Most investors don't have a clue how much they pay across all the different types of fees they are charged. There are fees for advice, administration, investment management, tax planning, and more. The examples below are intended to help you better understand these fees and roughly calculate how much you pay in total. Many investors who do this calculation are shocked at how much it comes to.

An example will demonstrate the importance of minimising investment fees. Imagine that over your 40 years in the work force, you put 10% of your annual income into superannuation each year. Let's assume that your income starts at $50,000 per year and then grows at 4% per year above inflation of 2.5%, and your investments deliver an annual, after-tax return of 5% per year above inflation, but before fees.

If the total annual fees you paid were 2% (200 basis points) of your accumulated super, then after 40 years you have $1.9 million in super. If instead, your fees were 1% (100 bps), then you have $2.3 million. Cutting fees by 1% leads to a 21% increase in the amount of money retirement in this realistic example.

Calculating fees

The first step towards ensuring that you are not paying too much is to understand how much you are paying today. The following examples are intended to help you calculate the total percentage (and dollar) amounts you are currently paying.

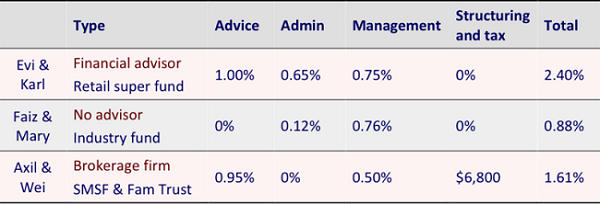

Total fees for different types of investment and advice

Example 1: Financial advisor and retail super fund

Evi and Karl's investible savings (other than the family home) are $580,000 of super. The couple's financial advisor, Steve, has put their $580,000 of combined super into one of the big retail super funds (MLC, CFS, BT and AMP are the largest).

They pay: 1.00% (for advice) + 0.65% (for administration) + 0.75% (for management) = 2.40% of $580,000 = $13,900 a year.

There are three levels here. Financial advice from their advisor. Administration from a retail super fund. Investment management from various fund managers.

Advice: Evi and Karl meet with their advisor once a year to discuss:

- their financial goals

- how much they need to save to meet those goals

- what they should invest in (asset allocation) and in which managed investment funds

- whether they should borrow to invest in property

- how much insurance they need

- how to minimise tax

- how they should structure their investments (do they need an accountant to set up an SMSF, a family trust, etc.)

Steve charges 1% (100 bps) of their super balance for this advice.

Administration: The retail super fund charges the couple 0.65% (65 basis points) for administration of the super fund, which involves:

- the creation and governance of the super fund

- access to a large number of different managed funds (for investing in Australian shares, global shares, fixed income, commercial real estate, infrastructure, etc.)

- buying power to access those managed funds at low cost

- calculation of the couple's share of value in the super fund (which has many thousands of members)

- preparation of reports for Steve, and some smaller things

Management: Steve chooses which retail super fund to put the couple's $580,000 into. Then he looks at all the different managed funds that the retail super fund gives access to and chooses a managed fund for Australian shares, global shares, commercial real estate, etc. On average these funds are charging 0.75% (75 basis points) for the effort they put into researching and choosing the shares or properties that they invest in. The 75 bps would be more if not for the buying power of the retail super fund (which many billions are invested through).

Tax and structuring: Evi and Karl's taxes are simple. They file their taxes online using 'intelligent' online software that takes them through the process and costs a small amount (negligible compared with their advice, administration and investment fees).

Example 2: No advisor and industry fund

Faiz and Mary's investible assets are $620,000 in super plus a negatively geared investment property (for which they pay the rental agent 8.5% of the rent, which I will ignore here). They both have their super in the 'balanced' option of their industry super fund (the biggest industry funds are AustralianSuper, Hostplus, HESTA, REST, and Unisuper)

They pay 0% (for advice) + 0.12% (for administration) + 0.76% (for management) = 0.88% of $620,000 = $5,500.

Advice: Faiz and Mary have never spoken to a financial advisor. They wonder whether they might benefit from advice but have put that off until their situation becomes more complex.

Administration: Their industry super fund charges an administration fee of 0.12% which covers the costs of collecting members' super payments, calculating account balances, providing annual statements and answering members' inquiries.

Management: Faiz and Mary's industry fund manages some of its members' money in-house and pays external managers fees to manage the remainder. The 0.76% fee covers all of the costs of this investment management. The couple chose the 'balanced' investment option and the industry fund makes decisions on asset allocation and choice of investment managers on their behalf.

Tax and structuring: Faiz and Mary pay a tax agent about $300 to complete their income taxes, but only because of the tax rules around their rental property, so I have ignored the tax expense above.

Example 3: Brokerage firm and SMSF

Axil and Wei have considerable investible assets: $2.4 million in an SMSF and $1.8 million in their family trust, which continue to grow quickly. This is in addition to the ownership of their family home and the business created and run by Wei. Their investible assets are managed by an advisor of a brokerage firm (some large brokerage firms are JBWere, Morgans, Ord Minnett and Evans).

They pay 0.95% on $4.2 million (for advice, administration and management of their Australian shares) plus 0.50% extra (for management of global shares and some commercial property trust investments - see below) = 1.45% of $4.2 million = $60,900. Their accountant's fees (structuring and taxes) are $6,800, which is 0.16% of their investible wealth. They have paid 0.95% since they started with the brokerage firm but are considering asking for a reduction to 0.85% now that their investible assets are larger.

Advice: Axil and Wei speak with their advisor three or four times a year. There is a scheduled annual meeting when their advisor takes them through the changes to their investments and performance of their portfolio over the year. But there are also ad hoc telephone conversations when their advisor is considering large changes to their investments or their advisor wants to offer them a particular investment opportunity. These include investments in property trusts, initial public offerings of shares and even investments in some start-up companies.

Administration: Advice, administration and management of the Australian share portfolio are bundled together in the 0.95% fee charged by the brokerage firm.

Management: The brokerage firm manages Axil and Wei's portfolio of Australian shares in a 'separately managed account' that is not pooled with the shares of their other clients. However, their investment in global shares is through a managed fund that charges 1.50% per annum, and their investment in private commercial property trusts has a fee of 1% per year. In total these extra fees are equivalent to 0.50% of their $4.2 million of investible assets.

Tax and structuring: Axil and Wei's accountant provides tax advice and prepares their personal tax forms, as well as the financial reporting, taxes and audit of their SMSF and family trust. The same accountant is used by their business, but those fees are charged to the company.

Concluding remarks

Fees, taxes and transaction costs are, in one sense, all the same thing for investors. They are all money out, and that needs to be minimised. But 'minimised' doesn't mean 'set to zero', because everyone needs some level of help, especially with tax planning and structuring (SMSFs, family trusts, etc.). The advice you receive might lead you to save more, take the right amount of risk, manage your taxes effectively, etc. which will lead to better outcomes. Minimising fees just means getting value for the fees that are paid.

How much do you pay annually in fees, with total fees broken down into advice / administration / management / structuring and tax? Try to work it out yourself. But if you have a financial advisor then ask them. If you don't get a clear and direct answer, then that is a problem. There is obviously a great deal more to discuss on this topic, but this can start your conversations.

Dr. Sam Wylie is a Principal Fellow of the Melbourne Business School and a Director of Windlestone Education. Please seek professional advice on structuring and tax planning from a qualified accountant or financial planner. This article is for general information only and does not consider the circumstances of any individual. A longer discussion of fees and managing your relationship with advisors is part of my Finance Education for Investors course. Go to Windlestone.com.au/melbourne or Windlestone.com.au/perth for more information.