Much has been made of the current low-return environment and its potentially long-lasting consequences. People using retirement projection tools might find their return assumptions are unlikely to materialise.

In light of this uncertainty, retirees need to factor risk into their retirement planning, and advisers should make them aware of a range of investment outcomes.

Retirees can then use this information to decide when they can afford to retire, or what level of spending they can sustain over the course of their retirement.

2015 SMSF returns and fund balances

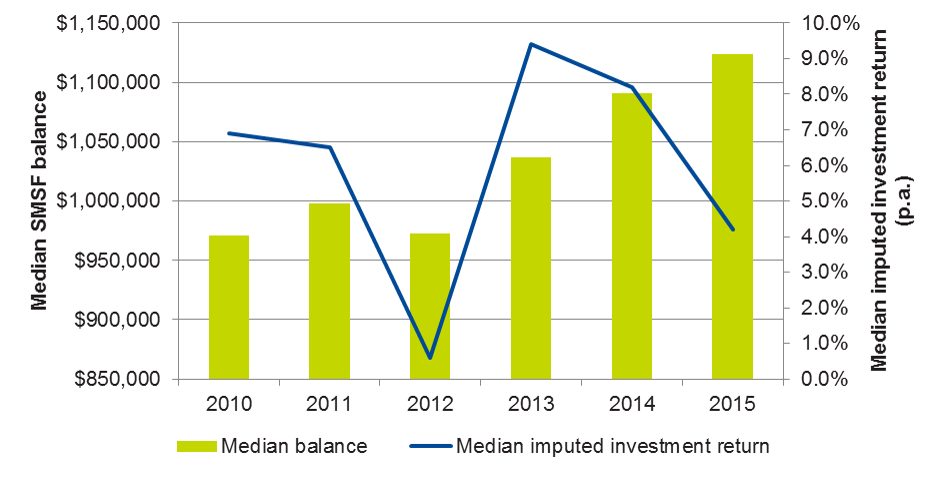

Research conducted by Accurium and the SMSF Association of over 65,000 SMSFs looked at how the retirement adequacy of Australia’s SMSF trustees has changed over the 2015 financial year. The study found the median balance for two-member SMSFs increased by 3.0% over the year to $1.1 million, based on a median investment return of 4.2%. This is lower than the average return over the previous five years of 6.2% per annum for the SMSFs in the study.

Chart 1: Median SMSF balances and investment returns as at 30 June

Note: Imputed investment returns are calculated net of administration expenses and gross of income tax. These imputed investment returns should not be used in comparisons with other superannuation sectors.

Fewer SMSFs are large enough for comfortable standard

The research used Accurium’s healthcheck to determine retirement adequacy, a retirement projection model that considers 2,000 economic and demographic scenarios and provides estimates of the savings needed to afford different lifestyles with different levels of confidence.

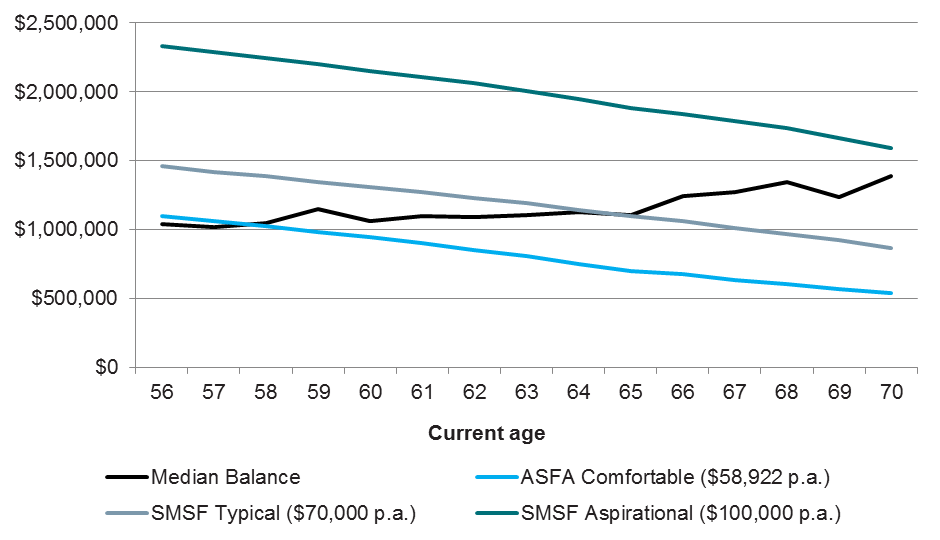

The research found that a 65-year-old couple will need $702,000 in savings to be confident of affording the ASFA Comfortable Retirement Standard, which is currently $58,922 per annum for 65-year-old couples. This is at the 80% confidence level, meaning retirees still have a one in five chance of outliving their savings. It also assumes an asset mix consistent with the ATO average for SMSFs in pension phase. Age pension entitlements, tax and superannuation settings are allowed for.

The results are testament to the success of the SMSFs in the sample, given about 70% of the couples in the research have enough in their funds to afford this lifestyle. However, that comes with an important caveat. Lower-than-average returns in 2015, together with a weaker economic outlook, mean fewer SMSF couples are in this fortunate position compared with a year ago, where 75% were on track for a comfortable retirement.

Lower expected returns are also affecting those aspiring to a higher standard of retirement living. For example, the study found a 65-year-old SMSF couple will need $1,886,000 in savings to be reasonably confident of having an income of $100,000 p.a, as shown in Chart 2. The proportion of 65-year-old SMSF couples with sufficient assets in their SMSFs to support this lifestyle has fallen from 34% to 29% over the past year. (Spending levels are assumed to keep pace with inflation, and allow for changing circumstances as retirees age. Specifically, spending is assumed to reduce by 10% once retirees reach age 85 and to drop by 30% once one spouse passes away).

Chart 2: Savings needed for different spending levels with 80% confidence vs. median SMSF balance

SMSF retirees can also achieve higher retirement living standards with savings outside of superannuation. However, the study highlights the need for trustees either in or preparing for retirement to review their plans.

The research also analysed the sustainability of individual SMSF households’ retirement plans based on their desired spending levels and their savings, both inside and outside their SMSF. Of the 1,500 households in the study, three in five could be reasonably confident that their savings would last as long as they do.

Our study also found a clear correlation between wealth and sustainability. It might seem intuitive that those with more wealth are more likely to sustain their desired retirement spending levels. However, the study revealed that SMSF retirees do not automatically increase their spending in line with greater wealth.

Value of retirement risk advice

SMSF trustees and their advisers need to assess their plans before and during retirement, including how much trustees need to spend per annum, how to meet essential expenditure and how to adjust asset allocations as a response to lower-yielding markets.

To do this effectively, advisers, or those going it alone, need the right projection tools (such as Accurium’s retirement healthcheck) that don’t just use average returns and lifespans, to consider a range of outcomes. To access Accurium’s research paper SMSF Retirement Insights: Are trustees prepared for retirement?, prepared in conjunction with the SMSF Association, click here.

Melanie Dunn is SMSF Technical Services Manager at Accurium. This article is information only and illustrates the value of providing retirement risk advice to SMSF trustees and is not intended to be financial product advice, legal advice or tax advice, and should not be relied upon as such. Advisers and SMSF trustees may need to seek appropriate professional advice.