During February and August every year, most Australian listed companies reveal their profit results and guide how they expect their businesses to perform in the upcoming year. Whilst we regularly meet with companies between reporting periods to gauge how their businesses are performing, reporting season offers investors a detailed and externally audited look at the company's financials.

The February 2024 company reporting period that concluded last week displayed stronger-than-expected results despite the higher inflationary and interest rate environment. The February reporting season's dominant themes have been a resilient consumer, strong cost management, moderation in inflation and a positive economic outlook. While many companies performed very well against the headwinds of higher inflation and interest rates, not all performed well. In this article, we look at the key themes from the reporting season that fared last week, as well as the best and worst results.

Better than expected

Going into the February reporting season, the market was expecting the themes that didn't occur in August 2023, including cost inflation, higher interest costs, and slowing retail sales. However, once again, the reporting season demonstrated that many companies have managed a higher inflation and interest rate environment much better than many expected, with around 40% of companies beating market expectations. ASX companies that exceeded expectations were in the IT, Consumer Discretionary and Real Estate sectors. Conversely, disappointments were clustered in the Energy, Materials, and Healthcare sectors, primarily related to falling commodity prices and rising costs.

Resilient consumer

The first dominant theme for the February reporting season was the strength of the domestic consumer. In November 2022, Westpac's economists forecasted a grim year for 2023, the much-feared fixed interest rate cliff was expected to see unemployment rise to 4.5%, an 8% fall in house prices, bad debts to spike and retail sales grinding to a halt.

However, February 2024 showed continued consumer demand for technology and electronic products, with sales growing across the JB Hi-Fi brand. Similarly, with Wesfarmers, Kmart increased profits by 27% as consumers looked to trade down to lower price point options and the success of its Anko brand, which is now stocked in Canadian department stores. Consumers were also willing to treat themselves to fashionable jewellery from Lovisa and 4WD accessories from ARB.

Conversely, with the cost of living increasing, the wagering environment has had a downturn, which saw Tabcorp revenues and active users decreasing across both digital and cash wagering. Similarly, consumers weren't as willing to spend on bedding and furniture at Harvey Norman, with sales falling by 9% in Australia.

Inflation moderation

Across the major supermarkets, a theme that stood out was that food inflation had moderated throughout the first half and into the first six weeks of the next half. During the half, Woolworths saw average prices for fruit and vegetables decline by 6% and average prices for meat fall by 7%, driven by lower livestock prices and an increased supply of fruit. Ironically, reporting expanding profit margins in February was a case of poor timing for Woolworths, as it will see the company appear before the Senate Select Committee into Grocery Prices; consequently, its share price declined by 8% over the month.

In contrast, companies with revenues linked to inflation continue to benefit. The best example is toll road operators Transurban and Atlas Arteria, which saw increased revenues from higher traffic volumes and inflation-linked tolls. For a toll road, the most significant cost is interest, with the ongoing costs of operating a toll road once built being minimal. Both toll road companies were very active in extending their loan book from 2020 to 2022, during a period of the lowest recorded interest rates in 5,000 years. For example, in mid-2021, Atlas Arteria sold €500 million of 7-year bonds priced at a coupon rate of a mere 0.17%. While this looks low, in early 2020, the company managed to sell €500 million of bonds, paying no coupons with a negative yield of -0.077%! Effectively, bondholders were paying the company to hold their money, a situation that economists such as Adam Smith or John Maynard Keynes would have never foreseen. Since January 2023, tolls have increased by +7.6% on Atlas Arteria's French toll roads, resulting in profit margin expansion from higher revenues and minimal change in expenses.

Cost management

During reporting season, a dominant theme that continued through was cost control and cost cutting, with over a third of companies reporting that cost pressures have now passed their peak. JB Hi-Fi cost management surprised markets, with costs only increasing by 5% despite the retailer facing wage and rent growth pressures. JB Hi-Fi benefitted from staff operating more efficiently and more online sales, with online sales in the last half of 2023 increasing to $736 million, up from $170 million in the same period pre-COVID-19.

On the flip side, Ramsay Healthcare saw its costs increase by over 11% and its profits fall by 40%, driven by labour costs and occupancy costs. Similarly, the miners saw cost pressures and weakening commodity prices, which squeezed margins. Diversified miner South32 had a particularly rough month, with reported profits falling 92% due to higher costs, production issues and falling nickel, aluminium and manganese prices.

Positive economic outlook

Commonwealth Bank provides a good look through the economy during reporting season, with Australia's largest bank holding 16 million customer accounts. Consequently, the banks' financial results and accompanying 231-page reporting suite give investors an insight into the health of the various sectors of the economy. CBA showed minimal bad debts and rising dividends but also that higher interest rates had differing impacts across their customer base. While discretionary spending had been cut back along with savings for customers aged between 20 and 54, older customers aged above 55 had increased spending and savings.

Insurers had their best results season since the GFC as they enjoyed higher premiums, lower claims inflation, lower adverse weather events, and sound investment returns. Suncorp expects gross written premiums to increase by low-mid double digits and for margins to rise as cost inflation subsides. Similarly, QBE expects its gross written premium to increase by mid-single digits over the coming year and for margins to expand.

Show me the money

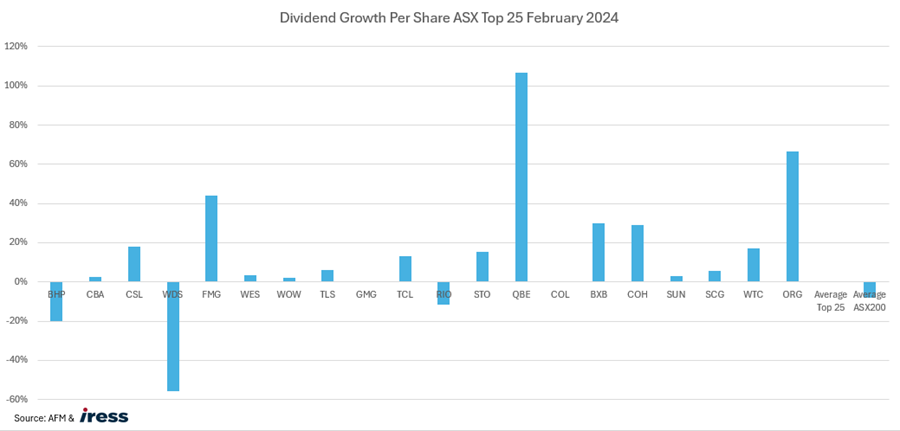

Looking across the top 20 stocks (that reported – the other banks have a different financial year-end), the weighted average dividend increase was 0%. The three companies that reduced their dividends, BHP, Rio, and Woodside, saw weaker commodity pricing.

On the positive side of the ledger, QBE, Origin, and Fortescue offset the cuts, posting solid increases in cash flows to their shareholders. Across the wider ASX 200, dividends declined by -8% in February.

Best and worst

Over the month, Lovisa Holdings, Wisetech Global, Reliance Worldwide, NextDC, and ARB Corporation delivered the best results. Despite the uncertain economic environment, especially around the softening of consumers, these companies were able to grow sales and expand gross margins along with providing optimistic outlooks.

Looking on the negative side of the ledger, South32, Corporate Travel Management, Healius, and Whitehaven Coal reported poorly received results by the markets. The common themes amongst this group were lower commodity prices (South32 and Whitehaven) and slowing sales with high PEs (Healius and Corporate Travel Management).

Result of the season

Before the February 2024 reporting season, conglomerate Wesfarmers would not have been near the top of any investor's picks after a stellar performance in the August 2023 reporting season. Many in the market predicted Wesfarmers' profits would go backwards following a softer economic outlook for domestic consumers and weaker lithium prices. However, the opposite happened with their flagship business, Bunnings, maintaining its earnings and Kmart increasing their profits by +27%, driven by its lowest price position and consumers moving to their Anko brand. Anko has been so successful in Australia that Kmart now offers its Anko product in Canada through the Hudson Bay Company (Canada's Myer). Wesfarmers was up +16% for February 2024.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor.