Financial inequality between men and women continues to be a significant issue in Australia. There is growing recognition that more needs to be done to achieve pay parity between men and women, as well as close the superannuation gap, to avoid leaving women to face their retirement years without enough money to support them.

However, while the unseen impact on mental health and wellbeing is also starting to be better understood, finding a solution continues to prove difficult.

But the evidence is clear. Studies show that women are more likely to suffer from financial stress than men, and that a significant number feel trapped by their financial circumstances, meaning they are unable to make important decisions such as changing jobs or leaving bad relationships.

Fidelity’s own research has found that only one-third of women are free from money worries, compared to almost half of men. Indeed, the number of women who worry about money is higher than those who don’t. This is particularly concerning because a number of studies have shown that financial stress has a major impact on other areas such as relationships, as well as mental and physical health.

Women are also more likely to feel trapped by their financial situation. When asked to define financial independence, the most common answer given by women was “having a personal income so you don’t have to rely on financial support from others”. But less than 60% of women say they have achieved this, compared to over 70% of men.

Meanwhile, one-in-three women say they don’t have enough savings to make significant life changes, leaving them feeling locked into toxic work cultures and personal relationships, compared to just one-in-five men.

The research revealed several barriers preventing women from feeling more confident about their financial capabilities, including:

Confidence

Having the confidence to make investment decisions and take steps to manage your money is important. Lacking this confidence can leave people feeling trapped, unable to make even simple decisions about how to improve their financial situation.

Unfortunately, women are significantly less likely than men to feel confident in their financial capabilities. Less than half of women agree they are knowledgeable in financial matters, compared to almost two-thirds of men who feel they are knowledgeable.

Overall, women report feeling less knowledgeable in financial matters, less confident in their capability to manage their own money, and less confident in their ability to make investment decisions, than men.

Planning

The lack of confidence displayed by many women in their financial decisions also creates a psychological barrier when it comes to looking to the future and planning appropriately.

Crucially, women are less likely than men to be planning for their retirement, and fewer women are making additional personal contributions to their superannuation. Overall, 55% of women are not personally contributing to super in any way, compared to 44% of men. Of those who are making additional super contributions, about twice as many men than women contribute more than 10 per cent of income to super a year.

Support

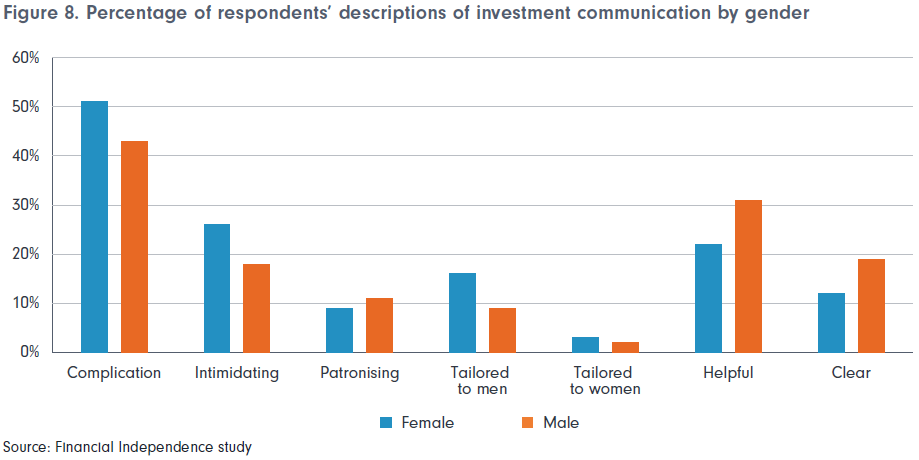

A majority of women are interested in using a financial planner for support and advice, but a key reason for not doing so is that they have trouble finding someone they can trust. Another reason is that they believe they can’t afford professional advice. Most women also feel that financial information is more tailored to men than to women, and they tend to find it complicated and intimidating. Around one in two women say investment communication is complicated, and one in four describe it as intimidating.

The important role of financial planners

Despite women reporting that they would like to take charge of their financial situation, and that achieving financial independence is important to them, they don’t feel that they are able to get professional help to do so.

Therefore, one of the most important ways to solve the financial gap between men and women is for financial planners to address the barriers to engagement. Ensuring the information and advice they give is more accessible to women, helping them build the confidence to make financial decisions, and providing the resources to plan for the future will go a long way to closing the gap.

Indeed, research has already shown that women who use professional financial advice have higher levels of wellbeing and are more satisfied in all areas of their life. They experience less financial stress and are more confident in their financial abilities.

One way to engage better with women is through transparency. Being transparent builds trust and brings the advice process to life. This helps move the conversation towards value of advice rather than cost of advice.

Another way is to focus on guiding and supporting female clients, rather than simply telling them what to do or doing it for them. Helping women learn about the process and their options will make them more engaged and encourage them to continue in the advice journey.

Most financial planners already use processes such as segmenting their client base so they can better design service offerings to meet their needs. Studies indicate that gender should also feature as a dimension in a segmentation model.

Women will often seek advice for a single, burning issue, such as paying school fees or paying off debt. Solving this problem provides an opportunity to engage further with female clients in a way that advisers perhaps haven’t considered in the past.

Without such steps, the issues of financial disparity between men and women will persist. This has a serious impact on the wider community. It is critical that we recognise the specific needs of female clients and take steps to overcome the barriers they face to achieving financial independence and well-being.

Alva Devoy is Managing Director, Australia at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2019 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.