In challenging trading conditions marked by rapid rate rises, inflation and geopolitical uncertainty, advised SMSF accounts have remained resilient, continuing to favour a distinct, well-diversified mix of asset classes, securities and sectors.

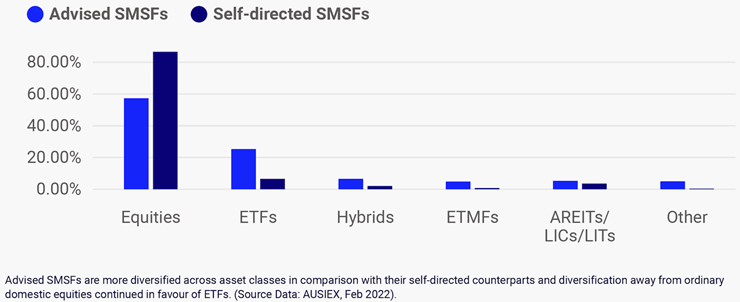

Figure 1: Holdings of SMSFs

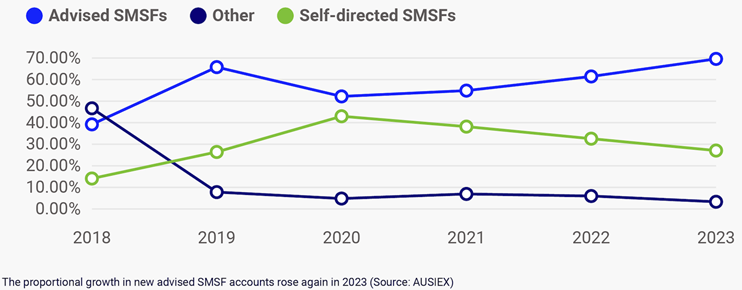

There was a rebound in the number of advised self-managed superannuation funds (SMSFs) over the past year. By contrast, the number of self-directed investors opening SMSF accounts declined.

Figure 2: New SMSF Accounts Created by Segment (trend)

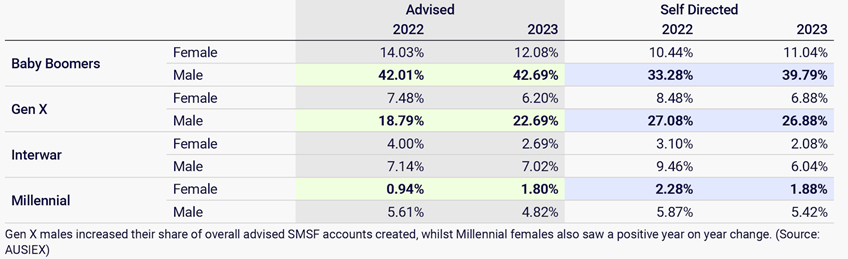

Generation X were chief among the advised investors opening new SMSF according to AUSIEX trading platform data. Their share of new accounts rose by more than 14% year-on-year to end 2023, while the share of new Baby Boomer accounts rose by a far more modest 2.1%. The share of new accounts opened by advisers for younger Millennials born between 1981 and 1996 rose 3.9% by comparison.

By contrast, the number of new accounts created for self-directed SMSF investors across Generation X, Millennials and the Interwar generation all fell sharply year on year.

Figure 3: New SMSF accounts by generation and gender

Advice results in different portfolios

When it came to portfolios, advised SMSFs showed a preference for a broader range of securities than self-directed peers, most notably for exchange-traded funds as advisers appeared to diversify and minimise volatility from their client portfolios.

A large majority of SMSFs allocated capital to financials and materials – two sectors that make up more than half the market capitalisation of the S&P/ASX 200.

Notably, however, advised SMSFs appeared to have a materially different allocation to the healthcare and consumer staple sectors than their self-directed peers.

The diversity of ETFs now available is not only allowing advisers to build desired client exposures more efficiently but also gain access to international markets. This was evident in the ETF strategies employed by advised SMSF accounts in 2023 where specific exposures and global strategy ETFs were in relatively higher usage compared with non-SMSF non-advised clients.

The rise of women-directed SMSFs

The data also revealed that women are still less likely than men to hold an SMSF account overall.

There are already indications of greater interest from women in investing into SMSFs, with the proportion of AUSIEX holdings accounted for by female primary account owners increasing from 18.8% to 19.6% over the course of 2023.

Women-directed SMSFs had higher average monthly holdings than men throughout 2022 and 2023, recorded larger trade sizes and traded fewer securities.

Female SMSF clients with AUSIEX accounts did trade less than males in 2023 and traded less security types but had a higher average trade size (+1.3%) than their males peers over the same period (6% in 2022). On a per account basis, female SMSF accounts had a higher monthly balance (3.5%) than male SMSF accounts in December 2023 and in each month through all of 2023 and 2022.

Female advised SMSF accounts favoured ordinary shares in 2023 (49.12% of total trades (Males were 51.14%)) followed by ETFs (19.73% (Males were 19.12%)) and local call options (10.8%). This was also markedly different to their self-directed (non-advised) female SMSF counterparts, who showed a significantly stronger preference for trading ordinary shares only, with ETFs making up a much smaller proportion of total trades.

Advised female SMSF accounts also had the highest allocation to hybrid securities (7.6%) across all accounts (SMSF/non-SMSF and self-directed and advised).

Generation X females are another business opportunity for SMSF advisers as a relatively low number (compared to males) seek advice for SMSF investments, with this cohort also accounting for a declining share of new SMSF accounts created year on year.

Increased financial independence and longevity means more females are likely to need advice than ever before in the coming decades. Some research such as Boston College’s Center on Wealth and Philanthropy suggest that women may inherit more than men from the Baby Boomer and Interwar generations from now until 2040, creating a large portion of potential clients for SMSF advisers. Various studies suggest 60% to 70% of wealth in the US and UK, respectively, is likely to be inherited by females over the coming years and it’s reasonable to expect a similar trend in Australia.

Increased use of ETFs

The numbers show advised SMSFs are heavy users of ETFs relative to their self-directed counterparts. This was evident in the ETF strategies employed by advised SMSF accounts in 2023 where global equity ETFs, US specific exposures and global strategy ETFs were in relatively higher usage compared with non-SMSF non-advised (retail) clients.

This suggests advised SMSF accounts may be utilising ETFs as a tool for gaining international exposures via local listed markets.

Brett Grant is Head of Product, Marketing & Customer Experience, at leading wholesale trading platform AUSIEX. This information contains general advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider its appropriateness, having regard to your objectives, financial situation and needs. Investors should read the relevant disclosure document and seek professional advice before making any decision based on this information.