When Gail Kelly sits down with her family to talk about giving money to charity, it's serious business. There are no ad hoc conversations about their private ancillary fund (PAF) – a tax-effective structured vehicle that enables the family to set aside a chunk of money in a trust to support charities over time. They hold scheduled meetings twice a year, often over Christmas or Easter when her four children and husband come together. The family gatherings have involved PowerPoint presentations, business cases about what charities fit the bill for each family member's area of interest and how their giving has made an impact. Each person has an equal pool of funds to give to the charity as they see fit. Former Westpac CEO Gail Kelly says giving away your wealth to charity is not just for the uber wealthy. The highly regarded former boss of Westpac is adamant that it's not just about giving money. Everyone must be personally involved. "It's a real time of sharing ideas," Kelly says of her young adult children. "They own it. This is very powerful stuff. This is very rewarding." "When Alan and I pass away, this is a family asset and they will continue with the giving and frankly they will develop something for their own families because they see the power of it from a family point of view." Kelly has been a long-time client of Australian Philanthropic Services (APS), where she recently joined the board headed by the founder, Chris Cuffe. It took Cuffe three years to convince her to join the high-profile board, which also includes other notable philanthropists David Gonski, Belinda Hutchinson, Tim Fairfax and Michael Traill. Kelly, who is passionate about supporting the empowerment of women and girls, says she joined the board because of the family involvement, and also due to Cuffe's credentials. "I think he has really forged a path here that is very impressive with regard to APS and philanthropy more broadly," Kelly tells the AFRWeekend. "The model is a not-for-profit business – which is awesome. So you know that all the funds are going to charities."

Streamlining a clunky process

Cuffe was instrumental in bringing together the vision that an Australian charity would be dedicated to growing philanthropy. The Hall of Fame fund manager along with about 30 investors provided around $2 million to get APS off the ground in 2012. APS is not quite break even today but has enough cash at hand so it does not need to raise more funds. The services offered were to set up and manage private ancillary funds for individuals and families, and to support wealth advisers to help their clients do the same. It also provided a grant-making service. Sirtex Medical founder Bruce Gray was one of Cuffe's first clients. APS today services more than 380 clients from just 120 five years ago. It has about $800 million in assets, and $52 million was given to charity in the 2018 financial year. Cuffe spends about 25% of his time on APS, where he manages the day-to-day investment of the near $70 million public ancillary fund – APS Foundation – on a pro-bono basis. He is busy with other commitments having just launched the $500 million LIC Hearts and Minds Investments Limited. He's a founder/PM of Third Link Investment Managers and a member of the UniSuper Investment Committee, among other roles. But he has a soft spot for APS after his own experience of setting up his family foundation after he finished his executive career as CEO of Challenger Group in 2006. He ran into difficulties. And it was pricey: it cost him $30,000 to set up his family's fund. "It was a clunky experience, and it was not an easy thing to do, dealing with multiple parties," Cuffe says. "I thought it has got a lot of value, so it would be good to streamline this process." He heard about PAFs from venture capitalist Daniel Petre. The idea took off, with proven demand for a service that is low cost at $3000 to set up a PAF at APS.

Lack of incentives

While this is a growing area of structured philanthropy, less than two decades ago Australia didn't have tax-efficient philanthropic structures comparable with those in the US and UK. There was rising concern there was no incentive for Australians to give away part of their wealth during their lifetime. In 2001 the Howard government introduced the Prescribed Private Fund or PPF (now the private ancillary fund) which allowed for a tax break when giving. APS has grown to become the largest provider of PAF services in Australia, setting up more than 30% of all such structures each year. So how does it work? A family donates around $1 million plus to create a private fund. The funds are put into the trust and the client gets the upfront tax deduction. The family can never get this money back since it's a charitable trust, but they can control how that money is used. Every year a minimum of 5% of the trust must be given away to eligible charities. APS chief executive Antonia Ruffell says while tax incentives play an important role as to when people choose to set up a structure, it's not usually the underlying reason. "Some might be driven by religious or personal values. For many people, they are worried about the impact that wealth will have on their kids. They see philanthropy as a way to inspire charitable values, and develop a sense of responsibility around wealth," she says. Ruffell adds that there will be a big change in the coming years, as the next generation gets more involved in their family's philanthropy.

Aussies could give more

Kelly agrees, saying more young people are getting involved who are interested in fairness in society and climate change. "There is a new generation of givers," she says. "They bring a focus on innovation. My kids want to know the funds they are giving are having an impact." APS also offers a public ancillary fund, the APS Foundation, in which people can open a named sub-fund. The APS Foundation has grown from just $7.2 million in 2014 to nearly $70 million in 2018. Graham Hand and his wife, Deborah Solomon, are sub-fund holders in the APS Foundation. Graham, founder and managing editor of investment newsletter Cuffelinks, says he likes the idea of giving an annuity stream, giving $5,000 to $10,000 a year. "I would concede that I wanted to share some money and this was a tax-efficient way of doing it," he says. Hand says that, while there is giving among Australians, more could be done. "What you do hear about here in Australia, as opposed to other cultures, we give quietly rather than making a big deal of it," he says. "We don't need to have the wing of the university named after us. "There is lots of giving going on. That said, there are lots of people who are making $1 million a year that are not giving. It would be good to encourage people who have had good fortune to consider sharing some of it."

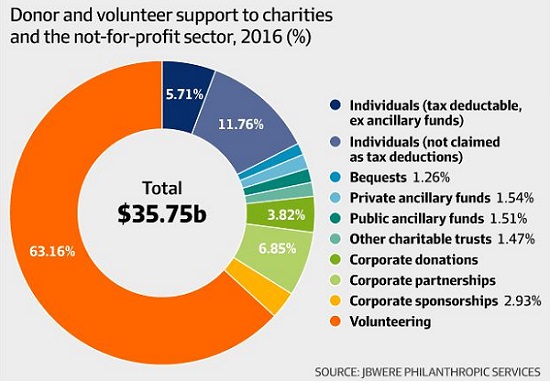

Cuffe expects the sub fund to double in size every year for several years with the number of sub-fund clients per year far exceeding the private ancillary fund clients. Cuffe adds that some wealthier clients prefer the sub fund: the largest sub-fund account is $8 million. He admits that, while APS has had success in a short period, he would like to see "'ancillary funds' become as popular as the words 'self-managed super'". The number of private ancillary funds is increasing: there are now about 1600 with a corpus of $10 billion, distributing $500 million per annum. Data from JBWere Philanthropic Services division shows that PAFs are susceptible to financial market performance. When the GFC hit in 2008, the number of new PAFs fell to fewer than 50 in 2009. But the numbers are climbing again.

Not just for the rich

Kelly and Cuffe are both clear that you do not have to be uber-wealthy with a fat balance sheet to donate. The public fund is a pooled investment vehicle. Families set up a sub fund, with a minimum $50,000 donation. APS manages all aspects of the foundation, and charges clients 1% of fund balance per annum. A sub fund must give away a minimum of 4% of its balance per annum. Most the assets of the foundation are managed by external fund managers. Often their investment services are also on a pro bono basis. Cuffe aims for a return target of inflation plus 4% per annum (after fees) over a rolling seven-year period. Since its inception in 2012 it has posted a 12.5% return. "A $50,000 entry point that can be with you for life is quite accessible for many people. In particular as Baby Boomers retire there will be much more transfer of wealth. It's not just for rich people," Cuffe says. Kelly – who started her career as a school teacher in Rhodesia (Zimbabwe) – has always remained interested in helping others. Outside of APS, she is an (unpaid) adjunct professor at UNSW, and set up a $1 million scholarship fund which links UNSW to Cape Town University where students can spend a semester on exchange. However, she is clear that APS is central to her family. "This is about learning about the impact, and the joy of helping others," she says. The AFR’s, Carrie LaFrenz has more than 10 years’ experience as a business journalist having previously covered healthcare, retail/consumer goods, industrials and agribusiness. This article was first published in The Australian Financial Review and is reproduced with permission.