The world has undergone a transition in its financial climate, moving from low-rate, stable inflation conditions to a period of higher rates, a spiralling cost of living and rising uncertainty across financial markets.

Retirees need to navigate through the immediate market turbulence knowing a wrong move now might have long-term implications, impacting retirement plans for what could be decades. Given the prevalence of these risks, it’s no surprise that funding their post-work lifestyle is a cause of stress for Australians close to retirement.

‘Controllable’ risks

There are several retirement risks that are often described as ‘controllable’, although that might not always be the case. Unforeseen circumstances can derail the best of plans, although personal insurance may provide a safety net for those forced to retire earlier than expected due to ill health or accident.

Controllable risks may include:

- The timing of retirement – although 43%[1] of Australians surveyed in 2021 were unexpectedly forced into early retirement due to ill health, accidents, carer responsibilities, job loss or business failure.

- The quantum of retirement savings available – while increasing contributions can mitigate the risk of insufficient savings, that’s not always possible.

- The rate of withdrawal – the higher the rate of capital drawdown, the faster retirement savings will be consumed.

Uncontrollable risks

Uncontrollable risks are often interrelated and can result in retirees questioning how long their money will last or whether they can afford the lifestyle they want. These risks may have longer term ramifications: lower investment risk tolerance, increased uncertainty, a reduction in spending or unwanted lifestyle adjustments.

Will the savings last?

The biggest fear voiced by Australians prior to and during retirement is running out of money. This is known as longevity risk – or the risk of outliving retirement savings.

With the expectations of a longer life, how much can a retiree afford to draw down each year? For many, it’s a dire choice: live more frugally today or risk running out of money.

Inflation chips away at the value of savings

Inflation risk is once again top of mind as Australia’s cost of living rapidly increases. Higher inflation reduces the purchasing power of every dollar saved. It can exacerbate the fear of running out of money and increase loss aversion.

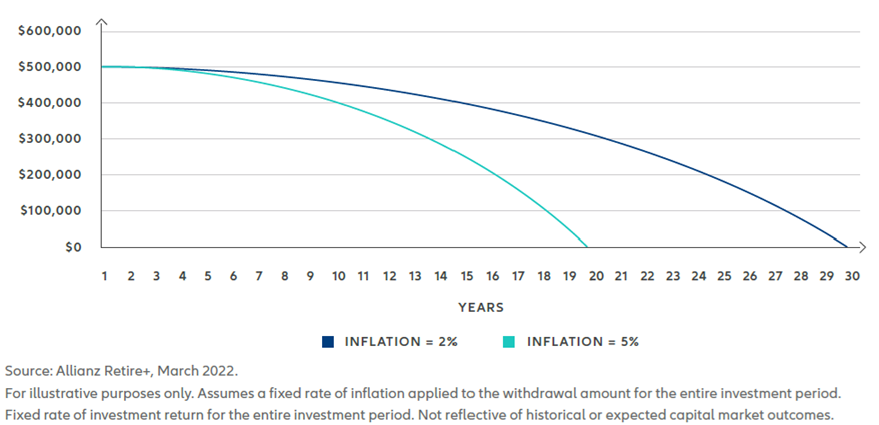

The compounding impact of inflation over time can erode retirement savings as illustrated in Figure 1, which uses the example of a retiree with $500,000. An annual inflation rate of 5% would result in their savings running out 10 years sooner than if inflation stayed at 2%.

Concerns about inflation and rising costs are top of mind for many pre-retirees; for those already living on a fixed income, the figure is likely to be much greater.

Figure 1: The impact of inflation

Market volatility erodes income producing assets

Financial market volatility is once again making headline news. The prevailing market conditions prior to and during retirement can affect the longevity of retirement capital and the level of income generated.

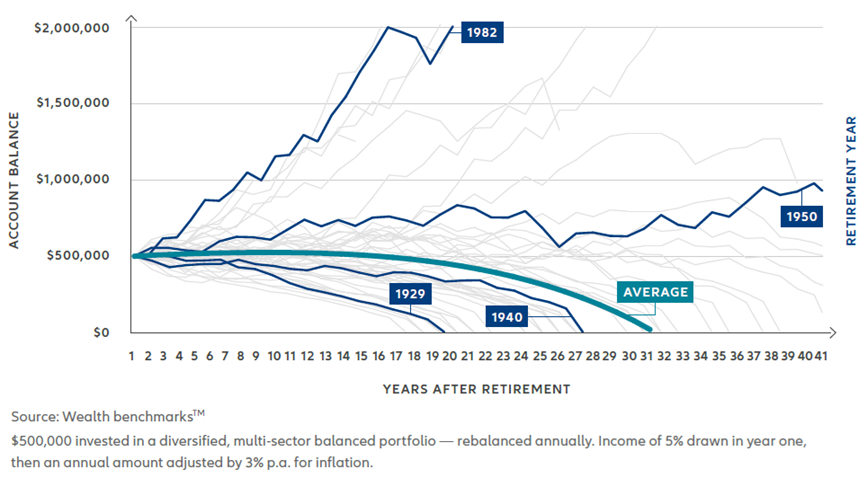

The timing, as well as the size, of a market downturn can have dramatic consequences. As modelled in Figure 2, the prevailing market conditions at the time of, and after, retirement can determine how long a retiree’s capital could last when investing in a balanced portfolio. It was chance that dealt 1982’s retirees buoyant markets, and chance that presented 1929’s retirees with a crash and rapid capital depletion.

Because retirees usually can’t align their retirement date with ideal market conditions, the decision (forced or not) to leave work can be a big gamble, particularly without the right mix of strategies and products. Unfortunately, chance can have a much greater impact on retirement outcomes than good planning.

Figure 2: Impact of retirement year on future returns

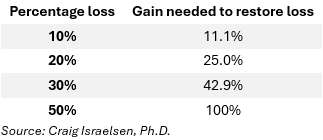

A significant capital loss requires a significant gain to get back to the same point. As illustrated in Figure 3, there is a nonlinear relationship between gains and losses; as the loss grows, the gain required to recoup the loss escalates.

Figure 3: The math of recovery from portfolio loss

A fall in market value can exacerbate longevity risk and increase loss aversion. While clients in the accumulation phase generally have the advantage of time to recover losses, retirees in the decumulation or pension phase generally don’t have this opportunity.

Timing risk impacts the longevity of retirement savings

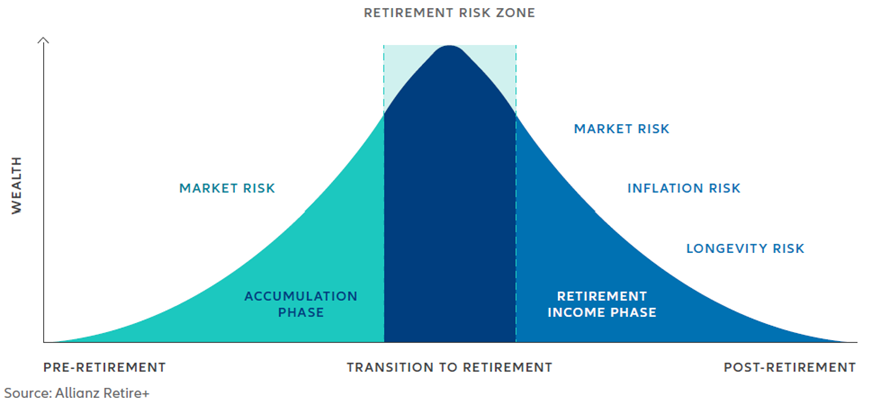

The market conditions that prevail in the years just before and after a person retires can make an enormous difference to how long their funds last. Those crucial years are often called ‘the retirement risk zone’; a period when retirees are most vulnerable to market volatility.

If someone is fortunate enough to retire in a period of upbeat markets, then their income drawdowns will be fully or partially offset by investment returns.

However, if the ‘retirement risk zone’ (see Figure 4) coincides with a period of negative returns, retirees may start eating into their savings at an accelerated rate, potentially emptying the nest egg[2]. Market shocks during the vulnerable period will leave Australian retirees with less time to recover, while falling asset prices and drawdowns for income can magnify the scale of capital losses.

Ultimately, any losses will diminish the total value of the remaining assets.

Figure 4: Timing risk zone

Loss aversion can negatively influence retirement decision making

Loss aversion, sometimes called behavioural risk, can impact how a retiree invests, how much income they draw – and can even impact their lifestyle. A range of behavioural studies have illustrated that the pain of a loss is exacerbated in retirement, and that there are other traits and biases that can impede people from making reasonable decisions about their retirement savings.

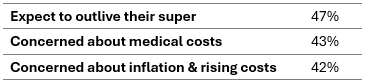

These biases might stem from others’ experiences, the fear of outliving their savings or the fear of losing capital. Investment Trends[3] identified three retirement fears pertinent in the current environment.

Loss aversion is a major factor influencing investor behaviour, particularly in retirement when it’s difficult to recoup losses. Understanding the biases and fears that can negatively impact decision making is an essential part of retirement planning.

Navigating retirement risks

Successfully navigating the (somewhat) controllable and non-controllable risks facing retirees and pre-retirees is challenging but not unachievable. Certainly, a more comprehensive set of considerations and features need to be incorporated into this cohort’s future income and estate plans to effectively address retirement risks. This is likely to include guaranteed lifetime income, market-linked returns and downside protection, as well the flexibility to make withdrawals and to have appropriate beneficiaries receive any death benefits.

Retirement income strategies will benefit from a layered and diversified approach that includes not only a super account-based pension with the usual mix of assets and perhaps an investment property, but also more innovative income solutions that help manage the unique risks of retirement and provide for longevity without sacrificing financial flexibility.

Justine Marquet is Head of Technical Services at Allianz Retire+, a sponsor of Firstlinks. This article is for general information only and does not take into account your objectives, financial situation or needs. For personal financial advice please speak to your financial adviser.

Allianz Guaranteed Income for Life (AGILE) is a next-generation retirement income solution that delivers certainty in the form of a guaranteed income for life. To learn more, visit www.allianzretireplus.com.au/about-us/certainty.

[1] Allianz Retire, [Project McFerrin], July 2021

[2] Allianz Retire+, ‘Talking about sequencing risk’, February 2019

[3] Investment Trends, 2022 Retirement Income Report, October 2022