Question from Chris Eastaway:

I am interested in knowing more about the differences between index ETF's and passive LIC's. More specifically I would be keen to see someone who can crunch the numbers on how the LIC capital gains tax laws and subsequent higher levels of dividend franking compare to the lower franking received on ETF's. Over time, does this make a large difference to income one would expect to receive (assuming the investor held the stock for the very long term)?

LIC provider, Wilson Asset Management, and ETF provider, Market Vectors, provide a response.

Chris Stott, Chief Investment Officer and Portfolio Manager, Wilson Asset Management.

In answering this question, I'll start by pointing out that I don't believe there are such things as 'passive' Listed Investment Companies (LICs). One of the key differences, and benefits, of LICs is that their investment portfolio is managed by a professional investment manager providing the opportunity to outperform the market. There are some LICs that are managed more actively than others, but no LICs are passive. Wilson Asset Management is an active investment manager.

LICs provide investors with the opportunity to invest in a managed portfolio of investments through a company structure listed on the Australian Securities Exchange (ASX). LICs provide investors with exposure to a diverse portfolio of shares and cash. Investors can buy and sell shares in LICs 'on market' like shares in other listed companies.

LICs vs ETFs

There are four key ways LICs differ from Exchange Traded Funds (ETFs):

1. Corporate Structure and Governance

The structure of an LIC differs significantly from the structure used by an ETF. As their name suggests, LICs use a company structure which requires them to comply with the Corporations Act and various governance principles. ETFs use a trust structure. The Board of an LIC is required to act in the best interests of its shareholders and its various statutory obligations give investors the opportunity to communicate with the Board and Management, for example through Annual General Meetings. The listed company structure provides investors with a high degree of transparency and accountability.

2. Performance

A LIC's pool of assets is managed professionally by a fund manager, either internally or externally. The fund manager applies their investment expertise and has the opportunity to add value to investors by outperforming the market. LICs such as Australian Foundation Investment Company, or AFIC, (ASX: AFI) and Argo Investments (ASX: ARG) have outperformed the market over several decades. On the other hand, the performance of an ETF will only ever track an index, not outperform it.

3. Franked dividends

LICs can pay investors fully franked dividends derived from its investee companies and additional franking credits from any tax paid from its company profit. An ETF can only pay investors dividends from the underlying investment companies (flow-through dividends). This means that over time as a LIC investor, your after-tax income can be significantly enhanced by the use of franking credits, depending on where those shares are held and your applicable tax rate.

4. Shares can trade at premium or discount to Net Tangible Assets

Like other listed companies, shares in LICs can trade at both a premium and a discount to their Net Tangible Assets or 'NTA'. This provides investors with the opportunity to exploit occasions that the LIC's shares trade at a discount to its NTA. For example, if a LIC trades at $1.00 but its NTA is $1.20, the LIC is trading at a 20% discount to its NTA. In the future the value of the underlying assets may trade at a premium to its NTA, giving potential for gain. In contrast, units in ETFs can only ever be bought and sold at the value of the assets.

Michael Brown, Director, Market Vectors Australia/ Van Eck Global

ETFs and LICs have a lot of similarities. They are both collective investment vehicles. That is, an investors’ money is pooled with the money of other investors to create a large diversified portfolio that can be professionally managed.

Unlike mainstream managed funds, ETFs and LICs can be bought and sold on the ASX through a stockbroker. This is a quick and convenient way to transact and is as cheap as the cheapest broker you can find. The management costs in ETFs are generally lower than the costs in mainstream managed funds. This is also the case for the older LICs but you have to be careful. Some newer LICs have some of the highest costs in the market.

ETFs and LICs also have their differences. For a start, ETFs are a newer phenomenon in Australia that many investors are still discovering. LICs have been around for decades. One of the big LICs advertises that it has been investing for over 80 years.

Most ETFs offer a high level of transparency. The net asset value is published each day and an estimated value is available via the ASX updated at least every 15 minutes during trading hours. ETFs also publish full details of the portfolio each day.

The trickiest part of the comparison is the franking credits and tax payments. Here is a simple example. A fund receives $100,000 in fully franked dividends and $100,000 in unfranked dividends. Harry the Investor owns 1% of the fund.

If the fund is an ETF everything flows through. It distributes $2,000 to Harry, made up of $1,000 in franked dividends and $1,000 in unfranked dividends.

If the fund is a LIC, the LIC needs to pay 30% tax on the unfranked dividends. It then declares whatever dividend its board deems appropriate. If we assume it chooses to pass on all of the dividends it receives, Harry is only going to receive $1,700 in cash because of the tax that had to be paid. The offset to this is that the $1,700 dividend from the LIC is fully franked.

After Harry receives credit from the Tax Office for the franking credits, he is in the same position whether the fund was an ETF or LIC. The steps are different but the final outcome is the same (with timing differences).

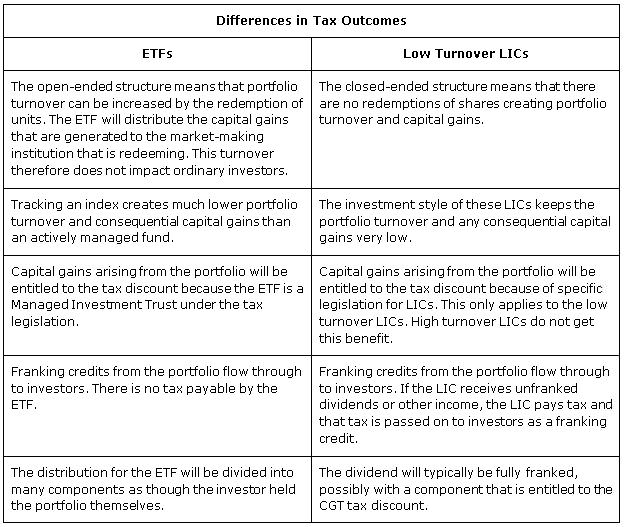

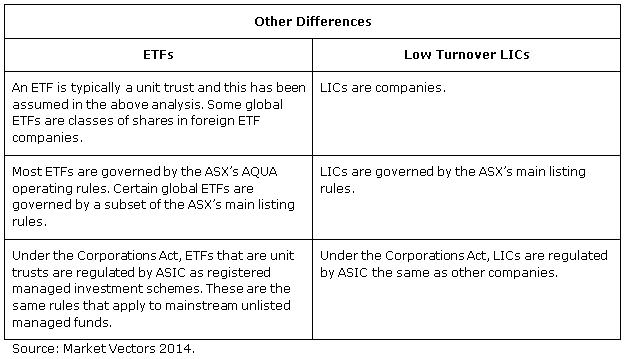

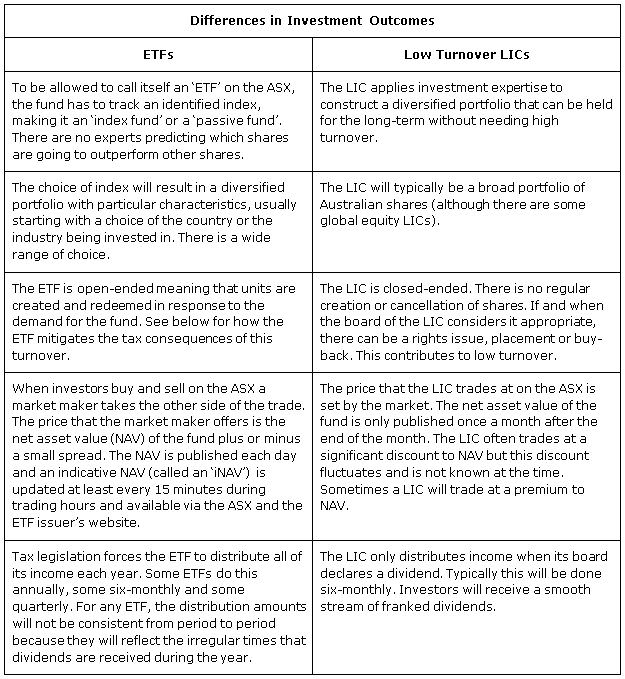

Market Vectors provided this table comparing LICs and ETFs

LICs cover a wide spectrum of investment styles. The comparison to ETFs is most useful where the LIC’s investment style comes closest to that of ETFs. This analysis focusses on the subset of LICs whose investment style has a low turnover in their portfolios, although many are actively traded.

CE Snip1 280314