A rebuttal to Graham Hand’s The 4Ps of roboadvice: persist, pivot, partner or pack up.

Sometime in 2018, the Australian population reached 25 million. There are almost 20 million mobile phones in use in this country today, and smartphones comprise 88% of them. Australians are among the leading adopters of smartphone technologies and the apps that we increasingly use in our daily lives.

A recent Deloitte survey asked, “What did we ever do before smartphones?”, noting that:

“From the moment our fingertips touched the screen, Australians have enthusiastically embraced the smartphone and its myriad and multiplying uses. This disruptive innovation, which started out as the technological Swiss Army knife, has gone on to enable radical changes in not only the global communications landscape but across almost all facets of life and the economy.”

According to the Productivity Commission's Inquiry Report into Competition in the Australian Financial System (PC AFS), during 2007, about 3 million Australians received financial advice, or approximately 20% of the adult population at the time. The PC AFS report notes that during 2016, about 2.6 million Australians received financial advice, or only 14.5% of the adult population, nine years later.

Far from expanding and assisting more Australians in the important task of securing their financial futures, the financial planning industry (yes, I said industry) is failing to engage people with a value proposition that resonates. Investment Trends estimates that 48% of adult Australians, or some 9 million people, have unmet advice needs. What gives?

Costly, complicated and untrustworthy

There are three hurdles that the advice industry has to overcome if it is to engage with, and genuinely provide, a value-added service to more Australians.

1. Too costly

From a global context, wealth management (as financial advice or planning is generally known) is a niche service for the wealthy. It’s an industry that was conceived to serve the needs of ‘High Net Worth’ (HNW) clients who could afford the costs involved in the provision of advice.

In the post-FoFA era, the cost of providing advice simply does not square with the fee appetite of the majority of non-HNW clients. The PC AFS report noted that the cost of providing comprehensive advice averaged $2,500, but people are only willing to pay $780 on average to receive such advice.

In a post-FASEA, post-Hayne Royal Commission world, the costs of providing advice will rise, precluding even more Australians from receiving the financial advice they desire and deserve.

2. Too complicated

Many Australians neither want nor need comprehensive (‘holistic’) financial advice. That 50-page Statement of Advice magnum opus incorporating debt, cashflow management, superannuation, retirement planning, insurances and estate planning is of interest to far fewer prospective clients than the advice industry cares to admit.

What people increasingly want is piece-by-piece advice on issues of concern at the point at which they occur. Rather than the all-encompassing comprehensive financial plan, the growing demand is for ‘scaled advice’. It must be suitably qualified, efficiently provided and at a price that reflects the nature of the advice.

3. Too untrustworthy

A recent Investment Trends report indicates that trust in financial planners has fallen to an all-time low, with a survey of over 8,000 respondents revealing that on a scale of 0 - 10 (with 10 being the most trusted) financial planners now sit at 4.8, placing them in the ‘distrusted’ range.

There is little doubt that the revelations at the April 2018 hearings of the Hayne Royal Commission of systemic and persistent failings by some of Australia’s largest advice providers have impacted the public’s perception of the advice industry. Many of the issues raised involved contraventions of the FoFA obligations that I’ve previously opined on. The advice industry has struggled to come to grips with the implementation of these changes years after they came into effect in 2013. These transgressions will likely now accelerate the removal of concessions, especially grandfathering of commission arrangements.

Roboadvice to the rescue?

First, one small gripe. The term ‘roboadvice’ does a disservice to both providers and users of this technology. It’s a pejorative phrase, coined in the US by those threatened by its arrival, thus labeling it with a term suggestive of killer droids from some dystopian future arriving to destroy advisers and take captive their HNW clientele. Nothing could be further from the truth.

In fact, the technology created by Clover.com.au and others like us who manage investments on behalf of clients can best be described as digitally-enabled advice. The technology facilitates user engagement in the advisory process, to produce the necessary disclosure documents in a compliant manner (for digital advisers that provide personal financial advice), to automate the on-boarding of a client (Know Your Client, AML/CTF, bank or broker account opening). Thereafter, it provides an ongoing service incorporating cashflow and market-based rebalancing and regular reporting, depending on the contractual nature of the on-going service.

Digital advice (the term preferred by ASIC) is as much about the automation of the middle and back office functions of a financial practice as it is about the front office interaction with the client. If digital advisers impact anyone in the financial advice industry, it’s more likely to be paraplanners, customer service officers and compliance personnel who won’t be required to the same degree in digitally-enabled offerings.

Future-proofed from birth

So why is digital advice here to stay, and will in time become a key component of future-oriented financial advice dealer groups and practices?

The reasons are simple. Australian digital advice was created from inception for a post-FoFA world where transparency, compelling user engagement, simple investment strategies that are evidence-based and low-cost and unapologetically favour the client’s interests over competing interests are defining features of the digital advice value proposition. As Commissioner Hayne noted in his Interim Report:

“The interests of the client are to obtain the best financial advice reasonably available. More particularly, if the advice is for the client to acquire some financial product, it is in the client’s interests to obtain the best product; best in the sense that it is fit for purpose but best in the sense also that it is the cheapest and (as far as can reasonably be determined) the best performing product available.”

Australians are increasingly turning to digital advisers. Investment Trends, in reporting that 27% of the Australian online investor population has heard of the term ‘roboadvice’, recently opined that “roboadvice will take centre stage as more solutions become available, and as investors themselves begin to engage with these non-traditional advice models.”

Why does CSC matter more than CAC in the long run?

Graham Hand’s piece, quoting the irrepressible US sage of all matters financial advice, Michael Kitces, noted that the Cost of Acquiring a Customer (CAC) is notoriously high in financial advice, and that this marketing cost would be difficult for digital advisers to overcome and lower over time, relative to the low fees charged by digital advisers.

In terms of engaging more people, and particularly people with lower investible assets earlier in life, Kitces is right when he says that …

“... the problem is not the lack of a business model to serve the masses effectively; the problem is a marketing model to convey the value of financial planning to the masses effectively, and doing so at a cost-effective price point that doesn’t bury the business model in too-high client acquisition costs.”

True, but we need to acknowledge that CAC is high in financial advice in large part because of the trust deficit that exists. A legislative environment has developed to protect investors from industry participants who seek to put personal financial interest above those of their clients. The lower the trust factor and higher the financial stakes, the higher CAC invariably will be.

In an Australian context, however, it is becoming increasingly apparent that in the future, it is not CAC that will determine the long-term winners in financial advice but the Cost of Servicing a Client (CSC).

The Royal Commission laid bare an inconvenient truth: the financial advice industry that emerged in the 1980s adopted the modus operandi of the insurance industry from which it evolved. It was a transaction-based, sales-oriented business model fueled by an opaque compensation structure in commission payments between product provider and advice giver.

The business model was never designed for the provision of ongoing services, and so CSC was never factored into the equation. Now it is front and centre.

In a post-FoFA world, the CSC will almost certainly rise, and reduce the viability of advice for even more Australians. The risks to the current 14.5% market penetration of traditional financial advice are more to the downside.

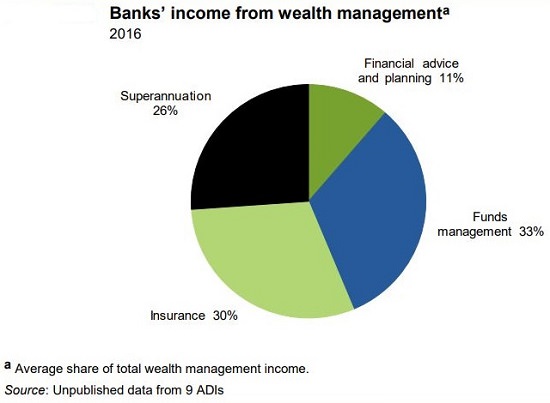

In fact, as the following chart from the PC AFS shows, for nine deposit-taking institutions dominated by the Big Four banks, financial advice is primarily a distribution strategy for asset management and platforms, and makes little money in its own right. Except for Westpac, the three others are exiting advice as it's simply not worth the problems.

A hybrid model will prevail for most people

It need not be so. The real future of financial advice may be neither purely digital or purely human, but a hybrid of advisers doing what they do best: engaging in honest conversations, determining financial needs, goals and objectives. Then they will use digital advice technologies to deliver investment solutions, investor education, client on-boarding, portfolio implementation and ongoing monitoring, reporting and compliance requirements.

As ASIC opined in its submission to the PC AFS report:

“An effective advice market should accommodate the diverse needs and different financial circumstances of consumers, deliver advice in a cost-efficient manner and be accessible through a variety of channels.”

Digitally-enabled advice offers the best hope for such a future to emerge, to the advantage of all Australians, not the shrinking minority who will be able to engage financial advice in a post-FoFA, post-FASEA, post-Royal Commission world.

Harry Chemay is a Co-Founder of the digital advice provider Clover.com.au.