Before modern communications, messages were often delivered by hand, with envoys sent from one camp to another. If the message was unwelcome, the receiver might blame and even kill the messenger, who was little more than a foot soldier obeying orders.

Have we not moved on in the last century?

In the last few weeks, Roy Morgan Research has issued three reports relating to the finance industry. Australians give good ratings to banks and institutional super funds, but not to the people who work in them.

An ongoing pattern is that satisfaction with banks and superannuation funds is high while bank managers and financial planners have low ratings for 'ethics and honesty'. The employees in these positions are not setting policies or defining corporate cultures. Those come from many pay grades higher. Retail super funds are overwhelmingly sold through financial planners, but we don’t rate financial planners highly. Bank financial planners sell from Approved Product Lists, operate under tight Statements of Advice, and have limited discretion over the advice. Bank managers have little power and try their best to deliver a service to their clients.

Why do we like the institutions and dislike their foot soldiers?

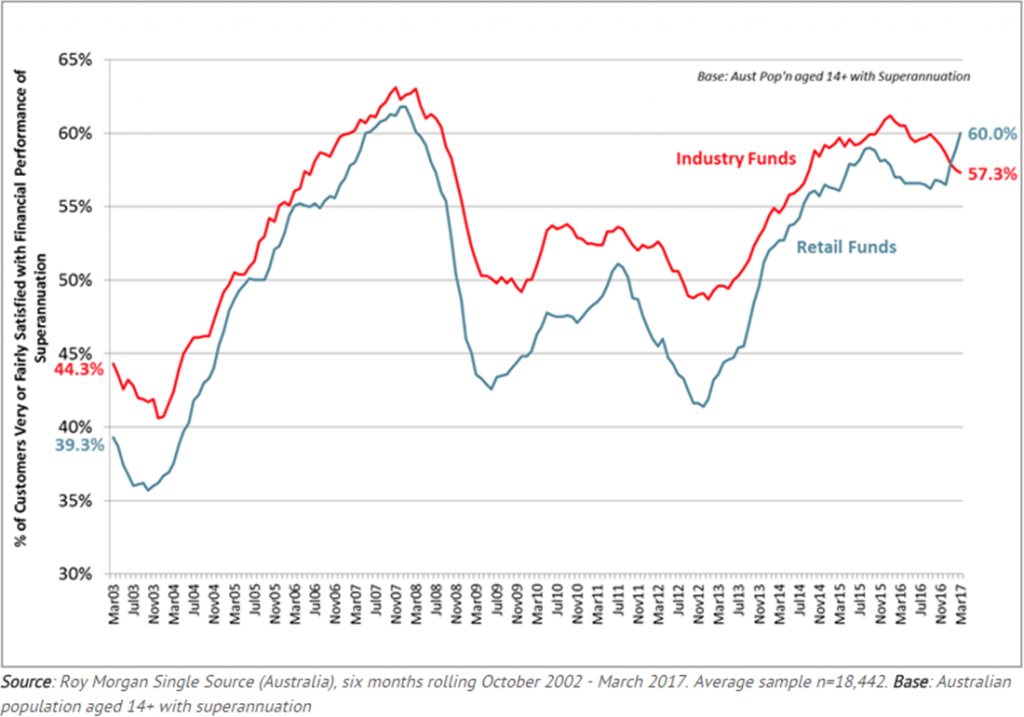

1. Satisfaction with financial performance of superannuation funds

Since this survey began in October 2002, industry funds have outrated retail funds, but they have switched places in the last six months. Both are well up since the start of the survey, especially retail funds, although the fact they took a battering around the GFC shows the ratings are often a reflection of the overall market.

Roy Morgan believes retail funds are more sensitive to market performance, improving strongly when the ASX rose 48% between 2012 and 2015. Retail funds hold a big lead for balances under $100,000, while in the larger balances, especially over $700,000, industry funds are the winners. Norman Morris, the Industry Communications Director at Roy Morgan, said of the rise of retail among lower value clients:

“This is possibly due in part to the introduction of the no-frills, low-cost MySuper products over recent years which appears to be mainly impacting on the less engaged, lower value customers who didn’t actively select an investment option but are now more satisfied with their returns.”

Not shown on the chart are SMSFs, way ahead with a satisfaction rating over 76%. I guess it’s easy to rate yourself highly when the markets have done well.

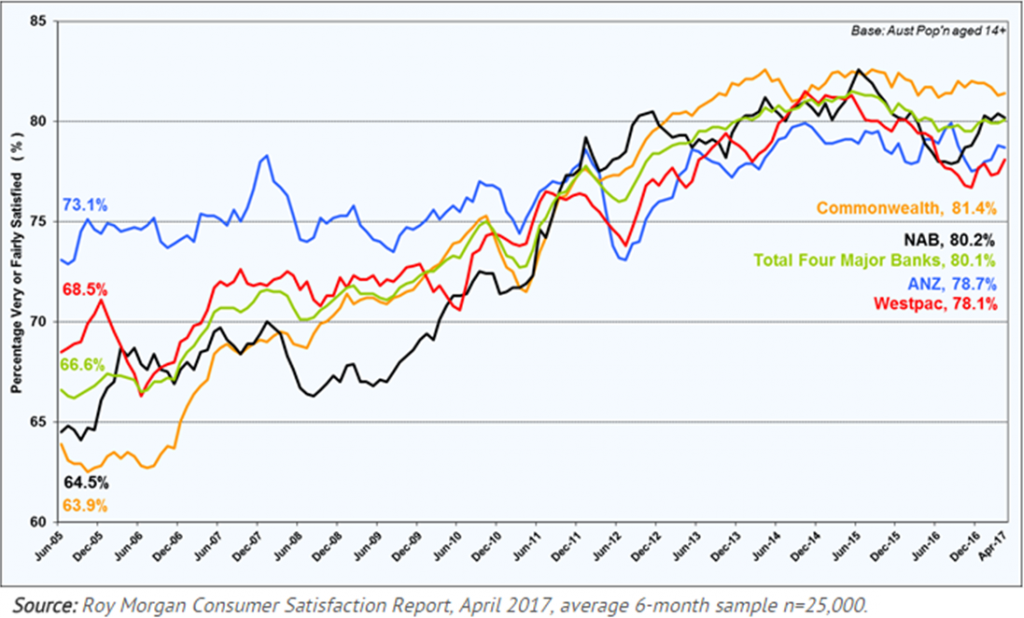

2. Consumer banking satisfaction – big four banks

It's widely believed that Australians love to hate banks. High CEO salaries, exorbitant profits, out-of-cycle mortgage rate increases, terrible deposit rates. But while the approval ratings are off their highs, they are significantly higher than long-term averages, with CBA under Ralph Norris streaking it between 2006 and 2012. Anyone who was subject to his ‘Sales & Service’ regime (which annoyingly for many non-retail executives, put everyone in the bank through the same service programme – hard to get FX dealers interested in 'customer service' at a 7am training session!). Generally, mortgage customers rank banks below non-mortgage customers, but the chart shows every bank has improved markedly over time.

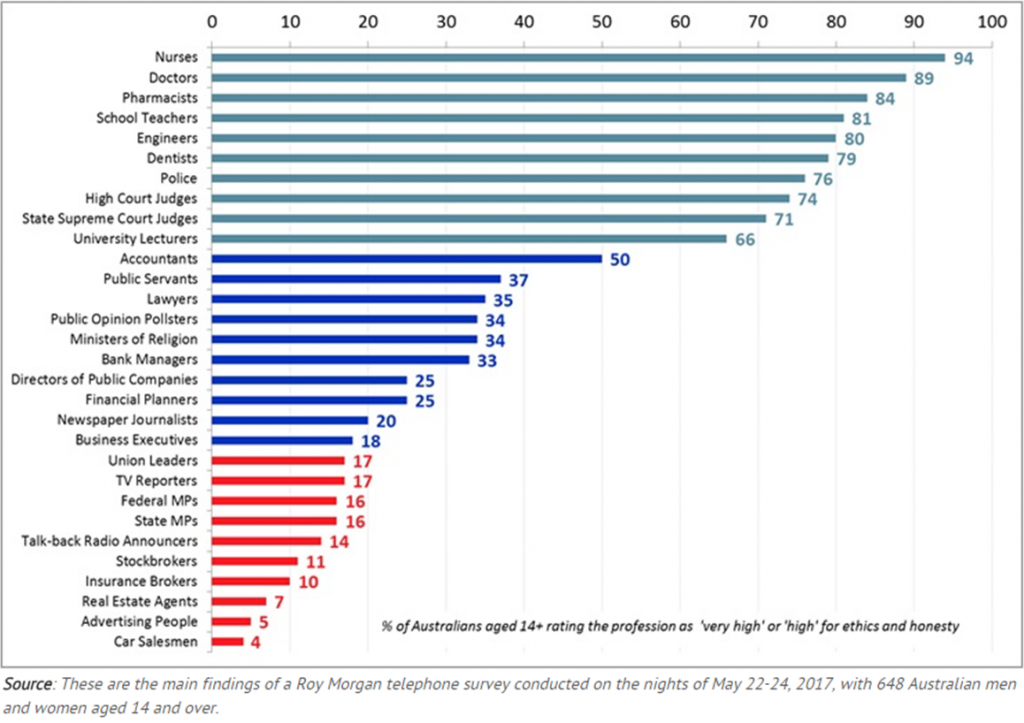

3. Image of the professions

This survey asks whether certain professions are rated ‘high’ or ‘very high’ for ‘ethics and honesty’. Health professionals have always done best, especially nurses and doctors. Good to see the big improvers are school teachers, up 4% in the last year. Not an easy or well-paid job. Engineers have continued a steady rise, from 53% in 1976 to 80% in 2017. Police are also at a record high.

2017 Image of the Professions, Roy Morgan Research

Graphs sourced from multiple Roy Morgan Media Releases, June 2017.

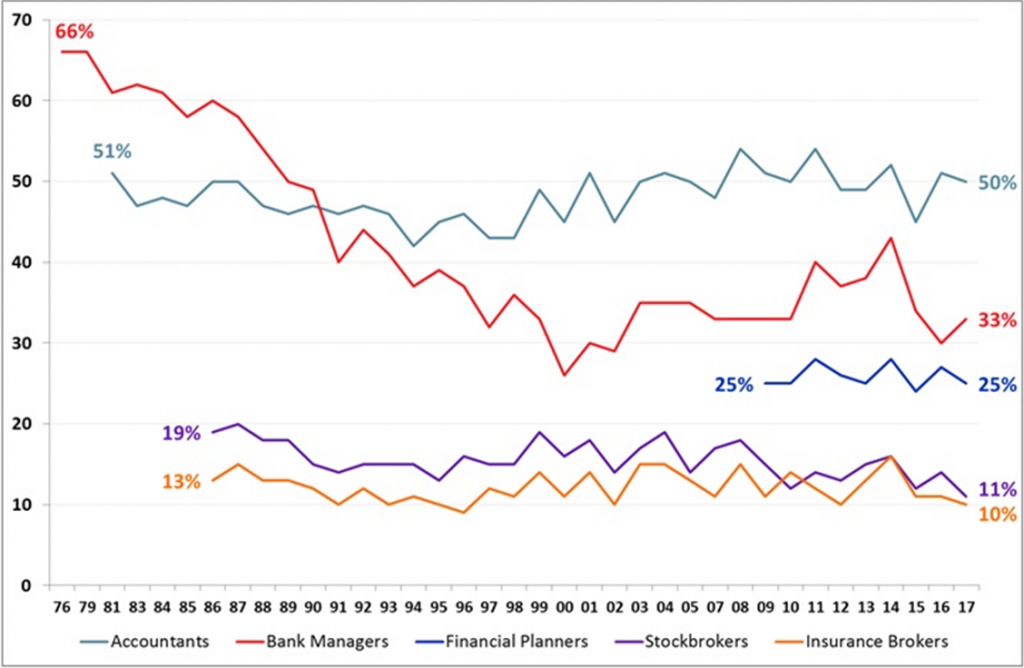

But the finance professions are lagging, in some cases sadly. Accountants do reasonably well at 50%, and have led the way among finance professions for 26 years. Bank managers have improved 3% to 33% in the last year, but it's still a miserable score and way down from the revered years of the 1970s. Financial planners have been around 25% since their introduction to the survey in 2011, while stockbrokers hit a new record low at 11%. As they don’t receive as much media criticism as financial planners, why are brokers so unloved? Not surprisingly, ministers of religion are also at an all-time low.

The long-term trend in the finance industry is for the institutions to improve satisfaction and their employees to decline. It doesn't stop there - sit in any bank call centre and you'll hear how badly the public treats the real foot soldiers.

Graham Hand is Managing Editor of Cuffelinks.