One of Australia’s leading research firms, Investment Trends, has revealed fewer people feel prepared for retirement than at any time since this question was first asked in 2012. The survey of almost 7,000 Australians over the age of 40 revealed only 44% feel prepared for retirement, but worryingly, this is down from 49% in 2015.

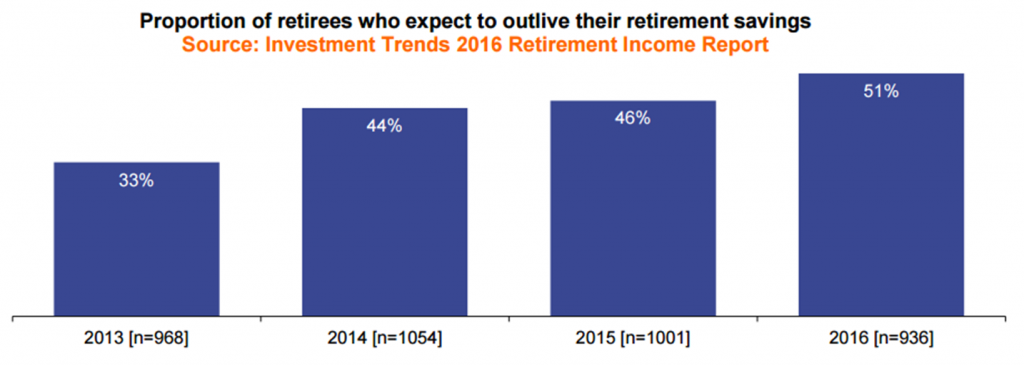

In addition, the 2016 Retirement Income Report shows a remarkable increase in the proportion of retirees who expect to outlive their retirement savings, reaching 51% from only 33% in 2013, as shown below. At a time when Australians have access to more education and advice on retirement than ever, and after 25 years of compulsory superannuation, the worsening of expectations is disappointing.

Reasons for the loss of confidence

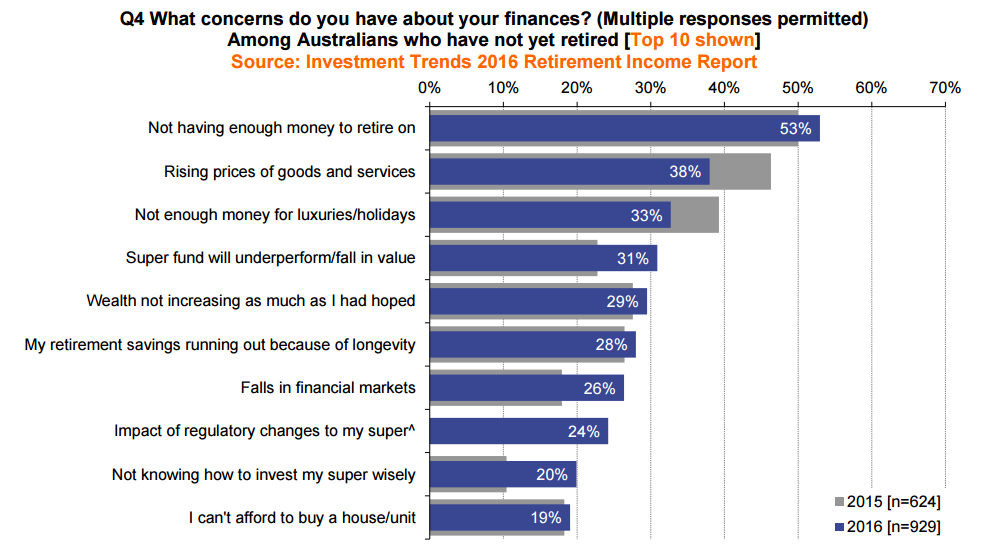

The researchers identified many reasons for the lack of confidence about future finances from Australians who have not yet retired, as shown in the table below, including:

- Inability to accumulate sufficient wealth and then not having enough to retire on

- The rising prices of goods and services (although less of a concern than last year)

- Worries about potential falls in the share market affecting the value of superannuation

- Adverse regulatory changes to superannuation.

This poor result is despite share markets performing reasonably well in the last two years (many global markets are trading at an all-time high), superannuation funds delivering solid results and a strong property market supported by low unemployment.

The same concerns translate into income worries, with half those surveyed saying they need at least $3,000 a month in retirement, but only one-third of respondents expecting to achieve this level.

The role of financial advice and planning for aged care

Most Australians do not have a good understanding of retirement products such as annuities or allocated pensions, with only 11% describing the retirement product range as “appealing”. The traditional focus on the accumulation stage for superannuation and the media attention on contribution rules and advantages of super have left innovation in the retirement phase in the shadows.

The planning for aged care is even worse. Less than one in five people not yet retired have considered how much it might cost to cover aged care needs. Most people expect to simply turn to government services or the medical profession to cover aged care needs, without considering the future ability of government budgets to pay for such a service.

“As an industry, we must address Australians’ lack of engagement on the topic of aged care and better prepare them for potential aged care needs,” said Investment Trends’ Senior Analyst, King Loong Choi. “This will require further action from super funds, financial advisers and product providers. The government and medical professionals also have a role to play in growing Australians’ awareness of the financial aspect of aged care, particularly in light of our aging population.”

Only about 20% of Australians have a financial adviser, but the research shows those people allocate about twice as much to retirement savings as those without a planner, who tend to spend more on lifestyle choices such as holidays, renovations, new vehicles or boats.

With interest rates on savings low, and share markets considered expensive, there are a few ways to address the potential shortage of money in retirement. These include the unpalatable choices of saving more, spending less or working for longer. Those sacrifices might be necessary to avoid a retirement worrying about money. It also helps to understand the superannuation rules and to take advantage of the tax-efficiency of long-term saving in super.

Graham Hand is Managing Editor of Cuffelinks. Graham will be speaking at the Australian Shareholders' Association's Conference 2017 in Melbourne on 15 May 2017. Early bird rate ends 31 March 2017.