The last four years have been eventful for bank shareholders, with each year bringing a new set of worries predicted to bring the banks to their knees. 2020 saw an emergency capital raising from NAB (some of which was used to pay the dividend) and Westpac missing their first dividend since the banking crisis of 1893, as experts forecasted 30% declines in house prices and 12% unemployment!

Then, 2021 saw the banks grappling with zero interest rates and APRA warning management teams about the systems issues they may face from zero or negative market interest rates expected to come in 2022.

In 2022 and 2023, the concerns have switched to the impact of a 4.25% rise in the cash rate on bad debts and the looming fixed interest rate cliff that would see retail sales and house prices plummet.

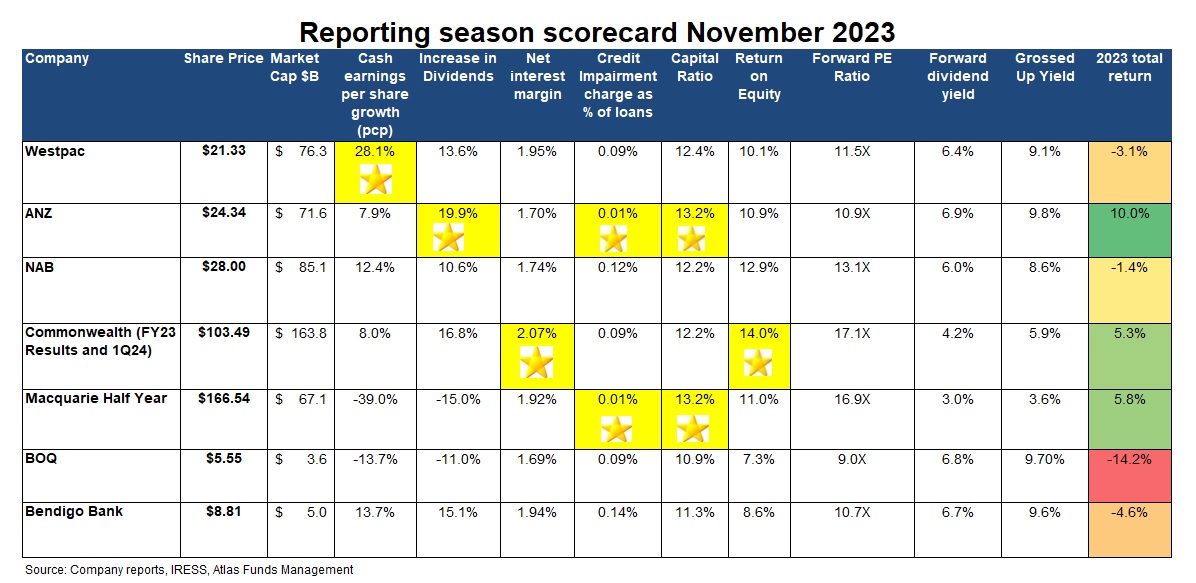

In this piece, we will look at the themes in approximately 900 pages of financial results released over November, including Commonwealth Banks 2023 full-year results from August and the regional banks, awarding gold stars based on performance over the past six months.

Lower net interest margins

Net interest margins are always a major topic during the November banks reporting season, with most investors going straight to the slide on margin movements in the immense Investor Discussion Pack. Banks earn a net interest margin [(Interest Received – Interest Paid) divided by Average Invested Assets) by lending out funds at a higher interest rate than by borrowing these funds from depositors or wholesale money markets.

During the peak COVID-19 period, when the cash rate was at 0.1%, interest margin pressure was on the lending side of the book, with banks trying to write as many loans as possible. The banks were willing to cut margins to gain market share by offering competitive interest rates and cash-back offers, with some exceeding $10,000! Today, this pressure has moved to the deposit side of the book, with consumers benefiting from higher interest rates on bank deposits and term deposits. Banks are now being forced to offer competitive deposit rates as consumers look to move their money to those who are most willing to offer better rates.

The November reporting season saw net interest margins decrease for all banks. The banks more heavily exposed to mortgages (CBA and Westpac) traditionally have higher margins than the business banks (NAB and ANZ), which face competition from international banks when lending to large corporates. Commonwealth Bank posted the highest net interest margin in June, with 2.07%. However, due to CBA closing their books on 30th June, we may see this number compress with the more recent deposit competition.

Low bad debts

From May 2022, Australia's official cash rate climbed from 0.10% to 4.35% across 13 different rate hikes. Every time we had a cash rate increase, investors were worried and questioned how it would impact consumers? Are bad debts going to rise sharply? Do house prices collapse? What we have seen over the last year is that employment in Australia has remained remarkably robust in a tight labour marketplace. This has seen consumers being able to reallocate funds from discretionary or non-necessity spending to being able to fund their home loans.

Bad debts have remained low in 2023, with all banks reporting negligible loan losses; ANZ and Macquarie reported the lowest level, with loan losses of 0.01%. To put this in context, since the implosion in 1991, banks grappled with interest rates of 18% and considerable losses to colourful entrepreneurs such as Bond, Skase, et al. Since then, loan losses have averaged around 0.3% of outstanding loans, and the banks price loans assuming losses of this magnitude.

The level of loan losses is important for investors as high loan losses reduce profits and, thus, dividends and erode a bank's capital base. Conversely, the very low losses in 2023 have translated into record dividends and billion-dollar share buybacks.

Bad debts have remained low in 2023, with all banks reporting negligible loan losses; ANZ and Macquarie reported the lowest level, with loan losses of 0.01%.

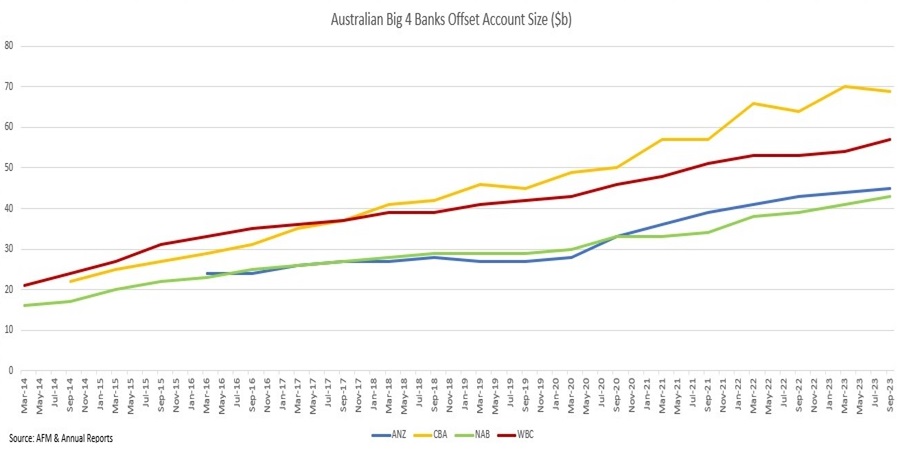

Building offset account balances

Something that we have seen over the past few years is consumers allocate more towards their home loans through offset accounts. As you can see in the chart below, balances in offset accounts have ballooned, meaning banks are forgoing some interest income in exchange for more secure clients and lower bad debts. We were surprised to see that despite rising interest rates, offset account balances have risen rather than fallen, with $5 billion added since March 2023, with a total of $214 billion currently sitting in the offset accounts of the big four banks.

Show me the money

While the big Australian banks are sometimes viewed as boring compared with the biotech or IT themes du jour, what is exciting is their ability to deliver profits in a range of market conditions. In 2023, the banks generated $32.7 billion in net profits after tax. This saw the big four banks' dividends per share increase by an average of 15% per share, with all banks except for NAB now paying out higher dividends than they did pre-Covid 19. The star among the banks was ANZ, which raised dividends per share by 20%.

Well capitalised

Capital ratio is the minimum capital requirement that financial institutions in Australia must maintain to weather the potential loan losses. The bank regulator, the Australian Prudential Regulation Authority (APRA), has mandated that banks hold a minimum of 10.5% of capital against their loans, significantly higher than the 5% requirement pre-GFC. Requiring banks to hold high levels of capital is not done to protect bank investors but rather to avoid the spectre of taxpayers having to bail out banks. In 2008, US taxpayers were forced to support Citigroup, Goldman Sachs and Bank of America, and British taxpayers dipping into their pockets to stop RBS, Northern Rock and Lloyds Bank going under. The Australian banks were better placed in 2008 and did not require explicit injections of government funds; the optics of bankers in three-thousand-dollar Armani suits asking for taxpayer assistance is not good.

In 2023, the Australian banks are all well capitalised and have seen their capital build. This allows the banks to return capital to shareholders through on-market buybacks. During the bank reporting season, Macquarie announced a $2 billion dollar on-market buyback, Westpac announced a $1.5 billion share buyback, CBA announced a $1 billion share buyback, and NAB announced they had a remaining $1.2 billion share buyback. For investors, this not only supports the share price in coming months but reduces the amount of shares outstanding to divide next year's profits by.

Expenses

Australia's banks operate in a competitive oligopoly, largely selling an undifferentiated product (loans) where their competitors have a similar cost of production (capital from depositors and wholesale capital markets). Consequently, other banks swiftly match moves to gain a higher market share and increase profits by discounting loans. However, banks can grow profits by reducing their expense base, which expands yearly.

Containing expense growth has proved challenging for the banks, with low unemployment contributing to wage growth and the need to hire more compliance staff after the 2018 Banking Royal Commission. Additionally, compliance teams have grown in response to the Commonwealth Bank and Westpac getting hit with hefty penalties from AUSTRAC for not complying with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006.

Wage growth was the major contributor for all the banks this year, accounting for more than half of the growth in expenses. Due to the persistent higher-than-normal levels of inflation experienced over the last year, banks were forced to increase wages for staff after increasing headcount from last year. Atlas still believes that rationalising the branch network will be the easiest way for the banks to grow earnings over the next few years.

An important measure when looking at a bank result is how the jaw ratio changed, which is the difference between the growth of operating income and operating expenses. This is a very important measure for banks due to the large size of their loan books. A small move in the jaws can move hundreds of millions of dollars in profits. Westpac wins the gold star for expense control, cutting costs by 1% whilst growing operating income by 8%.

The Vampire Kangaroo - Macquarie

After two sensational years driven by high volatility in energy and oil prices due to supply shocks from weather and geopolitical events, Macquarie's first-half profit was down 39%, cycling off a strong first half last year. The first half of last year was a great time for renewable companies following lots of hype around the transition to renewable energy, allowing Macquarie to get top dollar and even above book prices for these assets. This year, though, has seen a very different environment, with the market sceptical of risky IPOs in a risk-off environment, which has created a $831 million deficit on last year's earnings. Instead, MQG is moving some of these assets into a specific Green Energy Fund, creating lower short-term earnings but longer-term profits.

Outside of the market-facing business, the banking and financial services business has been outperforming, with the home loan portfolio growing by 6% to $114 billion and deposits growing to $131 billion. This is a great outcome for the bank, taking market share away from the big four banks while maintaining a strong net interest margin.

The regional banks

There are 4,236 commercial banks in the United States, with many small regional banks, a very different structure to Australia. This is a relic of historic US banking laws that prohibited interstate banking and limited the ability of banks to operate branches outside their state. While many of these regulations were repealed in the 1990s, they favoured the existence of many small local banks and in 2023, left the big 4 (JP Morgan, Bank of America, Citibank, and Wells Fargo) with a combined market share as measured by total assets of only 23%. Conversely, in Australia, there are 95 banks, with the big four banks having a market share in 2023 of 73%. The two listed regional banks, Bank of Queensland and Bendigo Bank, have a market share of around 2% each.

As we can see in the bank matrix at the top, the Australian regional banks did not win a single star across the board. This is due to having a higher capital cost than the big banks, as wholesale funders require higher coupons on their bonds to offset their higher risks. Additionally, the regional banks have limited access to the large pools of corporate transaction account balances that have historically paid minimal interest rates. To be competitive against the lending products from the major banks, the regional banks need to accept a lower net interest margin across their loan book, leading to lower returns on equity.

Our take

Overall, we are happy with the financial results in November from the banks owned by the Concentrated Australian Equity Portfolio. The three main overweight positions, Commonwealth Bank, ANZ, and Westpac, all increased their dividends, which is a crucial signal indicating improving prospects and board confidence in the outlook. All banks showed solid net interest margins, low bad debts, and good cost control. Profit growth is likely to be tough to find on the ASX over the next few years, with earnings for resources and consumer discretionary likely to retreat; however, Australia's major banks are in a good position in current turbulent markets.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor.