Analysis on the impact of the legislative changes to superannuation since 1 July 2017 has revealed a massive jump in the amount of tax paid by SMSFs, so much so it should prompt the Labor Party to scrap its proposal to cancel cash refunds for excess dividend imputation credits.

The June 2018 SMSF Benchmark Report by Class (an SMSF software provider) highlights that the Government’s decision to cap the amount of super an individual can hold in pension phase to $1.6 million, along with higher taxes for those people in the transition-to-retirement (TTR) phase, has had a dramatic impact on the SMSF sector.

The Class Report calls this impact “tectonic” and "the tax implications are huge" and I agree 100%.

Introducing the $1.6 million transfer balance cap and changing the tax treatment of TTR streams has meant almost 25% of SMSF assets have lost their tax-free status.

Source: Class Limited

Huge shift in assets out of tax-free pensions

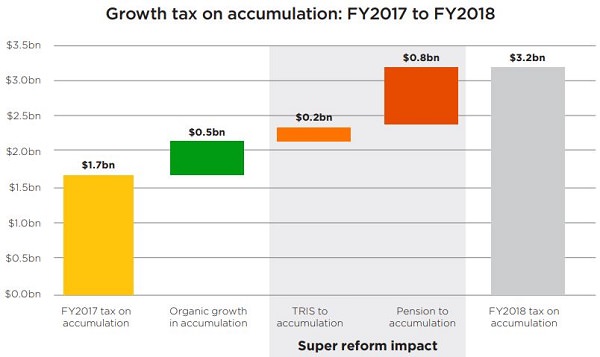

Assuming a modest return of 5% on assets for the 2018 financial year, Class estimates SMSF earnings are generating a tax bill of $3.2 billion, a “whopping” $1.5 billion jump from 2017. Remember, too, this estimate is based on earnings only. The tax outcome of a fund also needs to consider contributions taxes, deductible expenses and rebates including franking credits.

The higher tax bill reflects the huge shift in assets. At June 2018, the asset value in accumulation phase was $422 billion, a 90% increase from March 2017 when it was $222 billion. Another way of painting this picture is to note that in March 2017, 31% of assets were held in pension phase and 45% were held in the mixed phase. As at June 2018, only 14% of assets remain in the tax-free pension phase, while the mixed phase has jumped to 57%.

Inevitably, moving the goal posts will usher in new strategies. On this occasion, there’s been a silver lining; an increase in contribution splitting and recontributions has led to a significant improvement in the gender imbalance in SMSF assets and balances and it will be interesting to see if the trend continues.

Based on this data, Class concludes that pension SMSFs should not be hit again:

“Given the impact of the 2016 super reforms, we don't consider the proposed Labor policy to further increase the tax burden on self-funded retirees by reducing imputation credits for SMSFs is appropriate, especially if it disproportionately impacts SMSFs compared to APRA funds. If the proposed changes go through, SMSFs will not only be subject to 15% income tax on a higher portion of their assets (now in accumulation), but they may also lose their tax credits on their pension and accumulation assets. The system has undergone unprecedented SMSF regulatory changes over the past two years, and we hope the end of the impact of this super reform is now in sight.”

I couldn’t agree more. It’s why the Labor Party should revisit its proposal to cancel cash refunds for excess dividend imputation credits. The arguments why this is not only poor policy but highly inequitable have been well aired.

SMSFs have planned based on franking credit receipts

To begin with, this policy has been well-established for nearly two decades, having been introduced on 1 July 2000. For many SMSFs in retirement phase, it’s a core investment and income strategy.

Calculations by the SMSF Association suggest Labor’s proposal will affect more than one million Australians saving for their retirement. Further, it will cut about $5,000 from the median SMSF retiree earning about $50,000 a year in pension income, equal to a 10% pay cut. As the peak body said, “Arguing these people won’t be paying any more tax is just semantics.”

The fiscal benefits Labor believes it will reap are unlikely to eventuate, especially in wake of the 1 July 2017 changes. Changes of this magnitude always have unintended consequences. Expect SMSFs, especially those paying income streams, to seek other sources of yield, potentially from higher risk assets. In retirement, capital security is critical, yet the chase for yield (income) could jeopardise this for some retirees.

Alternatively, less attractive after-tax returns on domestic companies could presage a shift to foreign companies, with ramifications for blue-chip ASX-listed companies where SMSFs have provided much-needed ballast for their shares prices.

There’s a more fundamental issue to be addressed. When Labor introduced compulsory superannuation in 1992, the goal was to encourage people to be self-sufficient in retirement. And SMSFs have taken Labor at their word. They have used the system governments have devised to be financially independent in retirement and off the government pension.

But Labor is now seeing SMSFs as a cash cow, a retirement savings vehicle for the wealthy, to be tapped to meet more immediate fiscal needs. It reflects an attitude of all governments that the superannuation honey pot that has now reached $2.6 trillion is there to be tapped for any policy that typically only has political merit.

All governments need to remember the sole purpose of superannuation is to give people financial independence in retirement. If changes need to be made, then it should only be after long and considered debate outside the budget cycle.

Olivia Long is Managing Director, Strategy & Operations at Prime Financial. This article is general information and does not consider the circumstances of any individual.