As the world keeps a close eye on the political state of play leading up to the US election on 5 November, infrastructure investors are bracing for the implications of the outcome and what it will mean for the future of the global energy infrastructure industry.

Energy infrastructure in the US is uncertain. Although electricity generation has been deregulated in many areas, federal, state, and local policy and regulatory regimes still play a crucial role in incremental development and investment decisions. Influential policies and regimes include the Inflation Reduction Act of 2022 (IRA); the varying market constructions for the procurement of energy, capacity and ancillary services amongst Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs); and distributed generation deployment at state level, which is highly dependent on subsidy programs which vary in their incentive structures.

These overlapping systems create a fragmented market which partially mitigates the impact of the US federal elections. However, if a change were to occur in either the Federal Executive Branch and/or Congress, investors can take comfort in Congress typically provisioning for projects that have already qualified for existing incentives, and that legislative changes will only flow through in late 2026.

A change in power may create a state of flux for the industry, bringing a level of uncertainty for the future of infrastructure investment opportunities but what does that mean for key legislation and the energy infrastructure sector, and where will the opportunities be for investors?

Is the Inflation Reduction Act at risk of a repeal?

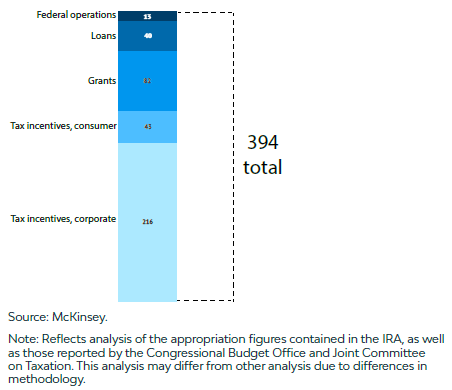

The IRA, aiming to provide federal incentive policy certainty around investing in domestic energy production while promoting clean energy with circa US$400 billion in federal funding, is a showpiece of the Biden administration. It is expected to deliver on its objective of substantially lowering the US’ carbon emissions by the end of this decade.

Figure 1: Energy and climate change funding expected in the IRA (US$ billion)

The upcoming US election presents a headline risk for the future of the IRA, with Republican party members calling for a full or partial repeal of the legislation. While any repeal of major policies has historically been difficult, if the Republicans sweep the election and introduce a budget reconciliation to target the IRA, the incentives for nascent strategies such as EV charging, rooftop solar and energy efficiency will be most at risk. This is based upon the number of Republican bills introduced to target these sectors in previous legislative sessions.

Other aspects like production tax credits (PTC) and investment tax credits (ITC) have traditionally received bipartisan support across past administrations and are unlikely to be fully repealed or majorly impacted. Similarly, incentives for nuclear, hydrogen, carbon capture and clean fuels, will likely be safe, given more pronounced Republican support for these technologies.

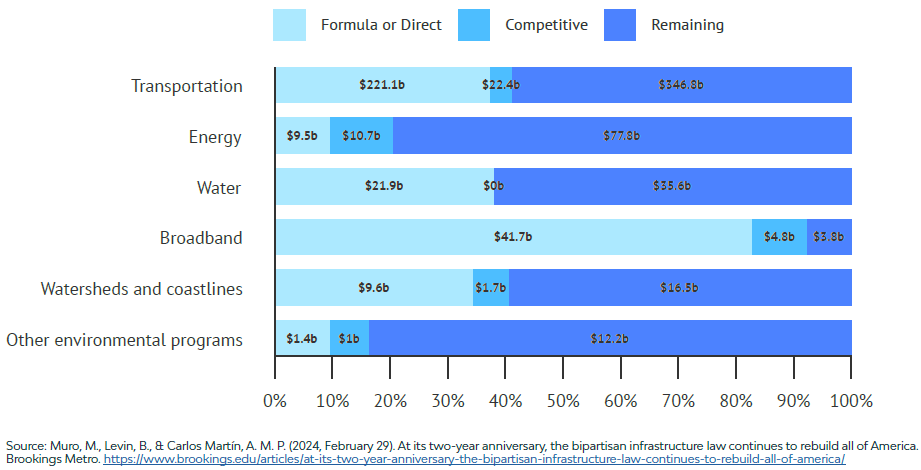

Additional legislation such as the Infrastructure Investment and Jobs Act (also referred to as the Bipartisan Infrastructure Law or “BIL”) was passed in Congress in November 2021. The aim of the law is to provide US$1.2 trillion in federal funding to rebuild significant portions of the US’s key infrastructure, including roads, bridges, rail, airports and digital infrastructure. Although approximately half of the direct spending has been allocated to date and most of the competitive grants are yet to be rewarded, generally the content of the BIL is less likely to be targeted for repeal than the IRA, given it was widely supported by the Republicans.

Figure 2: Progress of BIL-awarded funding by infrastructure sector and funding type, as of November 2023

The domino effect of manufacturing and supply chain challenges

Manufacturing and supply chain challenges pose continued risks for US energy developers. At its epicentre is rising political tensions between the US and China, and tariff and regulatory disruptions.

Solar photovoltaics (PV) developers have primarily faced specific supply chain challenges compared to other import-dependent industries. These disruptions include the Section 201 tariffs levied on imported modules from China in 2018, the 2021 Federal Department of Commerce’s investigation into tariff circumvention and the detention of equipment import shipments under the Uyghur Forced Labor Prevention Act in 2021.

Beyond these tariff and regulatory disruptions, the US will likely continue to face additional headwinds from China’s influence and dominance in clean energy, irrespective of the US federal election outcome. It relies on China’s dominance in original equipment manufacturing (OEM), which creates a risk for US energy developers and their import-dependent supply chains. These supply chain issues are a political lever for US policymakers to signal a strong political stance and apply pressure on Beijing.

To neutralise the US’ dependence on China, the IRA created an adder to the base level tax credits that increase credits by 33% to encourage the use of domestic content (i.e. domestically produced steel, iron, and manufactured products) in renewable projects. This has led to energy project developers and OEMs choosing to invest in greenfield US manufacturing facilities to produce compliant products with reduced risk of political or supply chain interference.

While in the long term, the market equilibrium for equipment procurement will feature more domestic production, in the medium- to long-term the industry is likely to face continued volatility, long lead times, and competition for supply capacity. Developers will have to navigate these dynamics and adapt their target project profiles accordingly.

Despite this, OEMs with domestic production facilities such First Solar, Tesla and Enphase, and the developers that have secured supply agreements with these manufactures, will benefit from these supply chain headwinds.

The future of offshore wind

While state and local-permitting challenges have impeded offshore wind development, the Biden administration had set targets of 30 gigawatt (GW) of new offshore wind generation by the end of 2030 – creating significant tailwinds for the offshore wind supply chain.

Recently however, the sector has experienced development and construction cost increases, and will experience further construction delays if a change in administration was to occur. These delays are anticipated as the Bureau of Ocean Energy Management (BOEM), the federal agency that is responsible for reviewing the key steps involved in offshore wind development, experienced more restrictive processes during the first Trump administration. Most states with ambitious offshore wind targets and projects within the US’s wind belt, however, have historically held Democratic majorities and are therefore unlikely to change their policy goals.

These headwinds and risks reduce the attractiveness of offshore wind projects to state procurers given they carry a higher levelised cost of electricity (LCOE) production than alternative technologies.

Opportunities and risks for investors to consider post-election day

Investors must keep their exposure to federal policy top of mind when managing their investment in the US’s energy transition, as well as evaluate how to manage and mitigate policy risk through political cycles given the illiquid nature of their investments and longer hold periods. It is prudent to consider that Republicans have typically promoted an energy agenda that favours energy independence, security and affordability. While these are not incompatible with advancing climate goals, it has historically translated into greater support for fossil fuels.

Key considerations include:

- Significant change to traditional renewables is unlikely due to the capital already committed to establish economic benefits for transitional Republican states

- carbon capture, and storage has largely avoided political controversy

- Support for nascent strategies such as EV infrastructure, are at risk so investors should ensure they have a thorough understanding of the direction of state policy and incentives in the absence of federal support

As many investors have been steered away from investments with significant scope one emissions, bifurcated capital markets have developed where higher returns are achievable for those willing to bear more transition exposure.

John DiMarco is a Managing Director, New York; Sarah Bibring is an Associate Director, New York; and Andrew O’Neil is an Executive, New York at Igneo Infrastructure Partners.

Igneo Infrastructure Partners is an investment team within the First Sentier Investors Group, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

For more articles and papers from First Sentier Investors, please click here.

Data citations