Australia’s highly rated superannuation system finally got a legislated objective in 2023. While most people probably understood the purpose of generating income in retirement, the objective provides a basis for, hopefully, getting the policy settings right for retirement. Last year we had to digest a new controversial tax while making some progress on advice reforms while volatile markets were helped by easing of inflation and a strong run into the end of the year. What will we have to digest in 2024?

The new year brings another consultation from Treasury on the Retirement Phase of Superannuation. This is recognition that Australia’s highly regarded accumulation system needs to be better at converting the accumulated savings of Australians into the income they need for retirement. There are different challenges in retirement, and 2024 is likely to showcase some of them.

Issues for retirees this year

Treasury notes that the need to fix the retirement phase is becoming “more urgent”. The success in accumulating savings means that there are more retirees who need help with their retirement income. Unfortunately, while the number of retirees has been growing, the number of financial advisers who can help is shrinking. Hopefully the Quality of Advice reforms will address this.

Another challenge lurking in 2024 is the ongoing cost of living. Inflation is down from the peak, but an annual rate of almost 5% (as at October 2023) is still too high to be easily managed. Retirees need help with managing inflation, and funds are required under the retirement income covenant to have a plan to manage inflation risk along with longevity and market risks. While the Australian market is close to highs, volatility in recent years has highlighted a challenge in drawing an income from risky markets. The risk is that the income might not last as long as anticipated. The challenge is to maintain some market exposure while locking in some income that will last for life. If the Age Pension of just over $26,000 for single is enough, you are set. For retirees who want a better lifestyle, they need a retirement income plan that improves their retirement outcome.

An example

A good retirement income plan is one that includes market exposure for long term growth and a secure income stream. Consider the example of Sun and Steve:

Sun and Steve are a recently retired 67-year-old couple. They’ve worked hard and are now looking forward to having a whole lot more time to do the things they love. They are active, interested and involved. They have a couple life expectancy of age 94 (when one of both is expected to still be alive).

Sun and Steve own their own home and are free of debt. They have $350,000 each in superannuation to start funding their retirement income. Their super (and any future account-based pension) is invested in accordance with their 50/50 growth/ defensive risk profile. They have $50,000 in cash and term deposits and $20,000 worth of personal assets.

Sun and Steve would like to live comfortably for as long as possible and estimate that $71,724p.a. (equal to the ASFA September 2023 ‘Comfortable’ retirement standard[1]), indexed each year with inflation, would be sufficient to meet this goal. As part of their total intended annual spend in retirement Sun and Steve have established that they require at least $46,250 p.a. (equal to the ASFA September 2023 ‘Modest’ retirement standard), indexed each year with inflation, to meet their essential spending requirements in retirement.

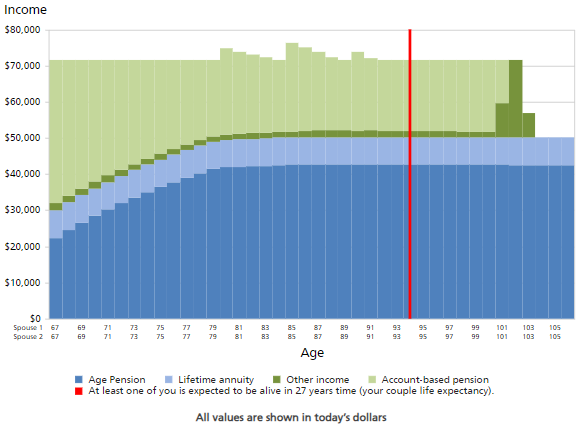

Modelling a combination of account-based pensions and a 20% allocation to guaranteed CPI-linked lifetime annuities

The retirement income modelling[2] for Sun and Steve involves a blend of both account-based pensions and a 20% allocation to guaranteed CPI-linked lifetime annuities. This strategy involves a re-balancing of the asset allocation of the account-based pensions to ensure that the allocation to the CPI-linked lifetime annuity does not ‘de-risk’ Sun and Steve’s asset allocation.

This combination of income streams payable to Sun and Steve over their retirement is represented in the graph below.

For Sun and Steve, a 20% partial allocation to a lifetime income stream provides:

- Lifetime income, fully indexed for inflation, for as long as they live. The lifetime income amount in the first year is $7,606;

- An Age Pension increase in year 1 of $4,368 (24% higher than the equivalent non-lifetime portfolio);

- A 100% chance of meeting income 'needs' (an increase of 38% over the non-lifetime portfolio);

- A 74% chance of meeting desired 'needs and wants' (an increase of 17% over the non-lifetime portfolio);

- Total retirement income paid over 27 years increases by $21,101 (in today's dollars); and

- The Estate value at the end of 27 years is $97,836 higher (in today's dollars).

The outcome is that the combined portfolio can deliver the retirement income that Sun and Steve need along with the confidence that the money they need will last. This can provide the confidence to spend so they can live their best retirement.

Predicting the next shock is difficult. Building a portfolio that can adjust to various shocks is a robust way to generate income through retirement. The blended portfolio does just that. It provides an appropriate mix to meet the goals of the retiree.

And it isn’t always good to focus on easy digestion. A meal of a steak, veggies and a drink is more enjoyable and probably better than blending them all into a brown-green smoothie that can be drunk on the run.

[1] https://www.superannuation.asn.au/resources/retirement-standard/

[2] All projections sourced from the Challenger Retirement Illustrator (17/12/2023) using Social Security rates and thresholds effective 20 September 2023. 67-year-old female/male homeowner couple. $350,000 each available for investment via account-based pension and partial (20%) allocation to lifetime annuity. Super asset allocation 50% growth/50% defensive. Assumes returns of 4% p.a. for defensive assets and 8% p.a. for growth assets before fees. $50,000 cash/TDs earning 4% p.a. interest. Personal assets of $20,000. $71,724 p.a. desired income including $46,620 p.a. essential income. Amounts shown are in today’s dollars. CPI of 2.5% p.a. See Challenger Retirement Illustrator Assumptions for all assumptions. Rates subject to change.

Aaron Minney is Head of Retirement Income Research at Challenger Limited. This article is for general educational purposes and does not consider the specific circumstances of any individual.