There is a major disconnect in the Australian financial system which the regulators are doing little to correct. Much of the nation’s saving is in the superannuation system (currently $1.5 trillion and heading for $6 trillion by 2030) while much of the nation’s funding need is in the banking system (total loans of the four major banks of $1.8 trillion are greater than their deposits). The obvious solution is to make it easier for publicly-offered super funds to invest in bank deposits, but some recent regulations operate in the opposite direction. Furthermore, they create more incentives for investors to set up SMSFs at the expense of publicly-offered super funds.

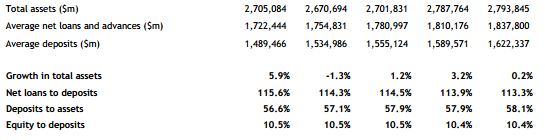

Consider the aggregated balance sheets of our four major banks:

Sep 2011 Dec 2011 Mar 2012 Jun 2012 Sep 2012

Source: Quarterly Bank Performance, APRA, issued 21 February 2013

The ratio of deposits to total assets of the major banks is only 58%, and the amount of their loans is 113% of their deposits. The funding shortfall comes primarily from two sources: wholesale short term money markets ($205 billion), and longer term bond markets, mainly offshore ($465 billion). In times of market distress such as during the GFC, the reliability of offshore funding falls away, and short term wholesale sources quickly seek the greater security of government paper. So it is in the interests of bank funding stability that they finance themselves more from stable, long-term retail sources, such as deposits from the superannuation system (including retail platforms and wraps).

Unfortunately, the proposed Australian Prudential Regulation Authority (APRA) Prudential Standards on Bank Liquidity (APS210) discourage this meeting of large super funds and bank deposits.

Same investment, different liquidity treatment

To see how the liquidity regulations work, let’s take a quick quiz, looking at Mrs Walsh making the same investment three different ways. There’s one rule: ‘retail’ is good and ‘wholesale’ is bad.

Question 1. When Mrs Walsh, a long time Westpac client, walks into Wagga Wagga branch and deposits $10,000 in an at call Westpac deposit, can the bank classify it as a long term retail deposit?

Answer 1. Yes, the liquidity rules treat this as a retail deposit, which is wonderful because the bank does not need to allow for Mrs Walsh’s ability to take the money out the next day. The bank does not need to hold any expensive liquidity to support the deposit, so Westpac loves this type of money and will pay Mrs Walsh an attractive rate. Smiles all round.

Question 2. When Mrs Walsh, a long time Westpac and BT Investment Management client, walks into Wagga Wagga branch and deposits $10,000 in an at call Westpac deposit offered on BT’s super platform, can the bank consider it a retail deposit?

Answer 2. No, the liquidity rules classify this as ‘wholesale’ because the super fund has a trustee which is not a ‘natural person’ making the deposit. Westpac must hold low-yielding liquid assets to support this deposit, and it has suddenly lost its ‘sticky’ characteristics. Westpac doesn’t like it and so offers a lower rate to the super fund. Frowns all round.

Following so far?

Question 3. When Mrs Walsh, a long time Westpac client and recent proud owner of an SMSF, walks into Wagga Wagga branch, and in the name of the corporate trustee of her SMSF, deposits $10,000 in an at call Westpac deposit, can the bank consider it a retail deposit?

Answer 3. Yes, because although the investment is held in the name of a corporate trustee, not a ‘natural person’, APRA has granted special treatment for SMSFs. Again, Westpac is not required to hold expensive liquidity to support this deposit. Good rates and more smiles.

Still following? The obvious bunnies missing out are the large public super funds and their clients.

In Cuffelinks Edition 2, we demonstrated how the government deposit guarantee does not apply for investors using publicly-offered super funds to deposit funds in banks. Now, the effect of APS210 is that deposits made via the same public super funds will be considered volatile, wholesale money on which banks will be less willing to pay competitive interest rates. SMSFs have a special exemption which categorises them as stable, retail depositors.

The lack of significant superannuation industry lobbying against the terms of the government guarantee and the liquidity rules is mysterious because they make little practical sense, either from the bank, superannuation or good liquidity management perspective. The days are long gone when the super industry could ignore what is happening with bank regulations, as retail investors have flocked into billions of dollars of bank deposits on super platforms in the last few years.

In fact, most of the major retail fund managers did not offer bank term deposits or bank cash accounts on their platforms until 2008 or later, and many industry funds still do not give their customers a range of term deposits to select. Their customers who want cash or term deposit exposure must choose managed funds such as cash trusts that invest in such instruments.

Even before APS210 hits, there are two problems for publicly-offered super fund investors that direct bank depositors and SMSFs can avoid: the first is that administrators of large super funds take a platform management fee; and the second is that large super fund investors are unable to take advantage of special ‘blackboard’ deals offered by banks. For example, although the cash rate is only 3%, it is not difficult for a bank customer or SMSF to earn 4.5% on a bank deposit. Such rates are not available in the wholesale money market because the banks only pay up for deposits classified as genuine retail. Large publicly-offered super cash funds are already uncompetitive compared with term deposits, and APS210 will only make it worse.

How do the new liquidity regulations create this outcome?

(Note, this is not about bank capital, that is a different set of regulations).

Under the direction of the Bank for International Settlements and Basel III, APRA is introducing a new standard called the Liquidity Coverage Ratio (LCR). It requires banks (and other Authorised Deposit-taking Institutions) to hold High Quality Liquid Assets (HQLAs; basically government securities) against liabilities maturing within 30 days, or any term deposit where the investor has the right to redeem early. Retail deposits are considered ‘sticky’ and the most stable of deposits, and do not need to be included in the 30 day maturity bucket, even if they are at call. Retail deposits must come from a ‘natural person’, not a trust.

Banks will be willing to pay more for retail deposits because they do not need to hold HQLAs against them, which is estimated to cost up to 80bp pa due to the lower yield on government securities. This is the potential disadvantage facing institutional super funds. Recent announcements from Basel indicate some relaxation regarding which assets qualify as HQLAs, opening the door to better returns, but APRA is reluctant to ease the rules in Australia.

What about those institutional super funds which offer bank deposits on their super platforms or wraps, where a retail investor directly selects a deposit issued by a specific bank? Surely this is a retail deposit, as it is a retail investor making the decision, not a fund manager. It would be almost impossible for the trustee to act against the instructions of the depositor, at least within the defined 30 day period.

At first glance, it appears these deposits will receive favourable APRA treatment as retail, as the Discussion Paper on Basel III, page 18, states:

“APRA recognises that there are some deposits that are acquired by an ADI through an intermediary but can be retail in nature where the natural person retains control. Subject to meeting certain conditions, as outlined in draft APS210, ADIs can treat these deposits as retail for determining cash outflows under the LCR scenario.”

So far so good. But what are these “certain conditions”? A massive sting in the tail, that’s what. The criteria to gain the favourable retail treatment include: the natural person must retain all legal rights, which cannot be transferred to an intermediary. The intermediary can have no duty to make investment decisions on behalf of the natural person.

In Australia, all superannuation money must be invested through a trust that complies with the Superannuation Industry (Supervision) Act 1993 (SIS Act). All super funds are trusts with a trustee. Therefore, all natural persons putting money in a super trust must be transferring rights to an intermediary (but with a special carve out for SMSFs), and all money invested by institutional super funds will be considered as coming from a financial institution.

Both the Basel rules and APRA judge money from financial institutions to be ‘hot’ and an unstable source of funding, and the regulations will discourage banks from raising this type of money, and provide another boost to SMSFs.

It’s not a good prospect for publicly-offered super funds as investors seek the security of bank deposits, and it will do nothing to reduce the reliance of our banks on wholesale and offshore funding. We should be designing the system to put super money and bank deposits together, not force them apart.