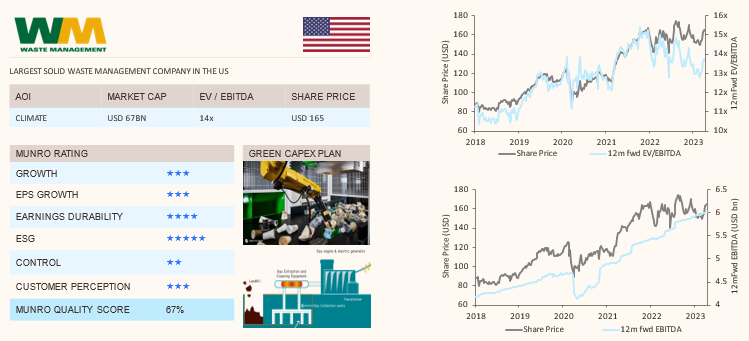

A good example of this is the waste management space and Texas-based Waste Management, the largest solid waste management company in the US.

Figure 2: Waste Management

Source: Bloomberg Finance L.P 24 April 2023

The market models Waste Management on its traditional business, which is going around the homes in the US and picking up the trash, sorting it and then sending it to landfill. It owns the landfill sites, the trucks, the transfer stations, and gets paid well for the services it offers. It's a good defensive company in a sector with high barriers to entry.

What the market is unable to currently price for because it's a new opportunity, is the increased EBITDA it can get from expanding into two new areas. The first one is recycling, which the US has been very poor at. The company is now putting in automation to be able to generate revenues from this recycling opportunity by selling the product back to consumer companies. But Wall Street analysts are not taking this into account yet because it's not yet visible in the next 1-2 years.

The other, even larger opportunity is the Landfill Gas To Energy (LFGTE) potential. Waste Management is trying to capture the renewable natural gas off its landfill sites and sell that back to other companies or use it in its own fleets.

These two activities offer a material upside to the EBITDA estimates in the market, which we predict are 10-15% too low versus what the company could generate 5 years out.

Hiding in plain sight

By looking beyond the headlines and delving deeper into some of the newer technologies that companies are exploring, investors can buy before share prices of many of these businesses take off.

James Tsinidis is a Partner and Portfolio Manager with Munro Partners, a specialist investment manager partner of GSFM Funds Management. GSFM is a sponsor of Firstlinks. Munro Partners may have holdings in the companies mentioned in this article. This article contains general information only and has been prepared without taking account of the objectives, financial situation or needs of individuals.

For more articles and papers from GSFM and partners, click here.