It is the subject most share market experts and commentators would rather not talk about: buying cheaply-priced stocks works best when interest rates are higher, economic growth and cycles are relatively robust and there is no mass-disruption eroding barriers of entry and technological innovations.

The current environment is different. Interest rates are exceptionally low, and likely to move lower still. Economic growth the world around post-GFC has never been quite the same, and the overall pace remains low by historical standards. And change caused by innovations.

Cheap companies might stay cheap

The direct result is that corporate throwbacks, missteps and failures are not necessarily temporary in nature, as was mostly the case pre-2012. Cheaply-priced companies might find it hard to sustainably improve their operations and thus catch up with the prolonged bull market in equities.

It is one reason why 80 of small cap and 92% of large cap actively managed funds in Australia, according to a recent sector update by Morgan Stanley, are unable to keep pace with their benchmark, let alone decisively beat it.

There are plenty of examples to choose from. In the health care sector, far and away the best performing in Australia, plenty of funds preferred Healius (ASX:HLS) instead of the much more ‘expensive’ looking Cochlear (ASX:COH), ResMed (ASX:RMD) or CSL (ASX:CSL). Yet it's the ‘cheaper’ one out of these four that has, on balance, hardly performed on a five-year horizon.

Amongst REITs, one of the better-performing segments on the ASX, the likes of Goodman Group (ASX:GMG) have at times become the focus of short-positioning, but the share price consistently moved upwards, at least until the mini-correction in August this year.

Once upon a time, Goodman Group shares were highly sought after by income hungry retirees, but these days the shares only offer circa 2% forward looking. That can serve as an indication of how ‘expensive’ those shares have become.

Income-seeking investors have instead preferenced REITs such as Vicinity Centres (ASX:VCX), which still offers circa 6% yield. On the flip side, Vicinity shares have eroded some -23% since their peak in mid-2016 and have largely trended sideways throughout 2019 when most market indices added near 20%.

Amidst an ongoing tough outlook for industrials in Australia, the increasing number of profit warnings and negative market updates are accompanied by a reduction in the dividend for shareholders. There are predictions of a lower payout by Vicinity Centres in 2020, and, post the recent profit warning, Medibank Private's (ASX:MPL) FY20 dividend might be at risk too.

Cheap stocks might lag for good reason

Probably the most striking examples have come from the banking sector, in particular in Australia, prominently represented in investment portfolios. If it isn't because of the dividend appeal, it's because the sector remains by far the largest on the local stock exchange with all four majors plus Macquarie included in the ASX Top10.

In a recent strategy update on global banks, analysts at Citi offered the following warning for investors: Don't Buy Cheapest Banks.

Their motivation: "Pursuing a Value strategy within the global Bank sector has been an especially disastrous strategy. Cheap banks in Europe and Japan have got even cheaper. More expensive banks in the US have stayed expensive. We don't expect this valuation gap to mean-revert anytime soon."

In other words: when growth is elusive, and the pressure is on, investors should adjust their strategy and focus too. Cheap stocks might be lagging for good reasons.

With yield curves inverting for government bonds, economic momentum struggling and credit growth sluggish, banks globally have been lagging the bull market. Hence the recent reset in bond markets, whereby yield curves steepened, and triggered a renewed interest in bank shares around the world. This is part of the rotation into ‘value’ career professionals like to talk about.

But Citi analysts are not buying it. They argue valuations for bank shares should stay ‘cheap’ because the global economy remains weak and bond yields will remain low.

In Australia, it can be argued, bank shares are not particularly ‘cheap’, as they have benefited from the attraction of 5%-6% dividend yield. But they seem ‘cheap’ in comparison with stocks like Macquarie Group (ASX:MQG), Transurban (ASX:TCL) and Charter Hall (ASX:CHC). These stocks that have fully participated in the share market uptrend and contributed with gusto to pushing major indices to an all-time high this year.

Banking sector not all about yield

Yet, the October-November reporting season has left shareholders with a sour after-taste. All of Bank of Queensland (ASX:BOQ), Westpac (ASX:WBC) and National Australia Bank (ASX:NAB) announced a sizable reduction in their final dividends, while ANZ Bank (ASX:ANZ) kept it stable, but with -30% less franking. In a surprise move, Westpac raised extra capital too.

Little surprise, the local bank sector has been the worst performer of late. October delivered a general decline of -4.4% for the sector to keep the overall performance for the Australian market slightly in the negative for the month. In the words of UBS: "it appears the market is coming to terms with the outlook of decreased profitability from lower rates and increased capital requirements".

The higher yield (as implied by a ‘cheaper’ share price) does not make the better investment. It's usually the exact opposite.

Commbank (ASX:CBA) shares trade at a noticeable premium and its premium valuation is backed up by superior returns versus ‘The Rest’ over five, 10, 15 and 20 years. Occasionally, one of the laggards in the sector might experience a catch-up rally that temporarily pushes CBA into the shadows, but the two prize for consistency and performance in Australian banking are CBA and Macquarie.

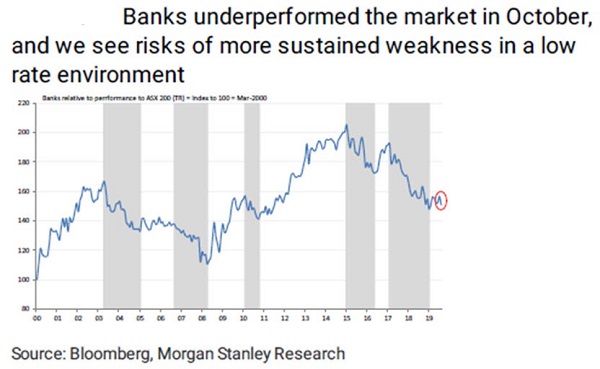

This by no means implies there cannot be more negative news from CBA or the other banks. If investors want more evidence the ‘Golden Years’ for banking in Australia are now well and truly in the past, Morgan Stanley's research shows banks have noticeably underperformed five prolonged times since 2000, with two of the five periods occurring since April 2015.

Below is the graphic depiction of the five periods since 2000 that accompanied the Morgan Stanley research report:

What the banks have once again shown to investors is that higher yield tends to correlate with higher risk. And that risk should not be solely measured in loss of capital. CBA shares have trended sideways since September 2015. Over that same period, shares in Macquarie have appreciated by some 75%.

For a slightly lower dividend yield on offer, backed by a superior growth profile, Australian income investors could have accumulated significantly better returns if only they weren't so afraid of paying a little more for it.

Where can cash be deployed in the share market?

So what is an investor to do who today is sitting on some cash, looking to be deployed in the share market?

My advice is to look for quality yield. What exactly defines quality yield? It's a dividend that is most likely to rise over multiple years ahead. Admittedly, such a proposition is probably not available at 5.5% or 6%, but then again, investors are less likely to find themselves confronted with capital erosion or a dividend cut further down the track.

Look for research that is not solely based upon ‘valuation’, relative or otherwise. Foe example, Morgan Stanley prefers ‘manufacturers’ over ‘collectors’ and ‘creators’ over ‘owners’, with the team labelling itself ‘selective with value’. Identified property sector favourites are Stockland (ASX:SGP), Goodman Group and Mirvac (ASX:MGR). Sector exposures to stay away from, even though they might look ‘cheap’, according to the team, include Scentre Group (ASX:SCG), Vicinity Centres and GPT (ASX:GPT).

Investors should note Morgan Stanley analysts agree with the view that owners of retail assets look ‘cheap’, but they still see shopping malls coming under pressure from both tenants and consumers.

Macquarie analysts have compared infrastructure stocks with utilities and AREITs and concluded utilities currently offer the superior total income profile, with infrastructure and AREITs both equal second. Risk-adjusted, Macquarie believes, infrastructure offers the highest potential return. AREITs are seen offering 'a balanced yield exposure'.

On Macquarie's projections, utilities such as AusNet Services (ASX:AST) and Spark Infrastructure (ASX:SKI) carry the highest income potential over the next three years, but they also come with the highest correlation with the broader share market (meaning: above average volatility in share prices). This is most likely because they offer little in terms of growth. It's all high yield.

Rudi Filapek-Vandyck is an Editor at the FNArena newsletter. This article has been prepared for educational purposes and is not meant to be a substitute for tailored financial advice.

FNArena offers independent and unbiased tools and insights for self-researching investors. The service can be trialed at www.fnarena.com.