The latest BetaShares/Investment Trends 2019 Report shows Exchange Traded Fund (ETF) adoption is at record highs. The insights are based on responses from around 8,000 investors and 800 advisers, making it the most comprehensive survey on the ETF industry in Australia.

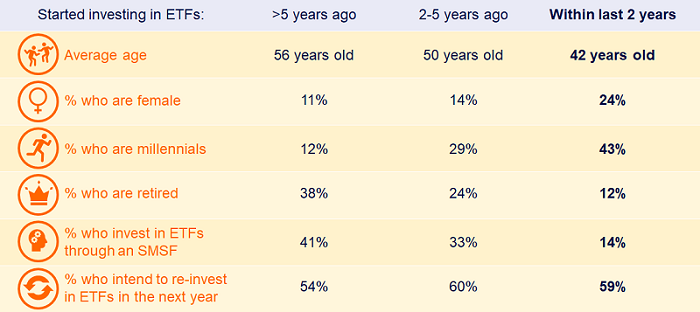

The average ETF investor is getting younger

The average age of new entrants to the ETF market (defined as those who started investing in ETFs within the last two years) is 42 years, down from 56 years more than five years ago. About 43% of these first-time investors are now in the millennial age-bracket, versus 12% more than five years ago.

Interestingly, one in four new ETF investors is female, compared to only one in 10 just five years ago.

Source: BetaShares/Investment Trends ETF Report, 2019

SMSF usage strong, but growth in non-SMSF faster

The number of Australian investors using ETFs has grown to a record number of 455,000, up 18% from 385,000 the previous year.

The number of SMSFs using ETFs continues to rise too, up 12% since 2018 to a total of 135,000 SMSFs. However, as the industry becomes increasingly mainstream, the proportion of SMSFs to total ETF investors remained relatively flat at 30%, versus 31% in 2018.

This is due to the even stronger growth in the self-directed investors who are using ETFs outside of SMSFs, up 21% to 320,000 in 2019.

Diversification remains the primary driving factor for using ETFs, cited by 78% of current ETF investors, followed by low cost (64%) and access to overseas markets (58%).

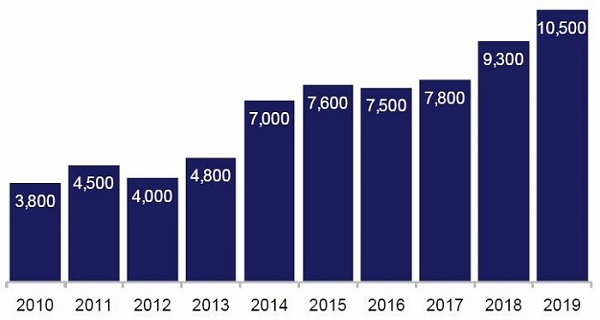

Use by financial advisers continues to rise

Financial advisers are increasingly adopting ETFs with clients, with 58% now providing advice on ETFs, up from 53% in 2018. Since 2010, this figure has more than doubled from 27%.

Among planners who recommend ETFs, low cost was the number one driver, cited by 75% of planners, followed by diversification (61%) and the ability to bring down fees in an overall portfolio (59%).

Number of financial advisers using ETFs in Australia

Source: BetaShares/Investment Trends ETF Report, 2019

Around a quarter of financial advisers now have their own financial services license (AFSL), up from 20% in 2018. These self-licensed advisers allocate double the share of client money to ETFs (14% of new inflows), compared to their aligned peers (7% of new inflows).

Self-licensed advisers also expect their allocation to ETFs to increase to 19% of client inflows over the next three years, compared to 11% for other advisers.

Only 22% of investors said a financial adviser was involved in their most recent decision to invest in ETFs, suggesting that there is potential to increase adviser involvement in the ETF market.

We think that, given the unprecedented regulatory scrutiny they face, advisers will increasingly make use of ETFs. As well as being transparent and low cost, ETFs can significantly decrease the time advisers spend on constructing client portfolios and assist with their compliance burden.

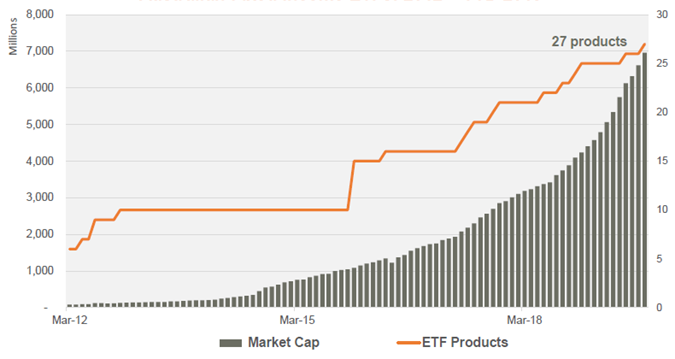

Investors turning to ETFs for defensive positioning

While around half of ETF investors made no significant changes to their asset allocation in the last 12 months. Of those who did, 40% made changes to increase defensive positioning in their portfolios.

We saw significant growth in the fixed income and cash ETF category, which attracted over $2.8 billion of inflows from December 2018 to end October 2019, making it the top category for flows in the period. Since 2012, the annual growth rate for fixed income ETFs in Australia has been 79.2%. The BetaShares cash, fixed income and hybrids range attracted ~$1.6 billion in net inflows to the end of October, to reach a combined $3.5 billion.

This trend reflects an increasing appreciation by investors that ETFs can be used as a convenient and cost-effective way to implement asset allocation decisions, and gain exposure to previously hard to access securities. The defensive and diversification benefits of fixed income ETFs also appeals.

Australian Fixed Income ETFs: 2012 – YTD 2019

Source: ASX. As at 31 October 2019.

Outlook for the sector

There remains plenty of scope for the industry to prosper, with over 135,000 investors planning to enter the ETF market within the next 12 months, and reinvestment amongst current ETF investors at a high 58%.

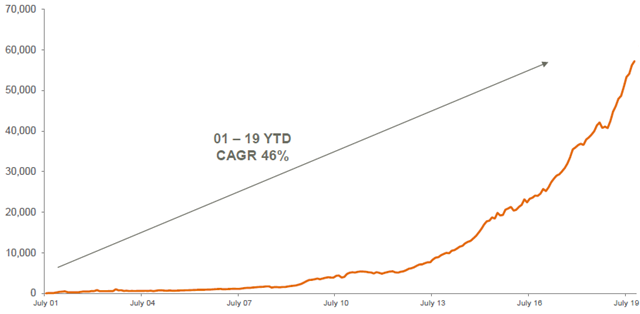

Assets in the ETF industry reached $60 billion in November 2019 after a record month, and we expect Australian ETFs to reach more than $75 billion by the end of 2020.

Australian ETP Market Cap: July 2001 – October 2019 (A $M)

Source: ASX, BetaShares. CAGR: Compound Annual Growth Rate.

*The term 'ETF' as used in this article includes both ETFs and other exchange traded products.

Ilan Israelstam is Head of Strategy at BetaShares, a sponsor of Firstlinks. A summary copy of the Report can be requested here. This article is for general information purposes only and does not address the needs of any individual.

For more articles and papers from BetaShares, please click here.