Although SMSFs hold $750 billion of Australia's almost $3 trillion superannuation system, the data on their investment allocations is surprisingly poor. There are two main sources:

* the Australian Taxation Office (ATO) produces out-of-date reports based on SMSF tax returns, using badly-defined categories (discussed in detail here).

* industry participants such as SuperConcepts, Class, Sharesight and Investment Trends provide asset allocations based on surveys or data dumps from their own clients.

While some of the attempts by industry are useful, a comprehensive report requires the ATO to improve its categories, and there are signs it wants to head in that direction.

In a talk called 'The Regulator - putting a spotlight on what they're putting a spotlight on' to Chartered Accountants on 21 October 2019, Dana Fleming, the Assistant Commissioner SMSF Segment said the ATO was looking at changing asset categories. For example, 'unlisted trusts' provides no information on the asset class held.

“I would love better data and granularity and hope to improve that for ourselves ... so we get better visibility of what people are actually invested in.”

The recent ATO letters

In August 2019, the ATO wrote to 17,700 SMSF trustees about their lack of asset diversification, and it sparked a flurry of activity from members. The ATO said:

“… SMSF annual return data indicated these SMSFs may be holding 90% or more of their retirement savings in one asset or a single asset class.”

In 99% of these cases, the SMSF had borrowed money to buy one asset, property. At a time of declining property prices, the concern for retirement savings was justified, but the vast majority of SMSFs do not borrow.

More importantly, another part of the ATO announcement has broader implications. About one-third, or 180,000 SMSFs, invest 90% in a single asset or asset class, and the ATO also said:

“We are concerned that these SMSF trustees may not have given due consideration to diversifying their fund’s investments and the risks associated with a lack of diversification when formulating and reviewing their investment strategy.”

Legal obligations of all SMSFs

Under superannuation regulations (section 4.09 of the SIS Act), it is a legal requirement for SMSFs to “review regularly and give effect to an investment strategy”, allowing for:

- Risks, liquidity and likely returns from investments, having regard to cash flow requirements.

- Composition of investments as a whole, avoiding inadequate diversification.

- Ability to discharge existing and prospective liabilities.

SMSFs make up the largest segment of super assets at about 26%, ahead of industry funds at 25% and rapidly dropping behind, retail funds at 22%.

The asset allocations of large funds (excluding SMSFs)

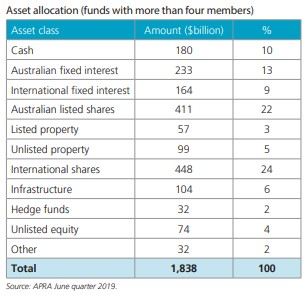

Large funds invest their assets in ways shown in the following table, providing a clearer classification than available for SMSFs.

Source: ASFA Statistics

Some highlights include:

- A larger allocation to international shares than Australian listed shares.

- A significant investment in unlisted and alternative assets, such as unlisted property (5%), infrastructure (6%), unlisted equity (4%) and hedge funds.

- A solid defensive cash and fixed interest allocation of 32%, often due to offering ‘balanced’ funds to their members.

Australia’s $160 billion sovereign wealth fund, the Future Fund, gives even more detail. It holds 29% of assets in global equities and only 7% in Australia, and it reports its unlisted investments in private equity, alternatives, infrastructure and timberland.

The asset allocation of SMSFs

The ATO quarterly report reports managed funds under one category without separating fixed interest, domestic and global equities. The foreign investment number is only direct equities, not including the holdings of Exchange Traded Funds (ETFs), Listed Investment Companies (LICs) and managed funds in global equities.

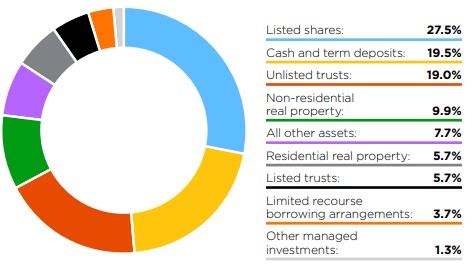

There are four alternative sources, each useful but limited by the sample size. Researchers at Investment Trends make broad allocation measurements, while three SMSF service providers (Class Limited, SuperConcepts and Sharesight) reveal what their clients are doing. Class's SMSF asset allocation as at 30 June 2019 reports:

Source: Class Limited, SMSF Benchmark Report, June 2019

Like the ATO reports, it is difficult to identify the global equity holdings. The listed shares component can be divided into:

- Domestic shares, 76.7%

- ETFs, 8.6%

- Debt and hybrid securities, 7.5%

- Other trusts and stapled securities, 7.2%

We know from reports issued by ETF providers that SMSFs have moved rapidly into fixed income investments and global equities in the last year, which is heading in the same direction as the large funds. A wide range of listed opportunities which were not available a couple of years ago, such as infrastructure, securitised assets, corporate credit and global fixed interest, are now available in listed form on the ASX.

SMSF global equity allocation

Many global equity managers like to quote the ATO data on international investments to encourage SMSFs to place more money in their funds. The ATO data shows an allocation of only 1.4% because most global shares are held by SMSFs in local funds. The portfolio tracking software company, Sharesight, estimates 15,500 SMSFs in its sample allocate about 14% to global equities in various vehicles. Checked against SuperConcepts estimates, this figure is far more accurate than the ATO data.

Source: Sharesight, ATO. ATO data is for the quarter ending March 2019, Sharesight is for September 2019.

Meeting the legal obligations of running an SMSF

We know enough about SMSFs to state that the majority have a diversified asset allocation, but as the ATO has said in its letters to trustees, there are many who need to consider whether their investment strategy meets the purpose of providing for retirement.

The main legal requirement is to put an investment strategy in place and to review it regularly in the context of risks, returns and cash flow needs. However, SMSF trustees have significant flexibility in their asset allocation, and if they document their strategy properly, they should be safe from ATO scrutiny, even if their assets are not well diversified. The ATO has no right to decide if an investment strategy is suitable for an SMSF trustee.

Let's at least collect accurate data. We can't hold an informed discussion on SMSF investing when we don't know what they really do.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.