Australia boasts one of the most stable and developed economies in the world. This prosperity has been built on a sometimes fortuitous blend of strong population growth, minerals, vast agricultural tracts and plentiful energy in the form of coal and gas.

These capital hungry sectors have been well-fed by a large financial services sector. Despite contributing just 0.3% of the global population, Australia is home to five of the 50 largest banks in the world by market capitalisation.

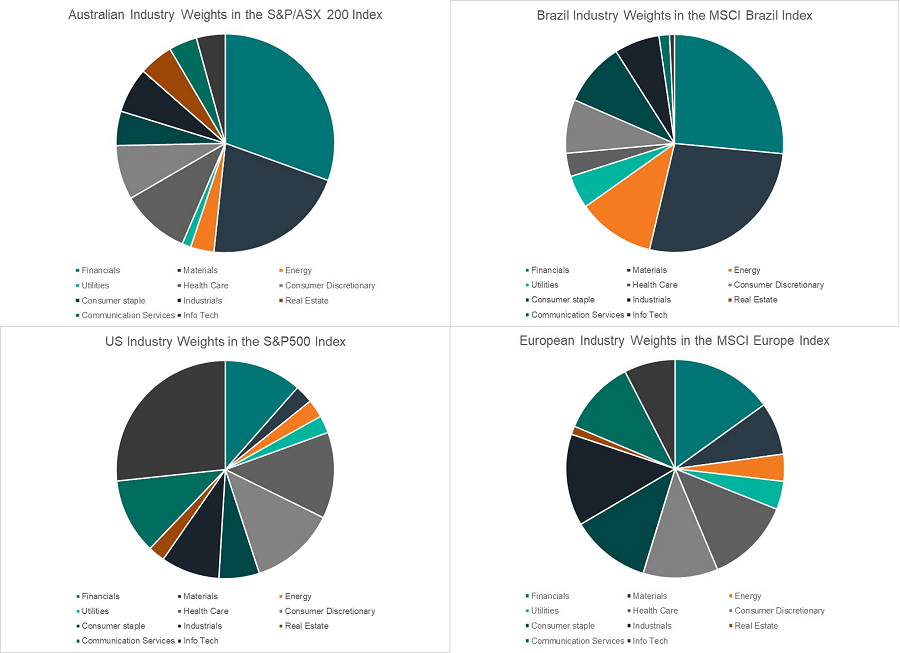

So it is not surprising that Australia’s economy shows a material weighting to these ‘traditional’ industries, much more so than in the USA and Europe. In fact, the makeup of the stock market benchmark, the S&P/ASX 200, arguably resembles that of a developing nation, more so than our larger Western peers.

Evolution, not revolution

So, how do we continue not only growing our economy but ensure it evolves to remain competitive on the global stage? Our international peers have a more balanced economic structure with technology, communications services and biotechnology representing much larger parts of the business community than in Australia (while acknowledging CSL as a global leader).

We need to take the opportunity presented by this economic moment in time to innovate within our current driving industries, while fostering a business, policy and economic environment that supports the impactful industries of tomorrow

The spending floodgates are open, let’s channel this to the growth engines of the future

With the Federal and State Governments and the Reserve Bank of Australia on their respective spending sprees, there’s an opportunity to not only underpin progressing businesses, but to invest in the sectors that represent long-term economic growth opportunities, particularly health care and technology.

Technology could involve either software or ‘mechanical’ advancements that drive efficiency or better environmental and social outcomes for society.

In the last three years, the technology sector has grown strongly in Australia, led by companies such as the Afterpay, Xero, Canva, Airwallex and Culture Amp among many more being valued at over $1 billion. While these organisations are not be as big as their US counterparts (Facebook, Apple, Amazon, Netflix, Google etc), they demonstrate that Australia is home to some impressive tech talent. Moreover, they highlight the opportunity Australia has to support smaller-scale tech companies out of the gate, investing in the next wave of impactful business ahead of the curve.

Industries including renewables and technologies such as artificial intelligence will likely have application not only in a renewed domestic manufacturing sector, but it will support other areas of future growth, such as aged care, which is undergoing transformation and improvement.

Refreshing the commercial approach to the political hot button of climate and renewable energy would yield impactful medium-term productivity, more so than postulating over climate targets.

Supportive regulatory and taxation structure will be vital to drive growth

Investing in our growing sectors should ensure that companies continue their growth trajectory in Australia, while fostering a supportive growth environment will encourage other entrepreneurs to innovate here.

Some of the measures introduced in the May 2021 Federal Budget can help businesses to support innovation in specific sectors, including health and technology. For example, the ‘patent box’ will ring-fence earnings from patented medical and biotechnology innovation. These will be concessionally taxed at 17% and taxpayers will be able to calculate the decline in value of eligible intangible depreciating assets (for example copyrights, patents registered designs and in-house software).

This means taxpayers can better align tax outcomes with the life of intangible assets while encouraging research and development activities in growing sectors. Although not applicable until 1 July 2023 onwards, businesses still have the temporary full expensing regime in the meantime.

Furthermore, the Modern Manufacturing Initiative (MMI) announced in the October 2021 Federal Budget will start funding projects with a second round of grants worth $50 million set to roll out.

On a local scale, sectors are transitioning at an exciting rate, with the Geelong carbon fibre and composites manufacturing precinct setting an interesting example. A collective effort between policymakers, industry and higher education institutions, it aims to transform an automotive icon to a resource powerhouse following the closure of the Ford manufacturing plants in Geelong and Broadmeadows in late-2016.

Create the frameworks that foster innovation

With so much of the country’s economic prosperity hinged on commodity and property prices, it makes sense from a risk perspective to ensure other sectors are supported to diversify the nation’s economic growth.

If our past successes have hinged on factors with exposure to commodity prices or currencies, we need a hedging strategy for those times when prices aren’t so buoyant. The balancing act lies in creating policy to support emerging industries without disenfranchising staple industries that continue to provide employment and significantly contribute to the country’s GDP.

As a country with relatively stable economic, political, and financial environments, Australia can compete more on the global stage by fostering innovation in our biggest sectors, while supporting newer industries to mature. But such large-scale transformation can’t be done in silos.

It is imperative that we see collaboration between policymakers, higher education institutions and industry, on a renewed commitment to championing diversity in economic support and success. We sit at an economic inflection point that could allow Australia to shore up its economic standing in a new and exciting way. Despite the turbulence of the last 18 months, Australia does have a bright future, but it’ll be brightest with innovation at its core.

Chris Gibson is a Principal Consultant at Pitcher Partners Melbourne, focussing on the integration of ESG and sustainability measurements in order to capitalise on the opportunities and challenges presented by the global business market. This article is general information not personal financial advice.