Despite the rapid and considerable growth of internal investment teams at some of the largest asset owner organisations, ‘external’ fund managers still play a major role in the investment of trillions of dollars of funds in the Australian market - $3.5 trillion in superannuation assets alone. While we believe asset allocation is the biggest contributor toward portfolio performance, returns are ultimately gained from the efforts of those actually investing the money.

As their portfolios increase in size, asset owners are keen to optimise the benefits of their growing scale both through demanding reduced fees and, in many cases, internalising investment management. In the last few years, superannuation fund consolidation has impacted managers significantly through the merger of portfolios and increasing internal expertise within funds.

In the 10 years since our Annual Fund Manager Survey began, the number of Australian superannuation funds (ex-SMSFs) has exactly halved from 268 to 134. At the same time, money continues to pour into the Australian superannuation system with assets under management in that sector growing 89% over the period of our survey history, from $1.85 trillion in June 2014 to $3.5 trillion in June 2023.

So, while this pool of capital might be growing, the proportion being invested with managers is not and the fees being paid to managers are tightening.

Potential death march shaping institutional behaviour

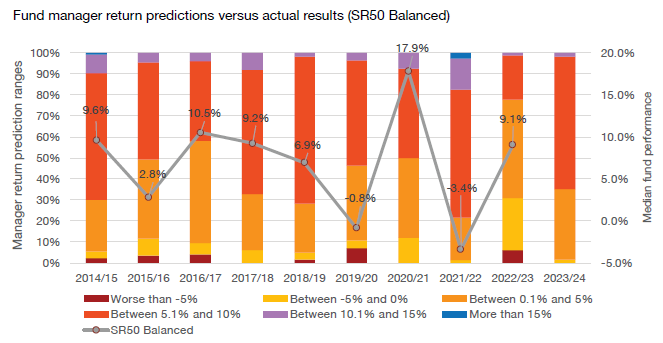

Fund managers tend to be optimistic and bullish, although this confidence has been tested a little in recent years with two instances of negative returns in the last four financial years. Over the duration of our 10-year study, returns have been generally strong with only three of the last 10 years producing a median balanced fund (60-76% growth assets) return of under than 6% – a generally accepted long-term average return target.

This is a strong result across a low-inflation environment for most of the last decade. The search for outperformance in this increasingly competitive and low-return expectation environment, along with well-resourced, inquisitive and competitive internal investment teams, has also shifted the way many investors approach their portfolio construction, often away from traditional managers and into newer or niche strategies. With the introduction of Your Future Your Super legislation, funds now also face the risk of underperforming benchmarks.

This is not just a matter of underperforming competitors, but potentially a death march. Super funds have always wanted to outperform, but the behaviour is now much more benchmark-aware. The risk appetite for seeking alpha (outperformance) now depends much more on how much risk ‘budget’ a fund has based on previous outperformance.

How has the mood and attitude of fund managers changed over the last 10 years?

Balanced fund return predictions

Last year, when asked to predict returns for 2022/23, the prior year (2021/22) of negative returns seemed to influence judgement with more than three-quarters of fund managers predicting a return below 5%, including almost a third predicting another negative result. The actual result for last year, measured as the SuperRatings median balanced fund, was a very healthy 9.05% with only 21% of managers successfully forecasting that result.

This year’s predictions for 2023/24 are notably more bullish than last year (again possibly reflecting the actual result of the prior year) with 63% of managers predicting a return of between 5.1% and 10% and almost all other managers tipping a lower return of between 0 and 5%. This is the most concentrated range of predictions of any year in this study.

So, it seems recent past performance is seen by some as an indicator of expected future performance, at least in the case of our survey.

Asset class performance leans to private equity and debt

It’s not surprising to see that over time, the asset classes predicted to be the best performing in the year ahead have tended to correlate with the sectors covered by those fund managers. Over the life of the survey, international equities has tended to be the most nominated sector each year, albeit alternating between developed and emerging markets.

However, this year there is a strong preference for alternative debt (33%) to deliver the strongest results, with private equity (17%) also coming in ahead of developed and emerging markets (13% each). The increasing number of managers nominating private equity as the sector most likely to produce outperformance has been climbing each year for the last half of our study. In the first four years of our study not a single fund manager had flagged private equity as their nominated top performer.

The most influential in making investment decisions

When we started this survey in 2014, superannuation funds made up around three quarters of our client numbers but now they are only around 40%.

It has been interesting to watch the evolution of how managers answer the question of “who are the most influential parties at superannuation funds when it comes to investment decision making”. From five choices of CEO, CIO, Board/Investment Committee, internal team or asset consultant, managers historically nominated the fund CIO as the most influential person. In 2021, for the first time, internal teams began to outrank their boss in terms of influence. And, outrank their boss’s boss as well, with CEOs ranked the least influential from our set of five options.

CIOs were at the peak of their perceived influence in 2017 when 52% of respondents ranked the CIO as the most influential in decision making, with 27% nominating the internal team at that time. Since then, those rates have steadily transferred with this year seeing 32% of managers ranking the CIO as the most influential and 48% throwing their weight behind internal teams. The Board and Investment Committee remain in third spot ahead of asset consultants and the CEO.

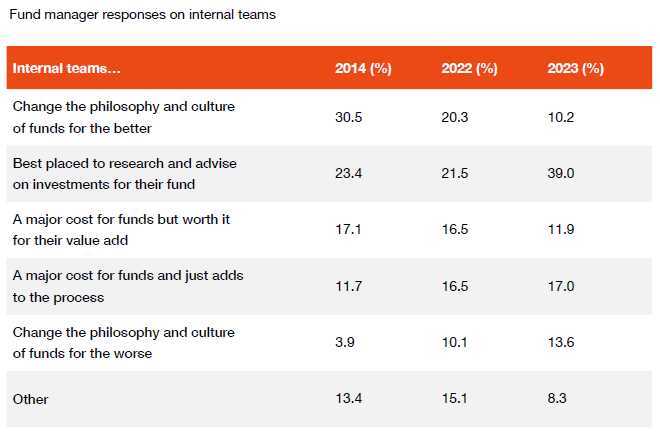

The growth of internal investment teams across the 10 years of our study has been perhaps the most significant evolution for funds management businesses to negotiate. Historically the comment that “internal teams will change the philosophy and culture of funds for the better” was the most supported sentiment, while “internal teams are best placed to research and advise on investments for their fund” was the second most favoured comment for managers to agree with. However, this year there has been a strong shift away from the “positive culture” sentiment, now ranked fifth at just 10%, with the notion of teams being “best placed to research and advise on their investments” climbing to the top spot, chosen by 39% of respondents.

There has been a sharp turn in sentiment towards internal teams over the last 12 months, which is unusual given the relatively steady transition over the prior nine years. It may be that managers now accept large and capable internal teams. Most would agree the power balance, or relationship dynamic, between internal staff and managers has shifted considerably with the ‘rock star’ persona now more likely to reside in the asset owner organisation than in the fund manager.

Returns compromised to contain costs

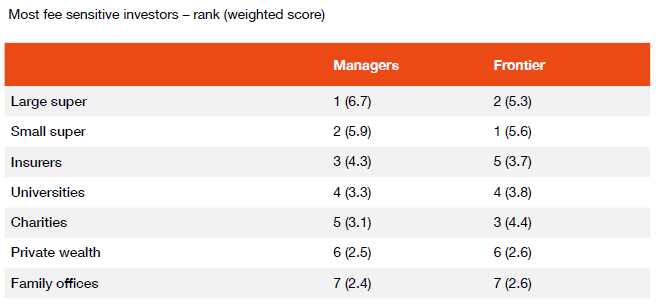

In our most recent survey, 83% of managers feel returns are being compromised in the quest to contain costs. This score has been steadily climbing each year since 2015 (70%). In the last three years of our study, we have asked managers to rank the most fee sensitive investor groups from across the institutional investment market.

Perhaps the most significant element to come out of this question is a strong sense the largest investors, the large super funds (>$50 billion), are the most fee sensitive with 86% of managers nominating that group first. Virtually the remainder of managers gave their number one vote to small super funds. In a weighted sense (considering the full range of 1-7 scores), behind super funds, managers ranked insurers behind the super funds, then universities and charities next.

Issues of concern to clients

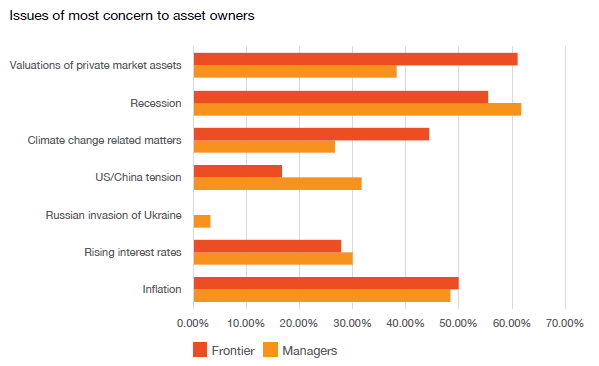

Effective managers will have a strong understanding of the key issues their clients are concerned about, rather than simply focussing on what products and ideas they want to put in front of investors and consultants.

Most managers ranked the impact of impending recession across the globe as a factor concerning their clients (62%) with inflation ranked second (48%), remembering that respondents were asked to nominate three issues. In terms of geopolitical matters, US and China tension was seen as far more concerning that the Russian invasion of Ukraine.

External fund managers at odds with trend to internal

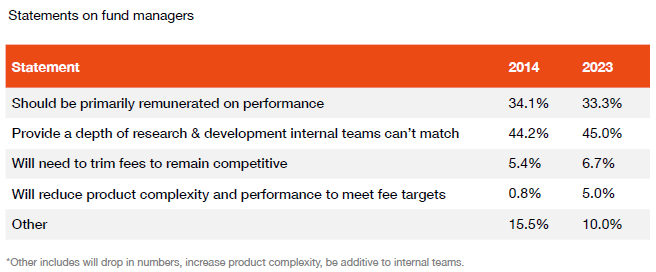

When asked about their own businesses, external fund managers have felt strongly they provide a depth of research and development that internal teams can’t match. Alignment with this comment is virtually identical to the first year of the study, after reaching a high of 58% in the 2021 results. This consistency is at odds with the trend increase regarding internal teams being best placed to research and advise their own funds highlighted earlier in this paper.

On the notion external fund managers should primarily be remunerated on performance, again managers are close to the same position offered 10 years ago, however this metric did climb to a high of 42% in 2017 before returning to levels of 2014. This may be a factor of the pattern of returns over that period (wanting to be remunerated on performance when it is high) and indicative of a view future alpha might be more muted. In the table below, fund managers were asked to choose the statement they most agree with.

Growth perspective

Despite the many challenges facing them, managers are a remarkably positive lot when it comes to their own business prospects. When asked if they expect their businesses to grow over the next five years (other than via market growth) the overwhelming majority are optimistic, a trend which has not wavered since our study began in 2014. Indeed, this year 93% of managers are predicting business growth between now and 2028. This figure has been as high as 97% back in 2016, and only ever as low as 86% the following year.

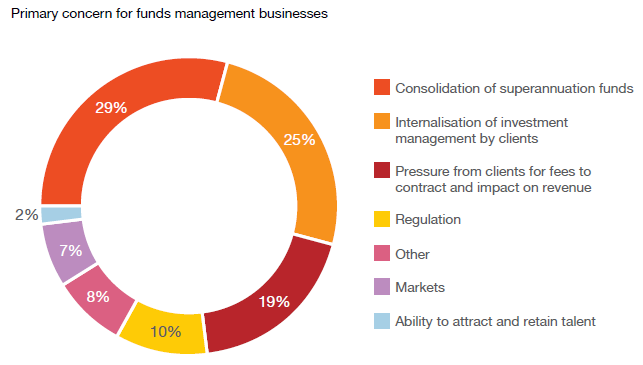

Despite that optimism, there are a number of headwinds to the growth of fund managers’ institutional businesses. The pattern around these factors was quite consistent in the first four years of our study, from 2014 to 2017, with “pressure from clients for fees to contract and impact on revenue” clearly being offered as the single biggest challenge, generally by around 30% of managers.

However, in more recent years, two other factors have emerged as significant threats. These are internalisation of investment management by clients, and consolidation of superannuation funds.

The final word

The institutional investment market has evolved significantly over the last decade and particularly so for fund managers and asset consultants alike.

Over the life of the study, the number of superannuation funds has reduced while assets in the sector have climbed. For larger funds, strong internal capability has been developed both in terms of in-house research and direct investment.

This 10-year period has been generally very positive markets for investors, although the last four years have produced periods of significant negative returns and volatility driven by a global pandemic and significant geopolitical developments.

While managing fees remains a critical factor for funds, government regulations may also start to influence investors’ strategies and broader objectives. This will likely impact the type of products investors seek and managers will need to respond.

Wayne Sullivan is Director of Marketing and Business Development at Frontier Advisors. This is an abridged version of the survey for the Firstlinks audience, with the full version available here.

The survey was completed in September 2023 by 60 representatives from funds management organisations and 36 members of the Frontier consulting team. Frontier Advisors is one of Australia’s leading asset consultants offering institutional investment advice on over $630 billion of assets. Frontier Advisors does not warrant the accuracy of any information or projections in this paper and does not undertake to publish any new information that may become available. Investors should seek individual advice prior to taking any action on any issues raised in this paper.