Most Australians consider superannuation as their most valuable asset. Contemplating the intended recipient of these funds in the event of one's death is crucial. Nevertheless, this objective is accompanied by a significant restriction: Australians cannot allocate their superannuation benefits to charitable organisations.

The need for reform

As Australians' wealth continues to rise, superannuation is one of the most significant assets in an Estate. According to Association of Superannuation Funds of Australia (ASFA), superannuation accounts in Australia are worth $3.5 trillion in 23.4 million accounts as of March 2023.

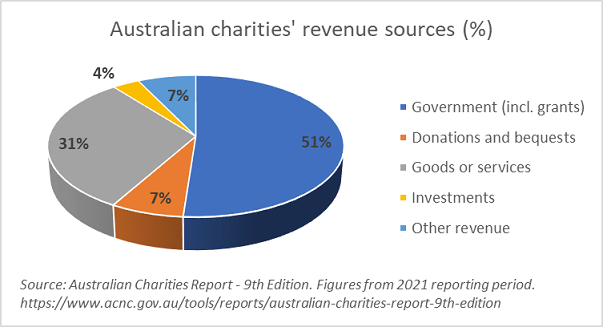

Over the next two decades, it is projected that approximately $2.6 trillion will be transferred to future generations, presenting numerous Australians, particularly those with higher incomes, with the chance to financially support their dependents and extend it further by leaving part of their bequest to charitable organisations. Although Australians can nominate bequests to charities within their wills; for charities, being solely reliant on gifts in wills has some limitations.

It is estimated that only 59% of Australians have a will, and of those wills made, not all meet the formal validity requirements. Some donors also decide to leave behind non-monetary gifts in wills, where the emotional value far outranks the gift’s financial value and cannot always be used like a pecuniary donation.

Despite some concerns, the contested rate for wills in Australia is generally low, with less than 5%, which may lead to intended charitable beneficiaries potentially receiving a somewhat reduced inheritance compared to the donor's original intentions.

Under current superannuation law, funds cannot pass directly from a superannuation fund to a charity. However, where assets pass from a superannuation fund into an Estate to be distributed through a will to a charity, the superannuation death benefits are subject to taxation, as the charity is not a tax dependent of the deceased member.

Given the tax advantages individuals receive when donating to Deductible Gift Recipient (DGR) charities while they are alive and the necessity for philanthropic contributions to grow in Australia, it is worth considering additional reforms to the regulations within the superannuation industry. These reforms would allow for direct donations from a superannuation fund to a tax-deductible charitable organisation, with the added benefit of ensuring that such contributions are received tax-free.

Leaving a legacy to charities through your Super

Enacting reforms that allow charitable organisations to directly receive death benefits from a superannuation fund within the current tax framework would have a limited financial impact. Still, it could potentially enhance benefits for charities. This is especially true considering the number of individuals who make superannuation nominations without creating a will. Since many Australians already possess a superannuation fund, they would not need to undertake the additional step of drafting a will and explicitly include a charitable donation. However, enabling tax-free charitable giving through superannuation will likely provide further incentives for philanthropic contributions from this source.

Ideally, the suggested reform in the superannuation sector would be complemented by tax reform that allows deductible gift recipients (charitable organisations) in Australia to directly receive superannuation death benefits as tax-free payments from the fund.

The current government has pledged to double philanthropic giving in Australia by 2030, to mirror giving levels in other countries. Prioritising and promoting charitable giving is crucial. This reform would generate a substantial upsurge in philanthropic contributions across Australia, leading to a transformative change in the philanthropic landscape.

Giving back to society

The Fundraising Institute of Australia and its Wills and Legal Taskforce are advocating for reform allowing Australians to make bequests through their superannuation. Institute CEO Katherine Raskob says:

“We are working diligently as the peak body for the fundraising sector to bring about policy changes like this, which will have a profound impact on the further development of charitable donations in Australia. It is also an opportunity for all Australians to use their trusted asset to ensure the charity organisations that they hold dear or the causes they believe in continue to thrive, leaving a lasting legacy for themselves that extends beyond their lifetime.”

She further adds, “Over the next two decades, $2.6 trillion will be passed on to the next generation – if just five per cent were left to charity, this would release $130 billion to help all charities, big or small. So, you can imagine the impact. The reform is crucial for social change in our society to normalize philanthropic giving – particularly through gifts in Wills.”

Empowering Australia's charitable future

Allowing a nomination in superannuation enables a supporter to quickly provide their own 'future legacy' distribution for causes dear to them, underpinning donor support and charitable intentions. Even a small share of superannuation income donated to a charity can significantly impact the charitable cause (or causes) that the person cared about and supported during their lifetime.

Superannuation funds can serve as a significant source of income for charities. It can become a popular choice for individuals who regularly make charitable donations and offers an easy option for those who may be hesitant about donating during their lifetime. This approach will foster a sense of ‘giving back to society’ and allow Australians to leave a meaningful legacy through their wills or superannuation.

Australia's annual charitable giving amounts to approximately $13 billion and the new pledge to double the philanthropic giving by 2030 will substantially increase contributions towards various vital causes, such as children's health and education, care for the elderly and individuals with disabilities, human rights protection, and more. While also addressing broader concerns such as environmental conservation, preservation of natural resources, animal welfare, and the safety of endangered species. Charitable giving through wills and superannuation entails no cost during the donor's lifetime, yet it has the potential to impact numerous lives and causes after their passing. By leaving a lasting legacy, individuals are remembered for their contributions long after they are gone.

By Rohani Bixler is, Principal Lawyer at Sage Succession Law. This information is intended for general use only, and is not intended as legal advice. If you intend to rely on any of the content, we recommend that you speak with a lawyer and/or seek out the source material to verify the legal position as it relates to your own circumstances.