Around this time three years ago I warned investors to brace themselves for bad news regarding potential tax and superannuation reforms as those areas were likely targets for the Government in the wake of the debt increase caused by the response to the pandemic. None of those reform options came to fruition (“thankfully” I hear you gasp!).

Since then, the Labor Party adopted a ‘policy light’ stance on tax and superannuation into the 2022 federal election probably due to its heavy defeat at the 2019 election where it sought to, among other things, implement limits on negative gearing, halve the capital gains tax discount from 50% to 25%, and eliminate the refundability of franking credits.

Furthermore, the October 2022 Budget was again light on tax reforms and changes to superannuation but, as NAB Group Economics noted:

“while this budget does little to address medium-term structural budget issues, it does lay the groundwork for the government to seek to address these challenges more actively in the future.”

On the back of recent developments, and the fact Treasurer Jim Chalmers is keen to stamp his mark by “building something better, more meaningful and more inclusive”, I think the sands may be shifting.

Potential tax changes

Last month, in its annual review of Australia, the IMF suggested comprehensive medium-term tax reform is needed to meet higher structural spending needs and to support economic efficiency and growth. The IMF recommended the government may need to:

- Reassess the stage three tax cuts given they limit the pace of budget consolidation

- Broaden the GST by limiting exemptions (e.g., healthcare) to rebalance from currently high direct to underutilised indirect taxes

- Restrict the capital gains tax exemption on the sale of main residences (family home) due to this exemption costing 2.5% of GDP and to make the tax system more efficient and equitable

- At the state and territory level, replace stamp duties with recurring property taxes to promote housing affordability and a more efficient use of the housing stock and provide a more stable tax base.

The last option is underway in some form in certain states and territories (NSW and ACT). However, while the cost in terms of revenue forgone in 2021 was about $64 billion, the third option is highly unlikely to ever be implemented in Australia. Taxing the family home is simply too controversial.

From a political perspective, the second option, although underpinned by strong arguments on efficiency, equity and simplicity grounds, is unlikely to be implemented in the near term given successive government reluctance to change the GST.

However, momentum has gathered for the first option over the past 12 months and the fight to scrap them is heating up in parliament. Regarding this recommendation, the IMF said:

“Stage three of the personal income tax (PIT) reforms legislated in 2018 is projected to lower tax receipts by around 1 percent of GDP annually starting in FY2024/25, partially offset by gains from bracket creep during ensuing years.” and…

“The stage 3 personal income tax cuts will reduce the personal income tax burden. With the cuts taking effect from FY2024/25, there would be time, if needed, to re-assess the parameters to appropriately balance costs on the budget and benefits to the economy. Addressing bracket creep in PIT by raising the tax brackets periodically will limit distributional implications, including for low-income households and women.”

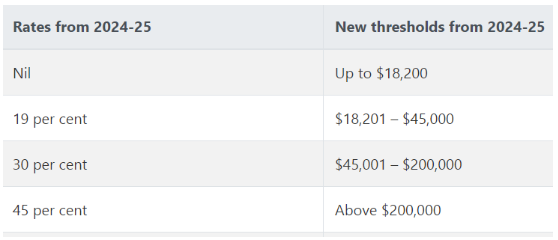

As a reminder, the stage three tax cuts will result in the following rates and thresholds from the 2024-25 income year:

In the lead up to the October 2022 federal Budget, Jim Chalmers announced the cost of the stage three tax cuts has blown out by $11 billion to $254 billion over 10 years. So, Labor is now between a rock and a hard place since it went into the 2022 federal election promising not to change the tax cuts and did not tinker with them in the October Budget. However, commenting on the IMF’s report, Jim Chalmers gave conflicting messages when he said:

“The point that the IMF is making is that when we’ve got these pressures on the budget … we need to make sure that we’ve got the tax system that can sustain the funding that we want to see in our areas of national priority” and…

"If there are avenues for responsible tax reform into the future, like what we are doing in multinationals, then obviously those opportunities and avenues should be explored"

Followed by:

"We listen respectfully when those kinds of suggestions are made to us, but the government's approach to the stage 3 tax cuts hasn't changed. We've got other priorities in the budget. You will see them in May."

So, the jury is out on whether the stage three tax cuts are at risk, but the IMF has effectively given the green light for the government to overhaul them.

Super changes show the need to be prepared

The announcements this week on the Government's intention to legislate an objective of superannuation is a sign of moves to come. The proposed definition is:

“to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way.”

It makes clear that superannuation is not a tax minimisation vehicle or a pot for later generations, as it must:

"to provide universal savings that are then drawn down in retirement to deliver income that support retirees’ standards of living. The focus on delivering income makes clear that the purpose of superannuation is not for minimising tax on wealth accumulation or enabling retirees to leave tax-effective bequests."

The Government has admitted this objective is background to introducing a cap of the amount of superannuation allowed per person.

The zeitgeist has changed and investors can expect some changes to the current taxation settings in the Budget as well. However, I suspect that, given the political cycle, they will not be significant but rather lay a platform to be followed by an in-depth holistic review of Australia’s taxation systems leading to a more comprehensive platform of reform prior to the next federal election.

Dr Rodney Brown is a Senior Lecturer at the School of Accounting, Auditing & Taxation at UNSW Business School. This article is for general information only, as it does not consider the circumstances of any individual.