Making knee-jerk changes to an investment portfolio’s asset allocations based on the current market conditions isn’t an ideal strategy - as a general rule. But we’re seeing a lot of reactive behaviour by investors right around the world at the moment. It’s mostly in response to the prevailing economic conditions and unsettling geopolitical events, which are triggering large capital movements between equities, fixed income, cash, and other asset classes.

For example, monthly exchange traded funds (ETFs) data released by the Australian Securities Exchange (ASX) shows investors seeking to capitalise on higher yields have been moving record amounts of capital into ETFs that invest in bonds. Some are doing this by selling down their equity positions.

Separately, there’s been a surge in cash inflows from investors into bank term deposit accounts that are paying relatively attractive returns now because of the sharp rise in interest rates.

This is not to say that all the investments into these categories are in response to the prevailing market conditions. But the evidence, especially in the context of the impact of higher interest rates on shorter-term investment returns, suggests many investors are making tactical asset allocation moves.

Making tactical adjustments to a portfolio based on what’s happening in investment markets at any point in time, particularly when there’s a high level of turbulence, may seem logical.

The terms ‘flight to quality’ and ‘flight to safety’ are often widely used to describe the tendency of investors to quickly move their capital out of higher-risk assets such as equities into so-called safer havens during periods of volatility.

But tactically adjusting long-term portfolios in a bid to minimise short-term risks and enhance returns is high risk. It’s difficult to get right, even for professional active portfolio managers. In fact, research has repeatedly shown that a ‘market timing’ approach is often counterproductive to investment returns over time.

Strategic versus tactical asset allocation

At the most basic level, asset allocation is about spreading investment capital across different investment assets.

As discussed above, tactical asset allocation involves making adjustments to a portfolio’s asset mix based on short-term circumstances.

By contrast, strategic asset allocation involves setting target allocations across various asset classes and rebalancing the portfolio regularly to ensure it stays closely aligned to the assigned allocation through all market conditions.

Vanguard employs a strategic allocation approach across its diversified products range (managed funds and ETFs) to maintain set exposures to international equities and bonds irrespective of market conditions.

Our research has consistently shown that the mix of assets in broadly diversified portfolios as a result of strategic asset allocation is by far the greatest determinant of both total returns and return variability over the long term.

Conversely, short-term tactical investment decisions made by active portfolio managers, such as market-timing and security selection, have relatively little impact on return variability over longer time frames.

The main reasons for this are twofold. Firstly, active portfolio managers need to ensure they’re making the right choices in relation to the prevailing market conditions. Timing markets is extremely difficult.

Secondly, for an active portfolio manager to add value over time, a tactical approach needs to mitigate the investment costs of making regular portfolio adjustments.

These costs include management fees, bid-ask spreads, administrative costs, commissions, market impact, and, where applicable, taxes. These costs can be high and reduce investor returns over time.

Active versus passive

Global index provider Standard & Poor’s regularly measures the performance of active funds against passive benchmarks. The results paint a strong case for index funds, because a high percentage of active managers underperform passive index benchmarks most of the time.

For example, the S&P Indices versus Active scorecard for 2022, or SPIVA as it’s known, shows that 57.6% of actively managed large-cap Australian equity funds – that is, funds that invest in a selection of the largest Australian companies chosen by an investment team – underperformed the Australian share market.

The SPIVA report found that underperformance rates over the longer term were even higher, with 81.2%, 78.2% and 83.6% of actively managed large-cap Australian equity funds underperforming the S&P/ASX 200 Index over the 5-, 10- and 15-year horizons, respectively.

Making active, tactical adjustments to portfolios based on short-term events can have far reaching consequences over the long term.

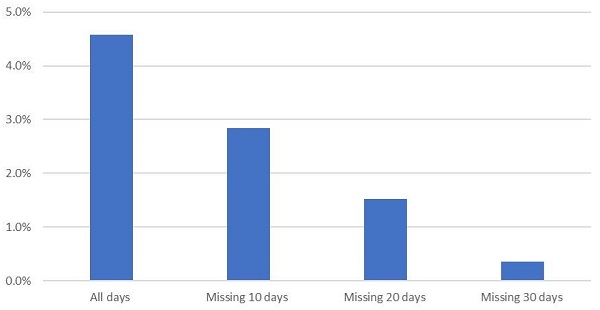

Let’s look at this based on investors who made tactical decisions around buying and selling shares and missed out on the 30 best trading days on the Australian stock market between June 1992 and October 2023. By missing those specific best days, they would have achieved only a fraction of the returns achieved by investors who had been invested for the whole period.

Furthermore, the best and worst return days on markets are often very close together.

Annualised returns of Australian stock market from 1992 to 2023

Notes: Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. Returns are based on the daily price return of the S&P/ASX 300 Index from June 1992 to 18 October 2023. The returns do not include reinvested dividends, which would make the figures higher for all bars.

Sources: Vanguard calculations, using data from Bloomberg as of 20 October, 2023.

For tactical portfolio adjustments to be successful an investor needs to identify a reliable indicator of short-term future market returns, then time their exit from an asset class or the market and re-entry precisely, to the day. They also need to decide on the size of the allocation and how to fund the trade, and execute the trade at a cost that’s less than the expected benefit.

A tactical approach can offer the chance to outperform. However, based on Vanguard’s extensive research, using a strategic asset allocation approach has proved to be a much more reliable driver for long-term returns because it’s based on evidence of what has performed well over time.

It’s also important to note that strategic asset allocation is not a ‘lazy’ approach, as some may perceive. Rather, coming up with a strategic asset allocation through a research-driven process is generally more laborious and difficult than a tactical approach.

Vanguard reviews its asset allocations regularly, although the bar for making changes is high. This is in contrast to what often takes place in tactical asset allocation, where the focus is on short-term performance.

Rather than making tactical changes, investors who stay aligned to their goals, who are well diversified, who minimise their costs, and who have the discipline to stay invested, even during periods of heightened volatility, have the best chance of investment success over the long term.

Maziar Nikpour is a Senior Manager, Investment Strategy Group at Vanguard Australia, a sponsor of Firstlinks. This article is for general information purposes only. It does not take your objectives, financial situation or needs into account so it may not be applicable to the particular situation you are considering.

For more articles and papers from Vanguard Investments Australia, please click here.