When it comes to retirement, people often experience a range of emotional and psychological fears. On top of this, once they have entered retirement, it becomes apparent that their financial and investment needs have changed.

Retirees view the world differently from when they were in the workforce and one of the single largest changes is how they observe and respond to risk. This is a key consideration when investors are shift from the accumulation to decumulation phase of their investment strategies.

Accumulation versus decumulation

Accumulation refers to strategies used by investors to accumulate, or build up, assets to save and invest efficiently over the long term. On the other hand, decumulation refers to retirees drawing down their assets and investments to generate an income and, ultimately, maintain their quality of life in retirement. Decumulation can also be described as the process of investors converting their retirement savings to retirement income.

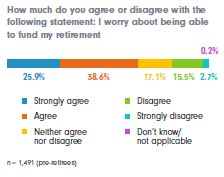

Accumulation is an almost universal objective for all savers where they are looking to maximise the return on their savings over the period until their retirement. In our recent survey 'Building better retirement futures', the majority of pre-retirees worry about funding their retirement, and the risk/return decision is an important trade off.

But objectives in decumulation can be much less uniform with individuals having a wide variety of objectives depending on their circumstances and aspirations. It requires a strategic view on factors such as income sources, health care costs, tax, whether to dip into home equity and the like.

In accumulation mode, investors are better able to cope with risk because when markets fall, subsequent contributions are invested at cheaper valuations and become more valuable as markets recover over time. This saving pattern is known as dollar-cost averaging and works in favour of investors saving for retirement.

In contrast, dollar-cost averaging in decumulation - drawing an income in retirement when markets are depressed - works against retirees as drawing an income when markets are down leads to a permanent loss of capital. So, it is critical for retirees to find the right balance between taking investment risk with their retirement savings and protecting the capital from market volatility.

Retirees’ risk requirement, tolerance and capacity

In the current economic environment, it is necessary for retirees to take some form of measured investment risk when it comes to their superannuation balances. If insufficient investment risk is taken, then it is much less likely that retirees will achieve their lifestyle goals. Sound risk management can therefore be an even more critical element for retirees to consider than for people who are still saving for their retirement.

However, people view risk in a unique way and more so in retirement. Even if retirees are emotionally and psychologically willing to take the risk, they may need guidance on just how much risk is appropriate for their goals.

Essentially, during the decumulation phase, retirees not only respond to risk differently, but they also face a host of other associated investment risks, with three main risks being:

1. Market risk and sequence of return risk

Market risk is inevitably linked to any type of investment strategy and is the risk of losing money when a market falls. But as retirees have a reduced risk appetite, they are more sensitive to falling markets. The GFC is an extreme example and resulted in a disruption of many Australians’ retirement plans. Those in the early stages of, or approaching, retirement saw their capital depleted and some never recovered their losses.

Sequence of return, or sequencing, risk is where market risk affects retirees’ portfolios by the order, or sequence, in which the market volatility is felt in a portfolio. For example, if a significant negative market event occurs just after someone retires when they have the largest balance and when they are having to take significant income from the portfolio, then this will have more negative impact overall than if the market event happened at another time when much less income was being drawn.

These risks can be mitigated and managed by the use of fit-for-purpose investments which provide exposure to the appropriate range of risk premia that are needed to provide the required returns over time whilst moderating the extent of market risk.

2. Longevity risk

We all aspire to live a good and long life. However, a common concern for retirees is the risk of living too long and not having enough money to support themselves later in life. Simply put, longevity risk is the risk that they will last longer than their savings.

With life expectancy increasing in Australia, longevity risk is becoming a growing issue for many. Investors, and especially women who have a longer life expectancy, are facing the task of generating income and accumulating enough savings in proportion to lifespan expectancy.

3. Inflation risk

Inflation is the increase in the costs of goods and services over time. Ultimately people’s income also needs to increase in order to afford these goods and services. If retirement savings do not keep pace with inflation, spending power will reduce over time and the standard of living will potentially fall.

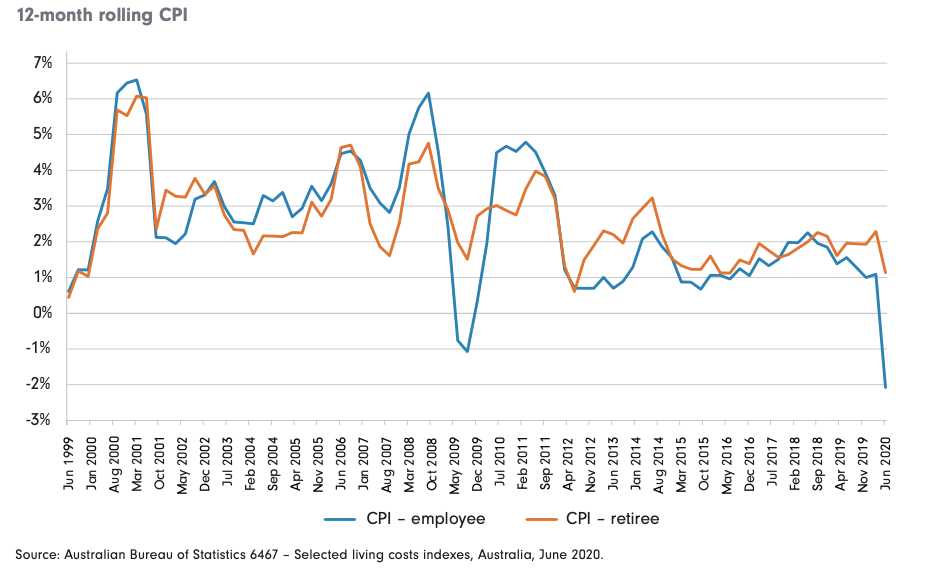

A key issue is that, while the Reserve Bank of Australia targets a headline inflation rate of 2% to 3% a year, the specific inflation experienced by retirees can vary significantly from the headline rate. For example, retirees may initially spend more on luxury items than those still in accumulation phase and, when older, on healthcare. In contrast, employee households tend to spend more on housing, children’s education and transport. This difference in household spending needs means that retiree households typically experience different price inflation than employee households, as indicated in the chart.

As one of the main aims of retirement planning is to maintain a certain lifestyle once retired, it is essential that the investment portfolio takes appropriate risk to help maintain the retirees’ spending power.

Fit for individual purpose

The retirement life event is one of the most significant events in Australians’ lives. As savers move from accumulation to decumulation, their feelings and views on risk will change, and the investment risks that are relevant to them will change. It is a certainty that retirees will need to take an appropriate amount of risk with their investment portfolios, or otherwise face the likelihood of not meeting their financial goals. With the help of an adviser, portfolios should include fit-for-purpose investments that increase the likelihood of meeting the financial objectives of each individual.

Richard Dinham is Head of Client Solutions and Retirement at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.