There are a number of issues regarding the payment of death benefits that are widely misunderstood. In this article, we review the types of accounts that can pay a death benefit as a pension, minimum pensions, rolling over death benefit pensions and tax treatment.

Death benefit pensions

A common misconception is that a death benefit can only be paid as a pension if the deceased was in pension phase. However, provided that the super fund rules allow, a death benefit may be paid as a lump sum, one or more pensions or a combination of both a lump sum and pension benefits. This ability applies regardless of whether the death benefit is being paid from an accumulation account, a non-reversionary pension or a reversionary pension.

Death benefits can only be paid as a pension to a death benefit dependant, including a spouse, a financial dependant, someone in an interdependency relationship or a child of the deceased. However, where the beneficiary is a child of the deceased, a pension may only be paid if the child:

- is under age 18

- is age 18 to 25 and financially dependent on the deceased

- has a significant disability.

A child death benefit must be commuted by the time the child turns 25 unless the child is disabled.

Minimum pensions

If the deceased was in pension phase, the treatment of minimum pension payments varies depending on whether the pension was reversionary or non-reversionary.

If the deceased had a reversionary pension, then the minimum annual payment based on the deceased’s age must be paid during the year. At the next 1 July, the minimum payments will be recalculated based on the recipient’s age.

If the deceased had a non-reversionary pension, then there is no requirement to pay the minimum annual payment.

Rolling over

From 1 July 2017, a death benefit pension can be rolled over to another fund at any time. A death benefit pension always retains its identity as a death benefit. This is valuable because it means lump sum commutations from a death benefit pension are PAYG tax-free. However, death benefit pensions cannot be intermingled with other pensions and cannot be rolled back to accumulation phase.

The ability to rollover can be a valuable option in an SMSF where the surviving spouse may not wish to continue managing the SMSF on their own.

Taxation

All death benefit pensions are retirement phase pensions which means that the investment returns are not taxed.

The PAYG tax treatment of pension payments depends upon the age of the deceased and/or death benefit pension recipient and the tax components of the pension as outlined in the table below:

The taxable component – untaxed element will generally only arise from a constitutionally protected fund that is taxed differently to most funds.

Lump sum payments

Any lump sum commutations from death benefit pensions are PAYG tax free. Where both spouses are under 60, there may be advantages of taking the required minimum pension payment and using tax-free lump sum commutations to fund any additional lifestyle needs.

Case study

Brenda dies on her 50th birthday and has a benefit of $1,000,000 of which $10,000 is tax-free component.

If Brenda’s husband Barry who is also 50 were to take the death benefit as a pension and draw the minimum annual pension for 2020/21 of $20,000 (temporary minimum of 2%) his tax components would be as follows:

If this was Barry’s only income in 2020/21, he would not pay any tax on his pension income.

If, however, Barry needed $60,000 to live on he could take the additional $40,000 as a lump sum commutation PAYG tax free.

If he took the additional $40,000 as pension payments and this was his only income for 2020/21, he would pay tax (including Medicare levy) of approximately $1,941.

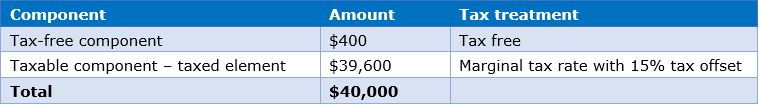

Assuming the death benefit pension was also $1,000,000 at 30 June 2021, if Barry was to draw the minimum annual pension for 2021/22 of $40,000 his tax components would be as follows:

Assuming no changes in personal tax rates, if this was Barry’s only income in 2021/22, he would pay the Medicare levy of $792.

If however Barry needed $60,000 to live on he could take the additional $20,000 as a lump sum commutation PAYG tax free.

If he took the additional $20,000 as pension payments and this was his only income for 2021/22, he would pay tax (including Medicare levy) of approximately $1,941.

Conclusion

Being aware of common misunderstandings in relation to the payment of death benefit pensions can assist in estate planning matters. Understanding the value of professional advice during difficult times can also greatly assist individuals to understand their choices and the tax consequences that follow.

Julie Steed is Senior Technical Services Manager at Australian Executor Trustees. This article is in the nature of general information and does not consider the circumstances of any individual.