For Formula E motorsport, the 2020-21 racing season was transformational. Seven years after electric single-seaters first raced, Formula E gained the elevated ‘championship’ status enjoyed by Formula 1, World Endurance, World Rally and World Rallycross.

Then came the embarrassment, the ‘absolute catastrophe’, at the Valencia E-Prix in April. The Grande Finale turned shambolic when five appearances by the safety car forced an extra lap and the racers lacked the battery charge to compete at speed. Only nine of 24 qualifiers finished legitimately and three of these drivers crawled to the finish. Three other cars spluttered to a halt mid-last lap when they ran out of charge while five others were disqualified for exceeding energy limits to finish.

The switch is on

Don’t be put off electric cars because an event to showcase the emissions-free driving option highlighted some of the challenges holding back the switch to green cars. In coming decades, electric vehicles are poised to become so reliable they will outsell those propelled by fossil fuels.

Fossil fuel vehicles account for about 10% of the global greenhouse-gas emissions driving climate change. Governments worldwide are promoting or mandating the switch. Automakers have pledged at least US$300 billion to go electric and compete with Tesla Motors, the leader of companies created to build electric.

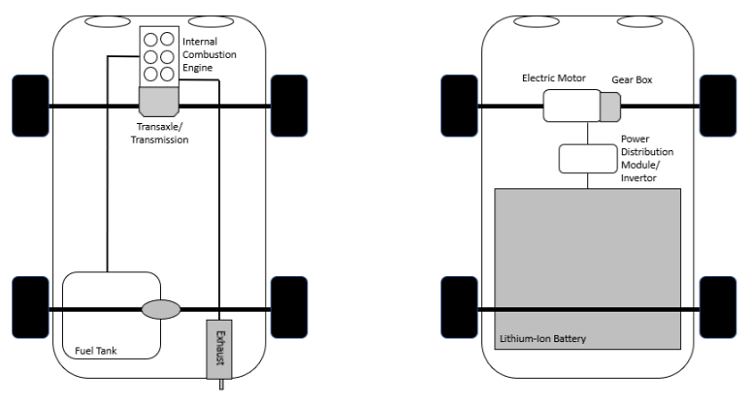

The race is on to switch to cars whereby an electric motor, battery and single-gear gearbox replace an internal combustion engine, radiator, fuel tank and multi-geared transmission and clutch. Electric cars have only 20 moving parts compared with about 2,000 in fossil-fuel vehicles.

Electric cars versus fossil-fuel vehicles

Source: UAW Research.

But there are challenges to solve

The switch to electric is hampered by the limits to battery power and thus distance. The infrastructure to ensure country-wide charging needs to be built. Another hurdle is that while electric vehicles are simpler to make because they have fewer parts, a battery that is the size of the back seat makes the cars more expensive to produce. The 60% higher price tag on average is slowing sales even though electric car owners save money on energy costs (up to 70%) and maintenance.

Another challenge is that while green cars emit no local pollution their environmental benefits come with caveats. The first is that generating the electricity for recharging produces emissions, although emissions will fall over time as grids use more renewables. A second qualification is that batteries make electric vehicles more emissions-intensive to manufacture. The raw materials needed for battery cells, especially cobalt, lithium and rare earth elements, give off emissions during the smelting process. Thirdly, batteries are a challenge to recycle.

The switch to electric comes with some social costs. The typical electric car requires six times the mineral inputs of fossil-fuel counterparts by weight and securing triple the number of raw materials can be problematic. A notable social cost is that more than 60% of the world’s cobalt supply comes from the Democratic Republic of Congo where children become ill and die mining for US$2 a day to attain the ore. Another possible side effect is that securing the supply of key battery ingredients located in far fewer countries than is oil might add to tensions between the West and China.

Electric cars right now are more a luxury purchase due to their higher price. But already 30% of global sales of mopeds, scooters and motorcycles are electric because the price differential over petrol equivalents is lower. Car sales will trend the same way if the price gap to fossil power is eliminated. Of the three touted future trends in driving – car sharing that makes ownership redundant, fully autonomous driving and electric vehicles – a world of green cars is the most believable.

The role of alternatives

To be sure, more advancements in the fuel economy of fossil fuels would reduce the case for electric vehicles. A halfway switch to hybrids might slow the switch to fully electric while unexpected leaps in hydrogen power could make electric cars passé. Governments might wind back green subsidies to repair their finances (especially as some will lose revenue from fuel excise). Any delay in battery improvements would slow the switch. Banning conventional cars might misfire if the masses can’t afford electric.

While the pace of the switch is debatable, the world of electric cars is coming. Valencia E-Prix debacles aside, the breakthrough into mainstream should prove as seamless as the switch from manual to automatic.

Michael Collins is an Investment Specialist at Magellan Asset Management, a sponsor of Firstlinks. This article is for general information purposes only, not investment advice. For the full version of this article and to view sources, go to: https://www.magellangroup.com.au/insights/.

For more articles and papers from Magellan, please click here.