The Labor Party stage 3 tax cuts expected to pass through the parliament are welcome cost-of-living relief for lower income taxpayers. But payback to higher income earners for the effects of wage inflation induced bracket creep is less than that intended under the Coalition's stage 3 version.

What bracket creep really is

Bracket creep is a function of a progressive tax system, constructed by setting higher marginal tax rates at higher income bands. It is both a scourge on taxpayers and an ally of governments.

As well as having the potential to push wage earners into higher tax brackets, it increases the average tax rate within brackets. Because as the portion of salary taxed at the higher marginal rate grows, the total tax paid as a percentage of income increases. ’Tax creep’ is probably a more apt description of this process.

In general, the more income tax brackets, and the wider the spread of marginal tax rates, the more progressive the tax system. And the more progressive the tax system, the greater the impact of bracket creep.

We clearly have a progressive income tax scale in Australia, with for example, the top 10% of salary earners paying about half of all income tax.

To negate bracket creep, the thresholds at which marginal tax rates change should be indexed to inflation. The problem is the government of the day does not index tax thresholds. Rather, it legislates ad-hoc tax cuts to address bracket creep, and usually announces them with lots of fanfare as if it was doing some great deed. But the cuts are basically payback for a silent tax that creeps up on wage earners like a librarian.

Indexing thresholds would also incentivise governments to exercise budgetary discipline, with no bracket creep to fall back on. And fiscal discipline may even lead to significant tax reform, with less reliance on personal income tax.

Labor's proposed changes

The Coalition stage 3 tax scale had only three tax brackets, with a super-sized bracket of income between $45,000 and $200,000 taxed at a marginal rate of 30%. It would have been a virtual flat-tax regime for around 94% of Australian taxpayers in that tax bracket. The marginal rate beyond $200,000 being 45%.

The soon to be legislated Labor stage 3 tax scale has an additional tax bracket, with a marginal rate of 37% for income between $135,000 and $190,000, after which the top marginal rate of 45% cuts in. And the lowest marginal rate is at 16% compared to the Coalition’s 19%. Both scales have the same tax-free threshold of $18,200.

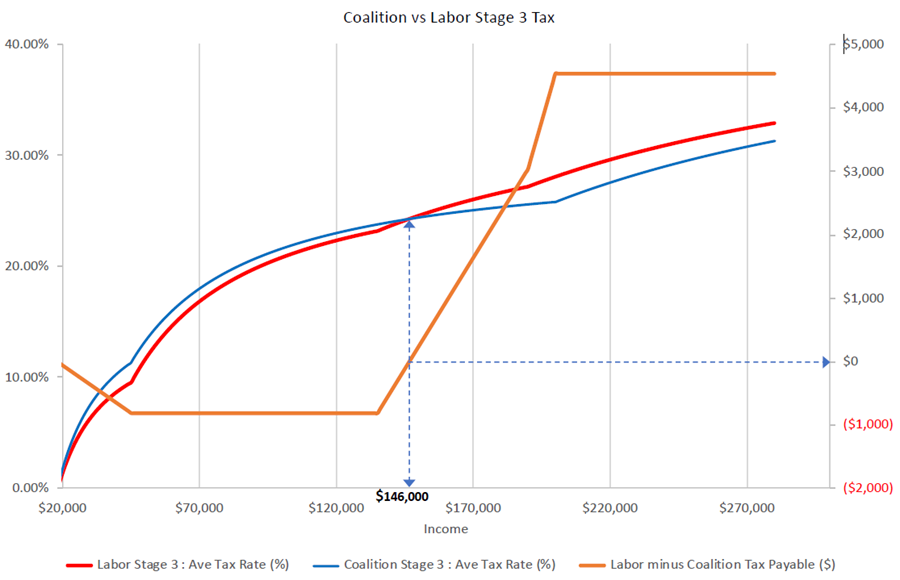

In the chart below, we compare the average tax rates for the two tax scales, with increasing income levels.

The chart shows a more progressive Labor tax regime, with average tax rates lower under Labor at lower income levels, and higher further up the income scale. The crossover point being $146,000 income, where average rates and tax payable are equal. Beyond that, bracket creep takes hold at a more rapid rate under Labor, with a sharper increase in average tax rates and tax paid.

Note under both scenarios, average rates of tax increase more sharply at lower income levels before flattening out at higher income levels. So that under a progressive tax system, bracket creep is actually regressive.

The key factor behind the accelerating Labor Party bracket creep is the 37% tax bracket. It puts wage earners’ average tax rate on a steeper trajectory compared to the Coalition's, when it arrives at $135,000. Which explains Treasury's advice that Labor’s reworked tax scale is expected to raise an extra $28 billion in tax over the next decade.

While the 37% marginal rate heightens bracket creep, it also incentivises tax minimisation. Removing alignment of the marginal tax rate with the 30% corporate tax rate for earnings between $135,000 and $200,000, means that the shuffling of income between different tax structures will persist. A golden opportunity to remove inefficiencies in the tax system has been lost.

Should tax cuts be separate from cost-of-living relief

Meanwhile, arguments for the Coalition stage 3 tax structure were compelling. Not only would its flatter tax structure dampen the ability for future governments to increase tax take by stealth, but it also would encourage initiative and ambition to a greater extent, stimulating labour supply and exposure to taxation. Overall, it would encourage lower wage earners to earn more, and higher wage earners not to earn less.

Recognising that cost-of-living support for lower income earners is appropriate, the intention of the Coalition's stage 3 tax cuts, and indeed of stages 1 and 2 before it, was to return bracket creep to all taxpayers. However, Labor argued that its revised tax position was in response to cost-of-living pressures brought about by changed economic circumstances. Which is a broad argument and doesn't really hold up when the economy is constantly changing.

Cutting personal income tax should be about reversing bracket creep and should not be conflated with other issues. In this instance, provision of cost-of-living relief could have been dealt with independently of stage 3 tax cuts, via targeted support.

Tony Dillon is a freelance writer and former actuary. This article is general information and does not consider the circumstances of any investor.