While the Australian superannuation system is one of the most successful in the world, it is still maturing.

After all, the Super Guarantee only commenced in 1992 at 3% of a person’s earnings (or 4% for employers with an annual payroll above $1 million), increased to 9% from 1 July 2002 and is scheduled to reach 12% from 1 July 2025. It will take another decade or two before most employees retire having only experienced superannuation contributions of 9% or more for all of their working lives.

As the system matures, a growing number of Australians will be less reliant on the Age Pension and, as a result, will enjoy a better retirement funded wholly or in part by their superannuation.

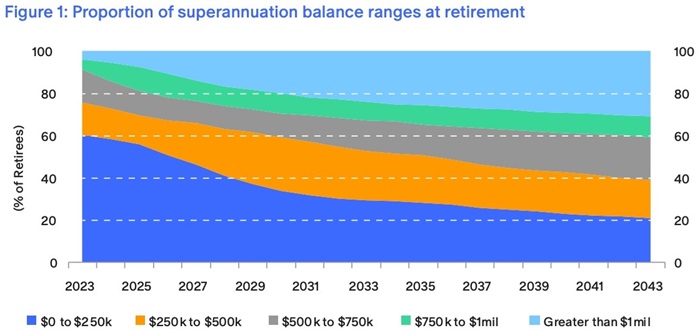

While around 60% of current retirees have less than $250,000 in superannuation ‘at retirement’, this percentage is expected to decrease to around 20% over the next 20 years as the compulsory superannuation system matures (Boal & Somerville, 2023).

This is what Treasurer Jim Chalmers calls “the intergenerational genius of super” (Ransley, 2023). But if we look at our ageing population and ‘retirement’ from an intergenerational perspective, we see there are many challenges.

In particular, government-funded health and aged care costs are on the rise while the superannuation system is still immature.

More than just a roof

An important part of voluntary private savings is the family home, with more than 80% of people currently aged 65 to 74 living in their own home (AIHW, 2023).

The property price boom of the past few decades means that even more modest properties have appreciated in value significantly, now accounting for a significant portion of the average homeowner’s wealth. Yet it is also true that many ‘asset rich, cash poor’ retirees live more frugally than they need to.

For these retirees who own their home but have insufficient superannuation or other liquid savings, perhaps the home should be treated and used more like any other financial asset to help fund their desired lifestyle, as long as there are appropriate consumer safeguards in place.

Given these trends, it is reasonable to now ask how we should treat the family home in retirement, in a fair way that supports the sustainability and equity of the retirement system both today and into the future, for homeowners and renters alike.

Key areas of reform to focus on in relation to the retirement phase include:

- changing the narrative, so that it is more acceptable to access and spend part of the equity that has been built up in the home;

- improving financial literacy, especially in relation to retirement and longevity, so that retirees understand how they could use their accumulated assets to live a better life in retirement while still managing the various risks;

- ensuring we have strong disclosure requirements and consumer protections for the range of home equity release and related products, including “debt type” products, to improve the level of community understanding and expectations for these products;

- improving equity in the system for renters to make renting more affordable, especially in retirement;

- addressing the financial disincentives to access part of the wealth stored in the home, such as removing or refunding some of the frictional costs associated with downsizing and changing the means test treatment of the proceeds from sale

We must also do more to narrow the gap in retirement outcomes between homeowners and renters.

Gradually including the value of the home above a reasonable threshold into the Age Pension means test, for example, could improve equity in the system and encourage retirees to access some of this wealth. This continues to be a politically sensitive issue. But that doesn’t mean we should fear having a conversation about it.

Given the amount of wealth stored in home equity in Australia, one could reasonably argue that the home is just as important as superannuation and the Age Pension when considering retirement outcomes. As policy makers bed down the legislated objective of superannuation and attention continues to shift to the retirement phase, we must take this opportunity to review our policies.

Andrew Boal is a Partner in Deloitte’s Superannuation & Investment Specialists Practice and Chair of the Actuaries Institute’s Retirement Strategy Group. This article is an edited extract from the Institute’s new dialogue paper “More Than Just a Roof: Changing the Narrative on the Role of the Home”.