The Australian Treasury’s 2015 Intergenerational Report released a few weeks ago makes for mixed reading. Australians are likely to live longer, which is good news. But this also means they will need more income for a longer retirement, which can be challenging.

So far, Australian investors have largely relied on a few traditional sources of income: term deposits, investment grade credit, and high-yield domestic equities. But we believe that a particular type of global equities – those that pay and grow dividends over time – can be an important addition to their portfolios. These 'dividend growers' have historically generated superior total returns with lower volatility compared with companies that pay a flat dividend, declining dividend, or no dividend at all. Some examples of world dividend growers include Nestle, Emerson Electric and more recently, Microsoft.

Market risk versus longevity risk

Investors approaching retirement face a conundrum. On the one hand, they need stable and secure income that can last for the next 20 to 30 years in retirement. But on the other hand, they also need growing income that can protect their purchasing power against inflation. In short, investors have to grapple with both market risk and longevity risk in retirement.

Traditional sources of income such as term deposits provide a fairly steady stream of income for investors’ current needs. But there is a trade-off – they fall short of delivering the growing income that can help offset the impact of inflation.

To be fair, high-yield Australian equities have delivered strong returns in recent years and franking credits make them even more attractive. However, this group of equities has been dominated by companies in just a few sectors. To put this into perspective, as at September 2014, about half of the dividend income from the S&P/ASX 200 index came from the financial sector. As a result, investors who turn mostly to high-yield domestic equities for income face another trade-off. They lose the benefits of diversification that come with investing in a wider range of companies.

Why dividend growth matters

Australian investors tend to view global equities as a homogeneous asset class, typically seen as a growth asset or a diversifier to domestic equities.

But not all global equities are created equal. Our analysis indicates that dividend growers have a unique profile that can be especially useful when it comes to retirement investing.

Dividend growth matters because it can be an important indicator of a quality company. For companies to pay and grow dividends in a sustainable manner over time, they need to grow their earnings and generate free cash flows. Those with the ability to do so tend to have competitive business models. They also need to have robust balance sheets. Importantly, dividend growth can signal the presence of management teams that have a disciplined approach to capital allocation and are aligned with shareholder interests.

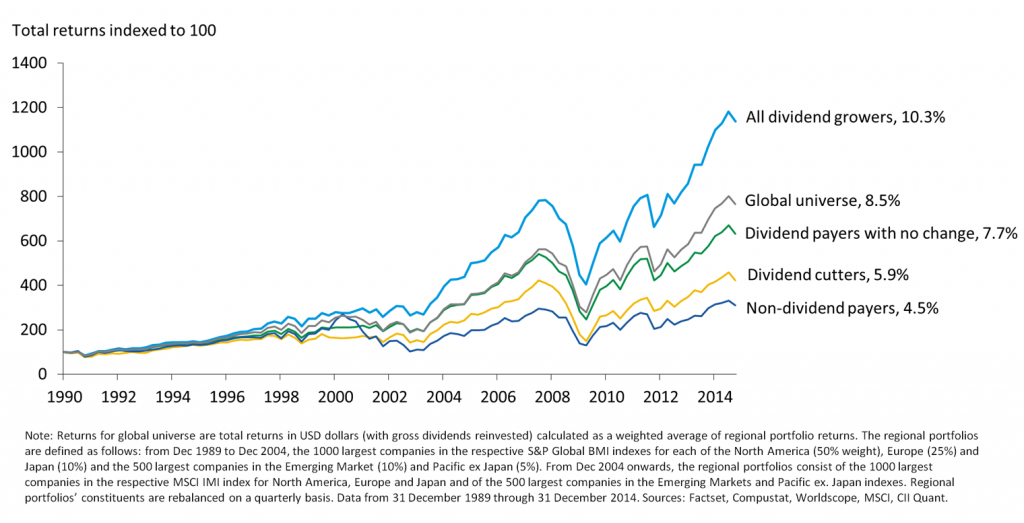

Dividend growth can be a powerful signal of a company’s ability to generate long-term value for shareholders and historical data supports this belief. From end-1989 to end-2014, dividend growers around the world delivered an annualised total return of 10.3% in US dollar terms while the broader market returned 8.5%. Dividend growers also outpaced stocks that did not pay dividends (4.5%), stocks that initially paid dividends but then cut them (5.9%), and even stocks that paid constant dividends (7.7%).

Global dividend growers have historically delivered superior long-term returns

Over the same period of time, dividend growers posted lower volatility compared with the global universe. Their returns were also more resilient than the broader market’s in periods of downturn. On average, dividend growers captured just 85% of the market’s downside. By comparison, steady dividend payers captured as much as 97% of the market’s downside.

A complementary retirement tool

The bottom line is: global dividend growers have the potential to deliver superior long-term returns and lower volatility, as well as an income stream. They can also provide diversification to a domestically-oriented portfolio. These characteristics are crucial for investors approaching retirement.

Australian investors looking to manage market and longevity risks should consider dividend growers as a complement to traditional sources of income. By adjusting their investment approach now, they could potentially better enjoy those well-deserved retirement years.

Paul Hennessy is Senior Vice President and Country Head, Australia of Capital Group. This article provides general information and does not address the personal circumstances of any individual.