History will record that the few years until 2019 were halcyon days for Listed Investment Companies (LICs) and Listed Investment Trusts (LITs). It will never be as good using the traditional ‘closed-end’ structures. A record amount of over $4 billion was invested in new issues during 2019, up from $3.3 billion the previous year. Fixed interest LITs alone raised $2.2 billion in four issues in 2019, with the largest by KKR (ASX:KKC) achieving an incredible $925 million in only a few weeks.

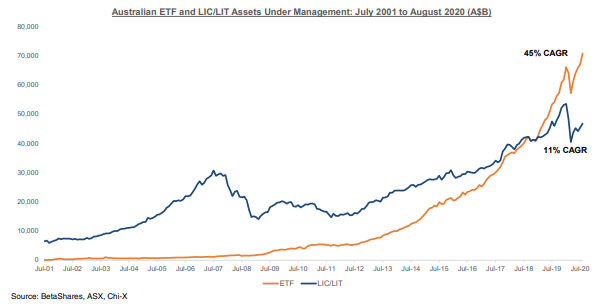

The main listed competitor for the LIC/LIT structure is Exchange Traded Funds (ETFs). While LICs/LITs have failed to launch any primary transactions in 2020, ETFs have gone from strength to strength, reaching a record $70 billion in August, a lead of $25 billion over their rivals. As recently as January 2019, LICs/LITs were larger, as shown below.

What has hit LICs/LITs?

Two factors are undermining demand for LICs/LITs.

1. Ban on stamping fees

A significant amount of demand was driven by stamping fees paid to brokers and advisers. Firstlinks has already covered this subject in detail, including here and here. For example, the KKR offer documents in 2019 stated:

“the Manager will pay to each Broker a selling fee of 1.25% (exclusive of GST) of the amount equal to the total number of Units for which the relevant Broker procured valid Applications.”

Brokers often shared the fees with advisers. On 20 May 2020, the Treasurer announced the results of an investigation which had started on 27 January 2020. It concluded:

"Extending the ban on conflicted remuneration to LICs will address risks associated with the potential mis-selling of these products to retail consumers.”

2. Consistent trading at a discount to Net Tangible Assets

Investors have tired of the inability to exit from most LICs/LITs at the value of Net Tangible Assets, or NTA. At the time when liquidity was most needed during the March 2020 COVID-19 sell-off, with no mechanism to create buying interest in a closed-end fund, prices collapsed, as described here.

Despite the subsequent stock market recovery, discounts remain and much damage is done. Some of the highest-profile managers in the market are overlooked by investors despite their reputations.

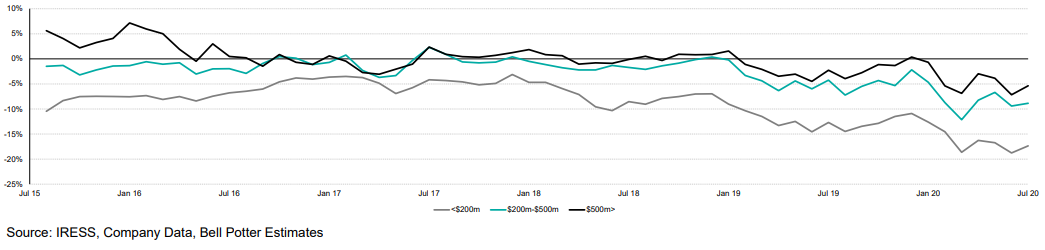

LIC/LIT premiums/discounts to NTA based on market capitalisation

Six LICs turn to radical solutions

Such is the severity of the problem that new announcements are now made every week by LICs/LITs attempting to address the discount problem. For the directors of many of these listed vehicles, most board time is spent on addressing and then implementing solutions, including:

1. Ellerston Global (previously ASX:EGI)

The best example of the extraordinary effort, cost and time expended to fix the discount frustration is Ellerston Global and its conversion into unlisted units in the Ellerston Global Mid Cap Fund. The Explanatory Booklet is 402 pages which nobody will read in full except the lawyer who drafted it.

Ellerston deserves praise for addressing the discount problem using a fund which will face redemptions. However, where previously investors held a listed vehicle which could be bought and sold easily on the exchange, they are now converted to an unlisted trust with tiresome paperwork of new application forms and identifications.

The holders of EGI do not simply receive units in the new fund, but a 24-page Information Form must be completed, and:

“You will not receive your Units in the Ellerston Fund under the Scheme unless and until you complete this Form (including all supporting documents).”

Ellerston undertook this process for a good reason, to address the structural weakness of LICs when too few buyers are in the market. The Scheme offers:

“The elimination of the persistent discount to NTA at which EGI Shares have traded on ASX since EGI's listing on ASX in October 2014. Although the portfolio performance has been strong, EGI Shares have persistently traded at a discount to EGI’s NTA. The price of Units in the Fund is expected to reflect more closely the underlying performance of the Fund Portfolio.”

There is an ironic footnote to the LIC which has taken Ellerston most of 2020 to unwind. Their website continues to espouse the benefits of the structure they have just rejected. It says:

“Listed Investment Companies (LICs) are a viable and well-established alternative to the managed fund and in fact have some considerable advantages when compared to managed funds.”

Perhaps it's because they continue to offer Ellerston Asian Investments (ASX:EAI) in listed form.

2. Antipodes Global (ASX:APL)

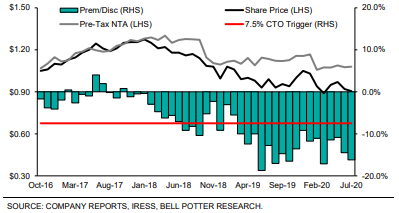

Antipodes should have all the right ingredients for a listed vehicle to trade well. It was established by Jacob Mitchell in 2015 after 14 years at Platinum Asset Management as Deputy Chief Investment Officer to Kerr Nielson. The fund manager had a successful start and manages an impressive $8 billion, yet its LIC has traded at a discount as high as 20%, as shown in the green bars below. In the first two years, it was keenly sought and even traded at a premium, but investors have fallen out of love with APL.

APL premium/discount since listing

After buying back 13% of the company’s shares at an average discount to NTA of over 14% without moving the needle, a more drastic step was needed. The board is offering a ‘discount control mechanism’ under a tender programme with the following features:

- Shareholders will have the opportunity to tender their shares for sale to the company via an off-market buyback.

- The maximum number of shares the company can buy back will be 25% of the shares on issue at that time.

- The tender offer price will be NTA less 2% as calculated on or around the closure of the offer period.

- The offer will take place if the company’s closing share price exceeds a 7.5% discount to pre-tax NTA.

- The board will make the offer regularly in future, aiming for every three years.

This is similar to a structure used by Ironbark Capital (ASX:IBC) to doubtful success, as it is currently trading at 44 cents versus an NTA of 51 cents. The downside is that a smaller company must spread its fixed costs over fewer assets, potentially increasing its management expense ratio.

Nevertheless, APL is attempting to remove the discount which must be an embarrassment to someone like Jacob Mitchell, and these repurchase practices have worked in other countries.

3. Blue Sky Alternatives Access Fund (ASX:BAF)

Geoff Wilson’s Wilson Asset Management (WAM) is a long-time market leader in promoting the merits of LICs. Some of their funds, such as WAM Capital, trade at a premium to NTA, and their shareholder engagement is strong. Wilson has a history of acquiring underperforming LICs and bringing them into his stable. WAM Capital (ASX:WAM) currently has an offer in the market to acquire the Concentrated Leaders Fund (ASX:CLF), and an independent board committee has been established by CLF to consider the offer.

Wilson has recently taken over the management of BAF, creating WAM Alternative Assets to complement his other funds such as Microcap and Global. BAF has struggled at a hefty discount to NTA of around 30% under previous management, and Wilson will now seek to address it.

What is different from the other times Wilson has taken over a LIC is a mechanism, called a Premium Target, which potentially terminates WAM as manager and liquidates the company if Wilson is unsuccessful, as follows:

“ ... we have agreed to deliver on the Premium Target, a first of its kind in the Australian market. The principle of the Premium Target is simple: the Company’s share price needs to trade at a premium to its pre-tax NTA for a period of one month for it to be achieved. If this does not occur at least three times during the next five years, shareholders will automatically have the right to vote to terminate the arrangements with Wilson Asset Management, and to liquidate the Company.”

At the time of writing, BAF was trading at 87 cents on an NTA of $1.08, despite a heavy buyback programme, including:

“During the month, the Alternatives Fund acquired an additional 252,706 shares at an average price of $0.76159 representing a 30% discount to August’s pre-tax NTA.”

Boards often embark on these buybacks to show investors they are doing something tangible, but they rarely work in Australia on a sustained basis.

Although there have been no LIC/LIT primary issues in 2020, WAM continues to raise money on existing LICs, such as the $88 million added to WAM Microcap in a recent Share Purchase Plan supported by 55% of shareholders.

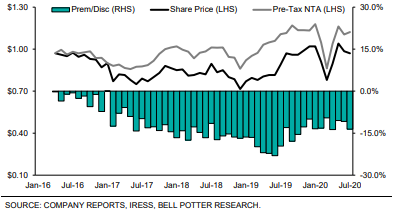

4. Monash Absolute Investment Company (ASX:MA1)

Monash recently won ‘Best Listed Alternative Investment Product’ at the Australian Alternative Investment Awards 2020. When a fund which regularly trades at a 15% to 20% discount wins an award, there is not much recognition of the LIC discount problem. Despite its solid investment performance under well-known manager Simon Shields, at the time of writing, it trades at $1.07 against a pre-tax NTA of $1.23, and has been at a heavy discount for years.

Monash (MA1) premium/discount to NTA

The board is proposing to restructure MA1 into an Exchange Traded Managed Fund (ETMF) which allows units to be issued or redeemed at close to the NTA. It will become yet another company removed from the traditional closed-end LIC world.

5. Absolute Equity Performance Fund (ASX:AEG)

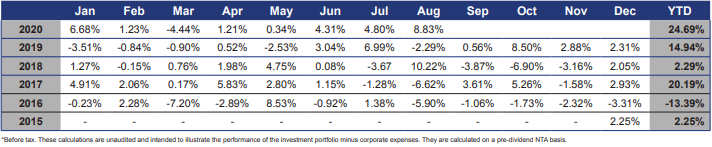

AEG has delivered excellent recent performance after a poor start as a listed company. It lost some support in 2016 and its shares traded at solid discounts to NTA. In 2019 and 2020, investors have shown more interest in this absolute return ‘pairs’ strategy, and here is the pre-tax NTA since inception:

Shares have traded closer to NTA in recent months, but in July 2020, the board announced to the exchange that:

“The Board … has received a non-binding proposal (Proposal) from its investment manager, Bennelong Long Short Equity Management Pty Ltd (BLESM). In summary, the Proposal details an amalgamation of AEG and an unlisted managed investment scheme, Bennelong Market Neutral Fund (BMN). BLESM is the investment manager of BMN. BLESM indicates the Proposal is designed to eliminate the share price discount due to the difference between AEG’s net tangible asset position and its current share price, and improving liquidity. As part of the Proposal, AEG shareholders would receive units in BMN and ultimately AEG would be would up.”

It's another LIC facing delisting as discussions continue.

(Disclosure: Until a year ago, I was on the board of this company. All the information in this article comes from public announcements).

6. Contango Income Generator (ASX:CIE)

Perhaps the most unusual of all the solutions to poor trading levels comes from CIE, which intends to change fundamentally how it manages money. The Managing Director of Contango is Marty Switzer, son of Peter. Established in August 2015 as an income-focused, ex-top 20 Australian equity fund paying franked dividends, it lost -19.5% in the 12 months to 31 July 2020. It is now proposing to adopt a global equity strategy by switching the money into the WCM Quality Global Growth Long Short Strategy, subject to shareholder approval.

Again, the discount to NTA is the culprit, and the company announced:

"One of the key reasons for the independent non-executive Directors unanimously recommending the new investment strategy was the potential to address the share price discount to net tangible assets (“NTA”) by increasing liquidity, growing the size of the Company and improving the investment performance. In addition, the Board of the Company assures shareholders that, in order to achieve this objective, it will actively consider appropriate capital management tools to reduce the share price discount to NTA."

What makes this move even more interesting is that two of Australia's highest profile investors, Peter Switzer and Geoff Wilson again, are involved in the battle for control. Switzer's group distributes WCM funds in Australia, while Wilson has requisitioned that WAM take control of the board and become the new investment manager. The argument has turned combative with Switzer questioning why Wilson does not report the performance of his funds after fees, and Wilson saying the WCM terms are unfavourable. Complicating matters is the fact that WCM's existing LIC (ASX:WQM) itself trades at an average discount to NTA of about 15%.

The problem for investors bemused by the stoush is that if they want to sell out of CIE, they must accept a hefty discount.

Shareholders should demand more changes

Some of the old-fashioned LICs, such as Australian Foundation Investment (ASX:AFI) with $7.6 billion and Argo Investments (ASX:ARG) with $5.4 billion, have a long history of trading around NTA, sometimes at a premium, with low fees. Among the 100+ LICs/LITs on issue, the structure can work in the right circumstances.

However, many of the LICs issued in recent years are small or not well supported and were sold to investors by brokers and advisers with the hope that the market would deliver decent liquidity. There was little follow-through demand as participants moved on to the next hot deal, sometimes even selling the existing issue to make way for the new glamour stock and its fee. Fund managers and their boards hang on, safe in the knowledge that long-term management contracts are in place, offering buybacks as a salve to shareholder concern.

The boards and managers adopting solutions, including Magellan's dual listed/unlisted structure, deserve recognition for giving investors a better opportunity to realise their asset values.

When LICs and LITs trade at persistent discounts for years, shareholders should become more active in attending annual meetings and writing to boards, prompting actions such as:

1. Convert to an open-ended ETF which allows cancellation or creation of shares at NTA.

2. Adopt a timetable where investors are given an exit facility at NTA, perhaps annually or at least every three years.

3. Delist into an equivalent unlisted fund with a redemption option, although investor paperwork is cumbersome.

4. Adopt the dual structure of unlisted managed fund and listed ETF.

Investors have tolerated complacency on many LICs for years and there are now market mechanisms showing how to address the problems.

Graham Hand in Managing Editor of Firstlinks, and he holds investments in some of the securities mentioned. This article is general information and does not consider the circumstances of any investor.