When I talk with acquaintances these days, the topic of investments naturally comes up. At a kids’ soccer game recently, a parent told me that he’d earned enough money through his business that he wanted to invest it and asked me how to best do it.

I told him that it depended on his goals, risk appetite, and time horizon, and that he should see a financial adviser for professional advice. I then went on to discuss some of his options, but a short way into the conversation, I realized that a five minute talk wouldn’t achieve much. I cut it short and said, “Read Firstlinks and I’ll do an article up on it over the next few weeks”. (no harm in giving the newsletter a plug!)

Here, then, are tips on the best ways to build an investment portfolio from scratch, and some of the challenges involved.

Portfolio theory in a nutshell

First, it’s necessary to cover off on various theories behind building an investment portfolio. I promise to keep it simple.

A central tenet of finance and asset allocation is that risk and return are related. You can’t earn high returns without having large losses along the way. Conversely, you can’t achieve complete safety without condemning yourself to low, long-term returns. Anyone promoting high returns with low risk should be treated with scepticism.

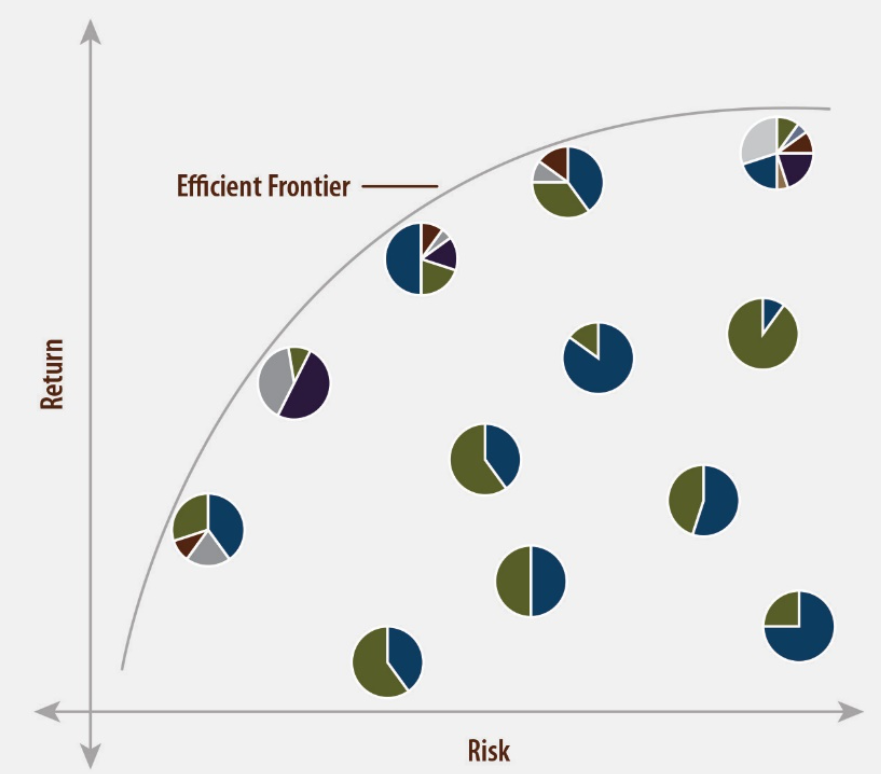

Modern Portfolio Theory (MPT) uses concepts such as correlation, risk, and return to find optimal portfolio weightings. MPT states that owning allocations of different asset classes that don't always move up or down together, is the best way of maximizing returns while minimizing risk and achieving the so-called ‘efficient frontier’.

Source: MCF Capital

Therefore, the key decision facing an investor is the overall percentages of a portfolio allocated to different assets such as stocks and bonds. That decision will determine the risk-return characteristics of a portfolio.

What is the best allocation? There is no such a thing as a perfect portfolio because we don’t know how different assets will perform in future. That’s why diversification is important.

It's often said that diversification is the only free lunch in finance. This quote, usually attributed to the founder of MPT, Harry Markowitz, refers to the power of diversification to reduce risk without necessarily hurting returns.

Markowitz won a Nobel Prize for his theories, yet even he admitted that he didn’t use fancy maths to determine his own asset allocation. In 1952, he said, “my intention was to minimize my future regret. So I split my contributions 50/50 between bonds and equities.”

The three drivers of asset allocation

Markowitz wasn’t short of money and minimizing future regret made sense as a goal for him. For others, it may be different.

Markowitz’s comments indicate that investors need to develop a coherent and well-defined personal strategy for the allocation of assets. That strategy, as alluded to earlier, will be driven by three key factors:

Your goals. Financial or otherwise.

Your risk appetite. In my experience, what people say about their tolerance to risk and what they do are completely different things. Often the best way to figure out your risk appetite is to look at how you reacted to past bear markets. Did you panic and sell stocks during the sharp pullbacks of 2022 and Covid? How about during the financial crisis of 2008. Did you panic and sell stocks at the wrong time?

As Fred Schweb colourfully put it in his masterpiece, Where Are The Customers Yachts?:

“There are certain things that cannot be adequately explained to a virgin either by words or pictures. Nor can any description that I might offer here even approximate what it feels like to lose a real chunk of money that you used to own.”

Your time horizon. Conventional wisdom suggests that younger people should invest more aggressively than the old. The guideline is based on the notion that younger individuals can afford to take on more investment risk because of their longer time horizons. As investors get older, their time horizons shorten, making an increasing fixed-income allocation more prudent.

It’s the basis of a common rule of thumb used by advisers: that in a stock/bond portfolio, an investor’s bond allocation should be equal to their age, with the remainder in stocks. Under this formula, if you’re 45 years of age, you should have 45% of your portfolio in bonds, and 55% in stocks.

A mix of these factors will determine the best allocation of assets for you.

A simple investment portfolio

For the novice or lazy investor, a simple portfolio can be best. Say you’ve worked out that a 60/40 stock/bond split of assets is what you’re after. The next question: which stocks to choose? If you want simplicity, then the answer is investing in an ETF which covers the whole market.

The stock allocation is not so simple, though. Should you invest just in Australia? That doesn’t make much sense. After all, the Australian share market is only about 2% of the size of global equity markets. The market here is also highly concentrated in banks and miners, and doesn’t offer the exposure to technology, healthcare and other sectors, that international markets do.

Does it mean that you should allocate just 2% of the stock portion of the portfolio to Australian equities? Probably not. There is no right answer because no one knows how different stock markets will perform in future. Keeping it simple might mean a 50/50 split of Australian and international stocks. This split can easily be done via popular ETFs such as Vanguard’s Australian Shares Index ETF (ASX:VAS) and its MSCI Index International Shares ETF (ASX:VGS).

What about bonds? Bonds are in a portfolio because stocks are volatile. It can be gut-wrenching as stocks move up and down, and sometimes people need some money when stocks are down. Bonds are there to smooth out the journey and act as ballast that balances out the stock holdings.

Given this, it makes sense to stick to local bonds rather than branch out to international bonds. Why? Because with the safer portion of your portfolio, you don’t want to be taking the currency risk associated with owning overseas bonds.

As to what type of bonds, government bonds are the least risky and are the most appropriate for a simple portfolio. The most popular Australian government bond ETFs are iShares Core Composite Bond ETF (ASC:IAF), SPDR S&P/ASX Australian Bond Fund ETF (ASX:BOND), and Vanguard Australian Fixed Interest Index ETF (ASX:VAF).

Here is what a basic investment portfolio might look like:

- 30% Australian stocks (ASX:VAS)

- 30% International stocks (ASX:VGS)

- 40% Australian bonds (ASX:IAF)

Getting more fancy

A simple investment portfolio can be made more complex in a variety of ways. Keep in mind that complexity requires more time and effort in both building and maintaining the portfolio.

The stock portion of the portfolio could include small cap companies. US research has shown that small caps have outperformed large caps in America over the long term. Interestingly, the research is less compelling in Australia, as small caps have lagged their larger counterparts. I suspect it’s because of the hundreds of small cap miners here which are both scrappy and unprofitable – and that’s being generous.

Another thing that can be considered for the stock part of the portfolio is adding value stocks. Numerous studies suggest value stocks outperform growth shares and broader indices in the long term.

REITs can also be considered for a small portion of the portfolio. Historically, REITs have shown a lower correlation to other asset classes and therefore can help to reduce overall risk to a portfolio. Keep in mind though that Goodman Group (ASX:GMG) is now around a 42% weighting in the A-REIT index and is priced more like a tech stock and less like a property play. Goodman drives the A-REIT index nowadays.

What about teasing out the international stocks into those of developed countries and emerging markets? It’s certainly an option as different regions tend to offer different returns. Yet, I’m not convinced that it’s worth the trouble for individual investors.

Here’s what a more complicated portfolio could look like:

- 14% ASX large cap (ASX:VLC)

- 14% ASX small cap (ASX:VSO)

- 2% Australian property (ASX:MVA)

- 14% International large cap (ASX:IOO)

- 7% International small cap (ASX:VISM)

- 7% International value (ASX:VLUE)

- 2% International property (ASX:GLPR)

- 40% Australian bonds (ASX:IAF)

Getting more hands-on

Now, you might be thinking, “Hang on, I’d like to also invest in stocks directly as well as managed funds.”

On this point, Vanguard Asia Pacific’s Head of Investments, Duncan Burns has an idea, called the core-satellite approach, which may help. This approach is about allocating the core of your portfolio – 80%, for example - to passive investments or ETFs, and the remainder to active funds or an active strategy.

He says that while carving out a small portion of your portfolio for active investing in the satellite portion isn’t backed up by academic studies, it may be helpful behaviourally. It could help you to avoid tinkering with the core of the portfolio and free up the satellite portion to pursue other opportunities – whether that’s an interest in stock picking or sectors or other elements you feel strongly about.

Rebalancing

Rebalancing a portfolio is generally helpful to enhance returns and to reduce risk. Rebalancing is a quasi-value strategy as it means selling something that has been performing well and switching it into something else that has been underperforming.

How often should you rebalance a portfolio? The research says once every year or two is sufficient. However, selling stock attracts capital gains and losses, therefore it will depend on your tax situation too.

Dollar cost averaging

Building a portfolio from scratch also raises the issue of whether you should put all your money into it straight away or to gradually deploy the cash. Some might be nervous putting a lump sum in.

One way to get around this is to put 50% into the portfolio, and then put the other 50% in via monthly increments over a 12-24 month period.

The latter is known as dollar cost averaging and it can also be used for any subsequent savings that you wish to add to the portfolio after it’s up and running. This approach automatically allocates regular fixed amounts and can help you take a disciplined, non-emotional approach to investing that’s not affected by what’s happening on financial markets at any particular point in time.

Remaining pieces

There is no perfect asset allocation that will allow you to keep up when shares are rising and perfectly hedge your portfolio when shares are falling. The best you can hope for is a portfolio that’s durable enough that you can hold onto it, regardless of what happens in the market and economy.

There is a lot I haven’t covered in this article that I’ll flesh out in future pieces. Next week will explore the pros and cons of ‘all weather’ portfolios.

James Gruber is the Editor of Firstlinks.