Shadow Treasurer, Chris Bowen, has laid down the gauntlet by making the introduction of superannuation earnings tax for pensioners a key electoral issue. The Liberals have responded in kind by declaring they will not fiddle with super if re-elected. Why has this seemingly trivial issue gained so much attention and which side will emerge victorious?

The increasing role of ‘fairness’

Arriving in this country nine years ago, superannuation was explained to me thus: 'a system whereby the government forcibly confiscates 9% of your income, deposits the cash in a faraway place for an indeterminate amount of time (assume no less than four decades), under a set of rules that are likely to change every few years. Oh, and it's very popular.'

One of the most delightful local expressions, for which there is no English equivalent, is the phrase 'unAustralian'. For instance, it is unAustralian to describe The Castle as unwatchable dirge (surely Kenny is a more entertaining representation of the Aussie battler class than those halfwits from Bonneydoon). Most unAustralian of all is to ignore the right to 'a fair go'. Fairness is the one cultural value that unites all Australians.

Fairness is a highly subjective concept and exists largely in the eye of the beholder; one person’s equity is another’s tyranny. But fairness has been in the news a lot recently. When the government released its discussion paper on tax it repeated ad nauseum the phrase 'lower, simpler, fairer.' Chris Bowen prefaced his super reform plans by declaring that 'an important criterion for a well-functioning tax system is fairness'. Peter Costello somewhat resignedly responded by remarking that 'once upon a time, fairer taxes meant lower taxes.' Clearly, not any more.

Survey of high net worth clients

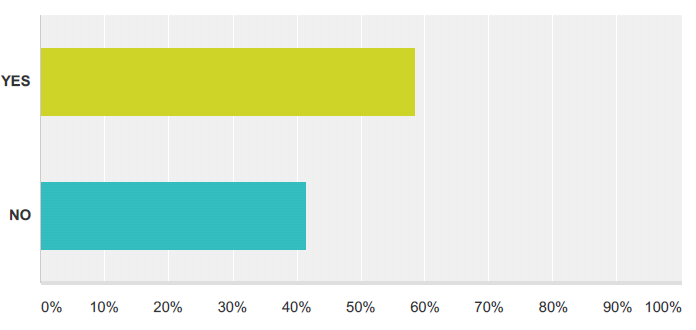

So what to make of Labor's plans to introduce superannuation earnings tax in the pension phase? We posed this question to some 400 of our high net worth clients, most of whom will be negatively impacted by Labor's proposals, either now or in the future.

‘Labor has proposed introducing a 15% tax on superannuation earnings that are in pension phase, subject to a tax-free threshold of $75,000. Currently, those in pension phase pay no earnings tax. Under this proposal, an individual would need a Super Fund balance in excess of $1.875 million before they would be eligible for earnings tax (assuming an earnings rate of 4%). An individual with a Superannuation balance of $3 million would be liable for $6,750 tax. Do you think this is fair?’

The results, shown below, were surprising to us. They showed a consistent 60% or so in favour of a pension tax. The comments were even more revealing (a selection is attached at the end). Though the majority accepted the need for the wealthy to contribute their fair share, there was a universal fear that 15% would become 20% and that inflation would quickly erode the exemption via bracket creep (the 9th Wonder of the World). Others pointed to the need to differentiate between super monies that have already been fully taxed (non-concessional contributions) versus lightly-taxed (concessional contributions) – a valid point. Finally, many pointed to the need for politicians to lead by example and switch their lucrative defined benefit pension arrangements to the more frugal defined contribution scheme. It is hard to lead with any moral authority when you are fattening the cat.

If even wealthy Mosman families have little argument, a pensions earnings tax is a racing certainty. We hope that it is accompanied by the indexing of the tax-free threshold (given that Bill Shorten first flagged $100,000 as the tax-free threshold three years ago, Chris Bowen's version with a $75,000 exemption is the first tax in living memory to be increased before its introduction!), we would urge the current assets test home exemption to be reviewed and we would dance naked in the streets if Canberra led by example. The Liberals are on an electoral hiding to nothing by dogmatically ruling out further pension changes. Politicians rarely stick with unpopular plans and hence we believe that pension earnings tax, equitable or despotic, is coming. Tax-fee retirement, Tony? Tell ‘im he’s dreamin’!

Jonathan Hoyle is Chief Executive Officer at Stanford Brown. Any advice contained in this article is general advice only and does not take into consideration the reader’s personal circumstances.

ResponseComments (unedited)

NOAltering long term arrangements amounts to retrospective taxation. I sold a family home to put money into super. That property may have doubled at this point of time. Can the labour party reverse that!

NOAny changes in super should not retrospective.

YESAs long as the figure is indexed, $75k is ok now but in 10 years it may need to be higher etc.

YESAs long as there was some method of ensuring it didn't become 20% or 25% etc!

NOBecause with inflation more and more retirees will be taxed.

NOI am opposed on principle because people with 3 Mill Super Balances are not on the Pension, and cost very little to the Govt to support. I also believe that this style of tax may raise far less income than they expect. Additionally, how many times can I expect my savings to be taxed, and what is the community (cost) trade off for people who will fall back into the pension? It would be far more equitable to raise the GST by 2% and revue items that are fundamental to sustain a basic lifestyle. This tax would hit the richer in the community as they always purchase more than those not so fortunate.

NOI can't believe that this is an election issue. Would it raise any more than 0.5billion?

NOI feel a bit torn on how to answer this. Personally I prefer to direct my money to causes I feel strongly about and know it is well spent. Then again I think more wealthy Australians should give something back. Perhaps tax those who dont give x amount philanthropically?

NOI have been working since I was 15 years old (47 years) and are no different to anyone else that has been trying to accumulate enough money so they have the ability to maintain the life style we have become accustomed to without having to dependence heavily on the pension If need. We haven`t just picked this this money of the local money tree. We have built businesses, employed people with substantial risk to our personal assets and families. Small Business have paid our fair sharegh.

NOI think that anybody who is not accessing any government benefits of any sort (i.e. are truly self funding their retirements) should not be taxed at all. Why? Because we have already been taxed on the money that has gone into the fund!

YESI think that the tax amount is quite reasonable and that without this tax on super the country will not be able to provide adequate health and welfare services for the community as a whole.

YESIf my fund was earning $100,000 per year I would pay $3,750 in tax. An effective tax rate of 3.75% in exchange for healthcare, roads, defence and of course the safety net of an old age pension should my investment be wiped out. Sounds like a great deal to me.

NOIt is grossly unreasonable for any government to have encouraged and structured long term retirement savings plans for over 20 years, then subsequently reduce the value of those savings to their owners. Regardless of the social equity (or other) debates which may emerge, this system was created on the trust that the Australian people have in their government and cannot be changed without destroying that trust.

NOMy answer is a "qualified 'no!' The qualification relates to the threshold number at which the tax is levied. My view is that it should be $4m and the earnings rate 5%; that is the tax would start when the earnings exceeded $200,000. With my proposal someone earning $250,000, taxed at the Labor rate of 15% would pay $7.5k. That would catch the truly 'fat cats!' and the amount earned by the ATO would drop by a small amount compared with the Labor proposal.

YESnot a question of fairness but probably what needs to be done. the worry is that the 15% would then become 20% & so on & on!! not and incentive for anyone to create a worthwhile Super account for themselves

YESNot a question of fairness, but necessity given Australia's circumstances, and the better off can more easily shoulder the burden.

NONot while politicians exempt themselves from similar tax treatment.

NOPensioners have already paid tax and shouldn't pay anymore, it's not fair.

NOPeople with Super have worked and earned their super one way or another & have already paid taxes. Even though this may not seem a lot of tax for a whole lot of people it takes away incentive for people to put money into Super. Ask someone below 40 about Super and its a necessary evil but ask someone who is 60 and its a necessity. More encouragement is required for people to invest in Super or the government will be supporting the nation with pensions. LEAVE SUPER ALONE!

YESSo long as the 75k threshold only related to income from super not income derived from outside super

YESSomething has to be done to redress the imbalance between advantages of super for the rich, vs the poor. This is at least a starting point (there could be others).

YESTax is required to provide services for all - including those in retirement. And we could be in retirement for many years. So yes some contribution to the services that we use in this stage of our lives is merited.

As most people in Australia wont be above tax free threshold I imagine that most would say it's fair. The issue is complex but that is the Australian political style...simplify it and dumb it down. Bill vs Tony. Should this happen? Probably no given that the rules were set a long time ago and are being changed because of the Iron Ore Price.

YESWe all pay tax on income during our working lives including income from investments. Paying a small tax on our retirement income is a natural extension of this. I am sure most retirees know they are currently gwtting a very gwnerous concession at present even if they worked and saved to accumulate all their super... which probably includes family inheritences which are also tax free.

YESWe cannot have one third of the population not paying tax. Abbott's argument about taxing the income of wealthy pensioners is ideologically driven and is, as usual completely illogical

NOWhen the Federal Government first urged the working citizen to start his or her own superannuation fund it was represented that they would not tax a person's saving!

NOWhy should those who have studied,worked hard and been responsible spenders and many of whom have contributed large amounts of tax for the benefit of others be asked to pay more We seem to want to encourage laziness and mediocrity

NOWithout all the facts, it seems in good return years I will pass this threshold with as little as $400,000 @ 20%. Yes only two years in ten on average. With it comes 1 -30% return do I get to carry the loss forward, I take the risk and ATO take the cream this isn't fair it's about normal.

YESYes but I'm tempted to answer no as it doesn't go far enough. We haven't earned the right to live for 30 years after retirement without contributing to the cost of society.